Financials - Deutsche EuroShop

Financials - Deutsche EuroShop

Financials - Deutsche EuroShop

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ConSoLIDAteD FInAnCIAL StAteMentS other disclosures<br />

other disClosures<br />

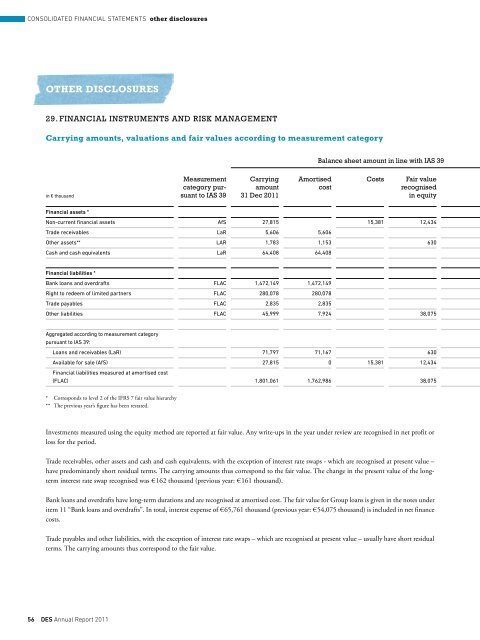

29. FINaNCIal INSTRuMENTS aND RISK MaNaGEMENT<br />

Carrying amounts, valuations and fair values according to measurement category<br />

in € thousand<br />

Financial assets *<br />

Measurement<br />

category pursuant<br />

to IaS 39<br />

Carrying<br />

amount<br />

31 Dec 2011<br />

amortised<br />

cost<br />

Balance sheet amount in line with IaS 39<br />

Costs Fair value<br />

recognised<br />

in equity<br />

Non-current financial assets AfS 27,815 15,381 12,434<br />

Trade receivables LaR 5,606 5,606<br />

Other assets** LAR 1,783 1,153 630<br />

Cash and cash equivalents LaR 64,408 64,408<br />

Financial liabilities *<br />

Bank loans and overdrafts FLAC 1,472,149 1,472,149<br />

Right to redeem of limited partners FLAC 280,078 280,078<br />

Trade payables FLAC 2,835 2,835<br />

Other liabilities FLAC 45,999 7,924 38,075<br />

Aggregated according to measurement category<br />

pursuant to IAS 39:<br />

Loans and receivables (LaR) 71,797 71,167 630<br />

Available for sale (AfS)<br />

Financial liabilities measured at amortised cost<br />

27,815 0 15,381 12,434<br />

(FLAC) 1,801,061 1,762,986 38,075<br />

* Corresponds to level 2 of the IFRS 7 fair value hierarchy<br />

** The previous year’s figure has been restated.<br />

Investments measured using the equity method are reported at fair value. Any write-ups in the year under review are recognised in net profit or<br />

loss for the period.<br />

Trade receivables, other assets and cash and cash equivalents, with the exception of interest rate swaps - which are recognised at present value –<br />

have predominantly short residual terms. The carrying amounts thus correspond to the fair value. The change in the present value of the longterm<br />

interest rate swap recognised was € 162 thousand (previous year: € 161 thousand).<br />

Bank loans and overdrafts have long-term durations and are recognised at amortised cost. The fair value for Group loans is given in the notes under<br />

item 11 “Bank loans and overdrafts”. In total, interest expense of € 65,761 thousand (previous year: € 54,075 thousand) is included in net finance<br />

costs.<br />

Trade payables and other liabilities, with the exception of interest rate swaps – which are recognised at present value – usually have short residual<br />

terms. The carrying amounts thus correspond to the fair value.<br />

56 Des Annual Report 2011