Financials - Deutsche EuroShop

Financials - Deutsche EuroShop

Financials - Deutsche EuroShop

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

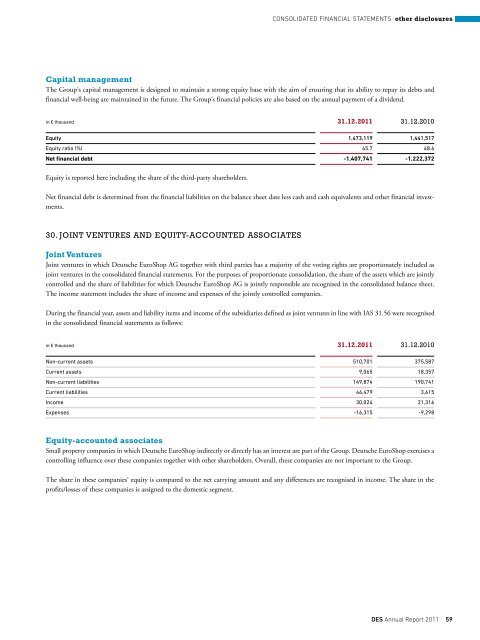

Capital management<br />

The Group‘s capital management is designed to maintain a strong equity base with the aim of ensuring that its ability to repay its debts and<br />

financial well-being are maintained in the future. The Group‘s financial policies are also based on the annual payment of a dividend.<br />

in € thousand 31.12.2011 31.12.2010<br />

equity 1,473,119 1,441,517<br />

Equity ratio (%) 45.7 48.6<br />

Net financial debt -1,407,741 -1,222,372<br />

Equity is reported here including the share of the third-party shareholders.<br />

Net financial debt is determined from the financial liabilities on the balance sheet date less cash and cash equivalents and other financial investments.<br />

30. jOINT vENTuRES aND EquITY-aCCOuNTED aSSOCIaTES<br />

ConSoLIDAteD FInAnCIAL StAteMentS other disclosures<br />

Joint ventures<br />

Joint ventures in which <strong>Deutsche</strong> <strong>EuroShop</strong> AG together with third parties has a majority of the voting rights are proportionately included as<br />

joint ventures in the consolidated financial statements. For the purposes of proportionate consolidation, the share of the assets which are jointly<br />

controlled and the share of liabilities for which <strong>Deutsche</strong> <strong>EuroShop</strong> AG is jointly responsible are recognised in the consolidated balance sheet.<br />

The income statement includes the share of income and expenses of the jointly controlled companies.<br />

During the financial year, assets and liability items and income of the subsidiaries defined as joint ventures in line with IAS 31.56 were recognised<br />

in the consolidated financial statements as follows:<br />

in € thousand 31.12.2011 31.12.2010<br />

Non-current assets 510,701 375,587<br />

Current assets 9,065 18,357<br />

Non-current liabilities 149,874 190,741<br />

Current liabilities 46,479 3,615<br />

Income 30,024 21,316<br />

Expenses -16,315 -9,298<br />

equity-accounted associates<br />

Small property companies in which <strong>Deutsche</strong> <strong>EuroShop</strong> indirectly or directly has an interest are part of the Group. <strong>Deutsche</strong> <strong>EuroShop</strong> exercises a<br />

controlling influence over these companies together with other shareholders. Overall, these companies are not important to the Group.<br />

The share in these companies‘ equity is compared to the net carrying amount and any differences are recognised in income. The share in the<br />

profits/losses of these companies is assigned to the domestic segment.<br />

Des Annual Report 2011 59