Financials - Deutsche EuroShop

Financials - Deutsche EuroShop

Financials - Deutsche EuroShop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

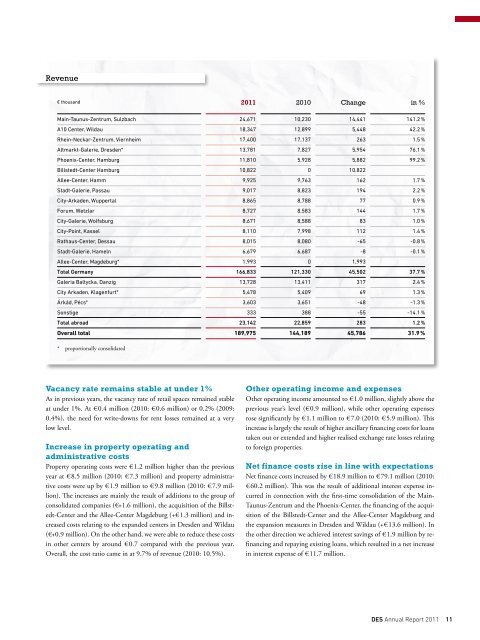

Revenue<br />

€ thousand 2011 2010 Change in %<br />

Main-Taunus-Zentrum, Sulzbach 24,671 10,230 14,441 141.2 %<br />

A10 Center, Wildau 18,347 12,899 5,448 42.2 %<br />

Rhein-Neckar-Zentrum, Viernheim 17,400 17,137 263 1.5 %<br />

Altmarkt-Galerie, Dresden* 13,781 7,827 5,954 76.1 %<br />

Phoenix-Center, Hamburg 11,810 5,928 5,882 99.2 %<br />

Billstedt-Center Hamburg 10,822 0 10,822<br />

Allee-Center, Hamm 9,925 9,763 162 1.7 %<br />

Stadt-Galerie, Passau 9,017 8,823 194 2.2 %<br />

City-Arkaden, Wuppertal 8,865 8,788 77 0.9 %<br />

Forum, Wetzlar 8,727 8,583 144 1.7 %<br />

City-Galerie, Wolfsburg 8,671 8,588 83 1.0 %<br />

City-Point, Kassel 8,110 7,998 112 1.4 %<br />

Rathaus-Center, Dessau 8,015 8,080 -65 -0.8 %<br />

Stadt-Galerie, Hameln 6,679 6,687 -8 -0.1 %<br />

Allee-Center, Magdeburg* 1,993 0 1,993<br />

Total Germany 166,833 121,330 45,502 37.7 %<br />

Galeria Baltycka, Danzig 13,728 13,411 317 2.4 %<br />

City Arkaden, Klagenfurt* 5,478 5,409 69 1.3 %<br />

Árkád, Pécs* 3,603 3,651 -48 -1.3 %<br />

Sonstige 333 388 -55 -14.1 %<br />

Total abroad 23,142 22,859 283 1.2 %<br />

Overall total 189,975 144,189 45,786 31.9 %<br />

* proportionally consolidated<br />

vacancy rate remains stable at under 1%<br />

As in previous years, the vacancy rate of retail spaces remained stable<br />

at under 1%. At € 0.4 million (2010: € 0.6 million) or 0.2% (2009:<br />

0.4%), the need for write-downs for rent losses remained at a very<br />

low level.<br />

increase in property operating and<br />

administrative costs<br />

Property operating costs were € 1.2 million higher than the previous<br />

year at € 8.5 million (2010: € 7.3 million) and property administrative<br />

costs were up by € 1.9 million to € 9.8 million (2010: € 7.9 million).<br />

The increases are mainly the result of additions to the group of<br />

consolidated companies (€+1.6 million), the acquisition of the Billstedt-Center<br />

and the Allee-Center Magdeburg (+€ 1.3 million) and increased<br />

costs relating to the expanded centers in Dresden and Wildau<br />

(€+0.9 million). On the other hand, we were able to reduce these costs<br />

in other centers by around € 0.7 compared with the previous year.<br />

Overall, the cost ratio came in at 9.7% of revenue (2010: 10.5%).<br />

other operating income and expenses<br />

Other operating income amounted to € 1.0 million, slightly above the<br />

previous year’s level (€ 0.9 million), while other operating expenses<br />

rose significantly by € 1.1 million to € 7.0 (2010: € 5.9 million). This<br />

increase is largely the result of higher ancillary financing costs for loans<br />

taken out or extended and higher realised exchange rate losses relating<br />

to foreign properties.<br />

net finance costs rise in line with expectations<br />

Net finance costs increased by € 18.9 million to € 79.1 million (2010:<br />

€ 60.2 million). This was the result of additional interest expense incurred<br />

in connection with the first-time consolidation of the Main-<br />

Taunus-Zentrum and the Phoenix-Center, the financing of the acquisition<br />

of the Billstedt-Center and the Allee-Center Magdeburg and<br />

the expansion measures in Dresden and Wildau (+€ 13.6 million). In<br />

the other direction we achieved interest savings of € 1.9 million by refinancing<br />

and repaying existing loans, which resulted in a net increase<br />

in interest expense of € 11.7 million.<br />

Des Annual Report 2011 11