Financials - Deutsche EuroShop

Financials - Deutsche EuroShop

Financials - Deutsche EuroShop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ConSoLIDAteD FInAnCIAL StAteMentS other disclosures<br />

MaRKET RISKS<br />

liquidity risk<br />

The liquidity of <strong>Deutsche</strong> <strong>EuroShop</strong> Group is continuously monitored and planned. The subsidiaries regularly have sufficient cash to be able to<br />

pay for their current commitments. Furthermore, credit lines and bank overdrafts can be utilised at short notice.<br />

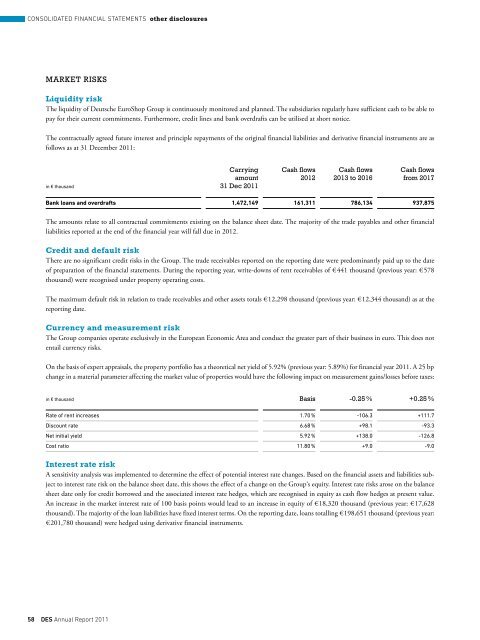

The contractually agreed future interest and principle repayments of the original financial liabilities and derivative financial instruments are as<br />

follows as at 31 December 2011:<br />

in € thousand<br />

Carrying<br />

amount<br />

31 Dec 2011<br />

Cash flows<br />

2012<br />

Cash flows<br />

2013 to 2016<br />

Cash flows<br />

from 2017<br />

Bank loans and overdrafts 1,472,149 161,311 786,134 937,875<br />

The amounts relate to all contractual commitments existing on the balance sheet date. The majority of the trade payables and other financial<br />

liabilities reported at the end of the financial year will fall due in 2012.<br />

Credit and default risk<br />

There are no significant credit risks in the Group. The trade receivables reported on the reporting date were predominantly paid up to the date<br />

of preparation of the financial statements. During the reporting year, write-downs of rent receivables of € 441 thousand (previous year: € 578<br />

thousand) were recognised under property operating costs.<br />

The maximum default risk in relation to trade receivables and other assets totals € 12,298 thousand (previous year: € 12,344 thousand) as at the<br />

reporting date.<br />

Currency and measurement risk<br />

The Group companies operate exclusively in the European Economic Area and conduct the greater part of their business in euro. This does not<br />

entail currency risks.<br />

On the basis of expert appraisals, the property portfolio has a theoretical net yield of 5.92% (previous year: 5.89%) for financial year 2011. A 25 bp<br />

change in a material parameter affecting the market value of properties would have the following impact on measurement gains/losses before taxes:<br />

in € thousand Basis -0.25 % +0.25 %<br />

Rate of rent increases 1.70 % -106.3 +111.7<br />

Discount rate 6.68 % +98.1 -93.3<br />

Net initial yield 5.92 % +138.0 -126.8<br />

Cost ratio 11.80 % +9.0 -9.0<br />

interest rate risk<br />

A sensitivity analysis was implemented to determine the effect of potential interest rate changes. Based on the financial assets and liabilities subject<br />

to interest rate risk on the balance sheet date, this shows the effect of a change on the Group‘s equity. Interest rate risks arose on the balance<br />

sheet date only for credit borrowed and the associated interest rate hedges, which are recognised in equity as cash flow hedges at present value.<br />

An increase in the market interest rate of 100 basis points would lead to an increase in equity of € 18,320 thousand (previous year: € 17,628<br />

thousand). The majority of the loan liabilities have fixed interest terms. On the reporting date, loans totalling € 198,651 thousand (previous year:<br />

€ 201,780 thousand) were hedged using derivative financial instruments.<br />

58 Des Annual Report 2011