Financials - Deutsche EuroShop

Financials - Deutsche EuroShop

Financials - Deutsche EuroShop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ConSoLIDAteD FInAnCIAL StAteMentS other disclosures<br />

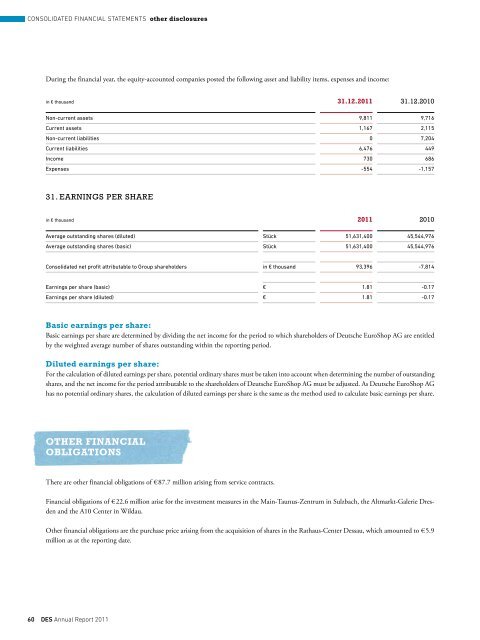

During the financial year, the equity-accounted companies posted the following asset and liability items, expenses and income:<br />

in € thousand 31.12.2011 31.12.2010<br />

Non-current assets 9,811 9,716<br />

Current assets 1,167 2,115<br />

Non-current liabilities 0 7,204<br />

Current liabilities 6,476 449<br />

Income 730 686<br />

Expenses -554 -1,157<br />

31. EaRNINGS pER ShaRE<br />

in € thousand 2011 2010<br />

Average outstanding shares (diluted) Stück 51,631,400 45,544,976<br />

Average outstanding shares (basic) Stück 51,631,400 45,544,976<br />

Consolidated net profit attributable to Group shareholders in € thousand 93,396 -7,814<br />

Earnings per share (basic) € 1.81 -0.17<br />

Earnings per share (diluted) € 1.81 -0.17<br />

basic earnings per share:<br />

Basic earnings per share are determined by dividing the net income for the period to which shareholders of <strong>Deutsche</strong> <strong>EuroShop</strong> AG are entitled<br />

by the weighted average number of shares outstanding within the reporting period.<br />

diluted earnings per share:<br />

For the calculation of diluted earnings per share, potential ordinary shares must be taken into account when determining the number of outstanding<br />

shares, and the net income for the period attributable to the shareholders of <strong>Deutsche</strong> <strong>EuroShop</strong> AG must be adjusted. As <strong>Deutsche</strong> <strong>EuroShop</strong> AG<br />

has no potential ordinary shares, the calculation of diluted earnings per share is the same as the method used to calculate basic earnings per share.<br />

other finanCial<br />

obligations<br />

There are other financial obligations of € 87.7 million arising from service contracts.<br />

Financial obligations of € 22.6 million arise for the investment measures in the Main-Taunus-Zentrum in Sulzbach, the Altmarkt-Galerie Dresden<br />

and the A10 Center in Wildau.<br />

Other financial obligations are the purchase price arising from the acquisition of shares in the Rathaus-Center Dessau, which amounted to € 5.9<br />

million as at the reporting date.<br />

60 Des Annual Report 2011