Curricu lum Vitae - School of Economics, Finance and Management

Curricu lum Vitae - School of Economics, Finance and Management

Curricu lum Vitae - School of Economics, Finance and Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

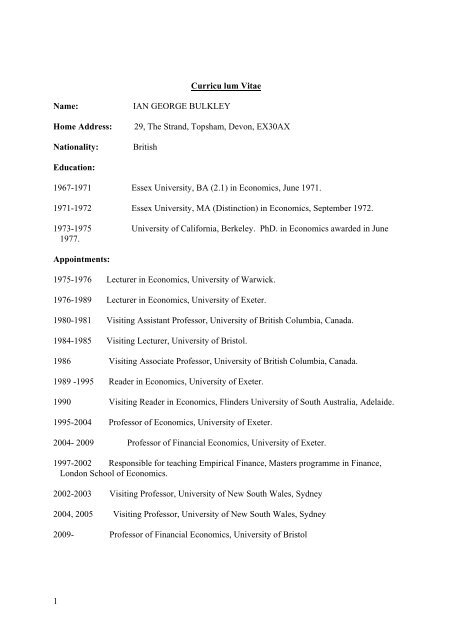

<strong>Curricu</strong> <strong>lum</strong> <strong>Vitae</strong><br />

Name:<br />

Home Address:<br />

Nationality:<br />

IAN GEORGE BULKLEY<br />

29, The Str<strong>and</strong>, Topsham, Devon, EX30AX<br />

British<br />

Education:<br />

1967-1971 Essex University, BA (2.1) in <strong>Economics</strong>, June 1971.<br />

1971-1972 Essex University, MA (Distinction) in <strong>Economics</strong>, September 1972.<br />

1973-1975 University <strong>of</strong> California, Berkeley. PhD. in <strong>Economics</strong> awarded in June<br />

1977.<br />

Appointments:<br />

1975-1976 Lecturer in <strong>Economics</strong>, University <strong>of</strong> Warwick.<br />

1976-1989 Lecturer in <strong>Economics</strong>, University <strong>of</strong> Exeter.<br />

1980-1981 Visiting Assistant Pr<strong>of</strong>essor, University <strong>of</strong> British Co<strong>lum</strong>bia, Canada.<br />

1984-1985 Visiting Lecturer, University <strong>of</strong> Bristol.<br />

1986 Visiting Associate Pr<strong>of</strong>essor, University <strong>of</strong> British Co<strong>lum</strong>bia, Canada.<br />

1989 -1995 Reader in <strong>Economics</strong>, University <strong>of</strong> Exeter.<br />

1990 Visiting Reader in <strong>Economics</strong>, Flinders University <strong>of</strong> South Australia, Adelaide.<br />

1995-2004 Pr<strong>of</strong>essor <strong>of</strong> <strong>Economics</strong>, University <strong>of</strong> Exeter.<br />

2004- 2009 Pr<strong>of</strong>essor <strong>of</strong> Financial <strong>Economics</strong>, University <strong>of</strong> Exeter.<br />

1997-2002 Responsible for teaching Empirical <strong>Finance</strong>, Masters programme in <strong>Finance</strong>,<br />

London <strong>School</strong> <strong>of</strong> <strong>Economics</strong>.<br />

2002-2003 Visiting Pr<strong>of</strong>essor, University <strong>of</strong> New South Wales, Sydney<br />

2004, 2005 Visiting Pr<strong>of</strong>essor, University <strong>of</strong> New South Wales, Sydney<br />

2009- Pr<strong>of</strong>essor <strong>of</strong> Financial <strong>Economics</strong>, University <strong>of</strong> Bristol<br />

1

Publications:<br />

1. Monograph<br />

"Who gains from Deep Ocean Mining: a Simulation <strong>of</strong> Alternative Regimes to Govern Nodule<br />

Mining", 117 pages, Institute <strong>of</strong> International Studies, University <strong>of</strong> California, Berkeley,<br />

1979.<br />

2. Papers<br />

"The Allocation <strong>of</strong> Property Rights to Minerals on the Ocean Floor", Research in Law <strong>and</strong><br />

<strong>Economics</strong>, Spring, 1981, pp 143-53.<br />

"Personal Saving <strong>and</strong> Anticipated Inflation", Economic Journal, March 1981, pp 124-135.<br />

"Union Utility Maximisation <strong>and</strong> Optimal Contracts", in Advances in Labour <strong>Economics</strong>, ed. J<br />

Treble <strong>and</strong> G Hutchinson, Croom Helm, 1984 (with Jane Black).<br />

"Evidence <strong>of</strong> a Correlation Between the Level <strong>of</strong> Inflation <strong>and</strong> the Degree <strong>of</strong> Uncertainty about<br />

Future Inflation" European Economic Review, 1984, pp 212-221.<br />

"Wage-Employment Contracts when there is a Constraint on the Firm's Pr<strong>of</strong>it Level in Each<br />

State", Scottish Journal <strong>of</strong> Political Economy, 1985, Vol. 32, no 3, pp 328-332 (with Jane<br />

Black).<br />

"Were there Unexploited Pr<strong>of</strong>it Opportunities on the UK Stock Exchange, 1930-1986" (with<br />

Ian Tonks) in A Reappraisal <strong>of</strong> the Efficiency <strong>of</strong> Financial Markets, eds. S.J. Taylor, B.G.<br />

Kingsman <strong>and</strong> R.M.C. Guimaraes, Springer-Verlag, 1988, pp 433-451.<br />

"The Role <strong>of</strong> Strategic Information Exchange in a Bargaining Model", Economic Journal, March<br />

1988, pp 50-57 (with Jane Black).<br />

"Insiders <strong>and</strong> Outsiders <strong>and</strong> Efficient Asymmetric Information Contracts", <strong>Economics</strong> Letters,<br />

1989, (with Jane Black), 5 pp.<br />

"A Comment on Shiller's model <strong>of</strong> the Price-Dividend ratio as a Vector Autoregression", in A<br />

Reappraisal <strong>of</strong> the Efficiency <strong>of</strong> Financial Markets, eds. S. J. Taylor, B. G. Kingsman <strong>and</strong> R.<br />

M. C. Guimaraes, Springer-Verlag, 1988, pp 431-432.<br />

"A Ratio Criterion for Signing the Effect <strong>of</strong> Increasing Uncertainty", International Economic<br />

Review, 1989, vol. 30, no 1, pp 119-130 (with Jane Black).<br />

"Do Trade Unions Reduce the Job Opportunities <strong>of</strong> Non-Members" Economic Journal, 1989,<br />

vol. 99, pp 177-186 (with Jane Black).<br />

2

"Are UK Stock Prices Excessively Volatile Trading Rules <strong>and</strong> Variance Bounds Tests",<br />

Economic Journal, 1989, vol. 99, December, pp. 1083-1099, (with Ian Tonks).<br />

"Excess Volatility on the UK Stock Market." Pr<strong>of</strong>essional Investor, April, 1990, (with Ian<br />

Tonks).<br />

"Cross-Sectional Volatility on the UK Stock Market" Manchester <strong>School</strong>, vol. LIX supp., June<br />

1991 pp 72-80 (with Ian Tonks).<br />

"The Role <strong>of</strong> Loyalty Discounts when Consumers are Uncertain <strong>of</strong> the Value <strong>of</strong> Repeat<br />

Purchases" International Journal <strong>of</strong> Industrial Organisation, Vol. 10, March 1992, pp 91-101.<br />

"Does a Trade Union Set a Lower Effort Level than Would be Determined in a Competitive<br />

Labour Market" Bulletin <strong>of</strong> Economic Research, Vol. 44, No.2, 1992, pp 153-160.<br />

"The Volatility <strong>of</strong> US Stock Prices" Journal <strong>of</strong> Financial <strong>and</strong> Quantitative Analysis, 1992,Vol.<br />

27, No. 3, pp 365-382. (with I. Tonks)<br />

"A Cross-Section Test <strong>of</strong> the Present Value Model Using U.S. Stock Price Data" <strong>Economics</strong><br />

Letters, vol.42, 1993, pp 373-377. (with J. Board <strong>and</strong> I. Tonks)<br />

“Econometric Models Can be Used to Identify Underpriced Shares”, Manchester <strong>School</strong>, 1995,<br />

vol. LXIII, pp 103-111. (with N. Taylor)<br />

“A Cross-Section Test <strong>of</strong> the Present Value Model” Journal <strong>of</strong> Empirical <strong>Finance</strong>, 1996, Vol. 2,<br />

pp 295-306. (with N. Taylor).<br />

“Seniority Wages can be Explained as an Insurance Against Future Income Uncertainty”,<br />

Southern Economic Journal, 1996, Vol. 62 710-722. (with G. D. Myles)<br />

“Trade Unions, Efficiency Wages, <strong>and</strong> Shirking”, Oxford Economic Papers, 1996, Vol. 48, pp<br />

75-88. (with G.D. Myles)<br />

“Bargaining over Effort”, European Journal <strong>of</strong> Political Economy, 1997, vol. 13,2, pp 375-384.<br />

(with G.D. Myles)<br />

“Irrational Analysts’ Expectations as a Cause <strong>of</strong> Excess Volatility in Stock Prices” Economic<br />

Journal, 1997, vol. 107, pp 359-371. (with R.D.F. Harris)<br />

“A Comment on Goerke “ Oxford Economic Papers, 1998. (with G.D. Myles)<br />

“Individually Rational Union Membership” European Journal <strong>of</strong> Political Economy, 2001, vol.<br />

17, pp117-137, (with G.D. Myles).<br />

“On The Membership <strong>of</strong> Decision Making Committees” Public Choice, 2001, vol.106, pp1-22.<br />

3

(with G.D. Myles <strong>and</strong> B. Pearson).<br />

“Why Does Book-to-Market Value <strong>of</strong> Equity Forecast Cross-Section Stock Returns”,<br />

International Review <strong>of</strong> Financial Analysis , 2004, 13, 153-160. (with R.D.F. Harris <strong>and</strong> R.<br />

Herrerias)<br />

“Does the Precision <strong>of</strong> News Affect Market Underreaction: Evidence from Returns Following<br />

Two Classes <strong>of</strong> Pr<strong>of</strong>it Warnings” European Journal <strong>of</strong> Financial <strong>Management</strong>, 2005, pp 603-<br />

624. (with R. Herrerias)<br />

“Can the Cross-Sectional Variation in Expected Stock Returns Explain Momentum” Journal <strong>of</strong><br />

Financial <strong>and</strong> Quantitative Analysis, August 2009, pp 777-794.(with V. Nawosah)<br />

“Revisiting the Campbell-Shiller tests <strong>of</strong> the Expectations Hypothesis for the Term Structure”<br />

Journal <strong>of</strong> Banking <strong>and</strong> <strong>Finance</strong>, forthcoming 2011 (with R.D.F. Harris <strong>and</strong> V. Nawosah)<br />

“Structural Breaks, Parameter Uncertainty <strong>and</strong> Term Structure Puzzles” Journal <strong>of</strong> Financial<br />

<strong>Economics</strong>, forthcoming 2011 (with P. Giordani)<br />

Work in Progress:<br />

“Non-linearities in Stock Returns: Evidence from Duration Dependence Tests” Currently under<br />

review, submitted January 2010, Journal <strong>of</strong> Financial Markets. (with V. Nawosah)<br />

“How does the Precision <strong>of</strong> News Affect Trading Vo<strong>lum</strong>e Evidence from Vo<strong>lum</strong>e Following<br />

Pr<strong>of</strong>it Warnings” 2nd invited resubmission in preparation, Journal <strong>of</strong> Business <strong>Finance</strong> <strong>and</strong><br />

Accounting (with I. Krassas)<br />

“Tests <strong>of</strong> Behavioural <strong>Finance</strong> Models using Expectations Data Inferred from the Term Structure<br />

<strong>of</strong> Interest Rates” Manuscript in preparation, (with R.D.F. Harris <strong>and</strong> V. Nawosah)<br />

PhD. Students:<br />

Recent PhD graduates: R. Herrerias (Abnormal returns following Pr<strong>of</strong>it Warnings, 2004);<br />

V.Nawosah (Tests <strong>of</strong> Efficient Markets using Individual Stock Data, 2005); Y.Ionnidis ( The<br />

Impact <strong>of</strong> Disclosure Precision on Trading Vo<strong>lum</strong>e, 2007).<br />

Currently I have three PhD students working on: “Is the Value Premium a Reward to Risk or an<br />

Anomaly”; “ Forecasting returns from dividend models” ; “Testing for bubbles using<br />

company level data”<br />

Awards:<br />

E.S.R.C. Award <strong>of</strong> £60,000, 1994-1996, to support a project entitled: “Testing the relationship<br />

between stock market prices <strong>and</strong> the present discounted value <strong>of</strong> future dividends”. I was the<br />

Principal Applicant for award which was received jointly with D. de Meza <strong>and</strong> G. Shea.<br />

4

E.S.R.C. Award <strong>of</strong> £106,000 2004-2006 to support a project entitled: “Tests <strong>and</strong> Development<br />

<strong>of</strong> Behavioural <strong>Finance</strong> Models in the Bond Market”. I was the Principal Applicant for award<br />

which was received jointly with R.D.F. Harris.<br />

Administrative duties:<br />

Head, Department <strong>of</strong> <strong>Economics</strong>, 1997-2000<br />

<strong>School</strong> Director <strong>of</strong> Research, 2006-<br />

Strategic responsibility for research students in <strong>School</strong>, 2008-<br />

Other Activities:<br />

External Examiner: Keele, 1995-1999; Bristol, 1996-2000; Essex, 2001-2006; Queen Mary<br />

College, 2004-2007; Edinburgh, 2008-; Bath, 2009- .<br />

ESRC Virtual College Assessor <strong>of</strong> small grant applications, 2004- .<br />

External Assessor on the 2009 review <strong>of</strong> the Department <strong>of</strong> <strong>Finance</strong>, London <strong>School</strong> <strong>of</strong><br />

<strong>Economics</strong>.<br />

Consultancy:<br />

Department <strong>of</strong> Trade <strong>and</strong> Industry, 2005 ( Report prepared on the role that real option valuations<br />

might make in public sector investment appraisal)<br />

HM Treasury, 2001 (Member <strong>of</strong> committee that determined the appropriate discount rate for<br />

public sector investment projects).<br />

Government Office, 2002 (Member <strong>of</strong> committee that developed a policy for government loans<br />

to public sector employees).<br />

5