Department of Strategy and Donor Coordination

Department of Strategy and Donor Coordination

Department of Strategy and Donor Coordination

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.3.5 Social insurance<br />

Indicator: Coverage <strong>of</strong> social assistance scheme: proportion <strong>of</strong> contributors <strong>and</strong> beneficiaries<br />

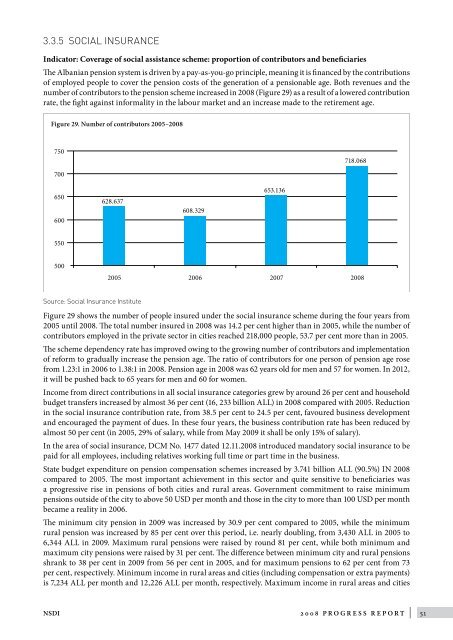

The Albanian pension system is driven by a pay-as-you-go principle, meaning it is financed by the contributions<br />

<strong>of</strong> employed people to cover the pension costs <strong>of</strong> the generation <strong>of</strong> a pensionable age. Both revenues <strong>and</strong> the<br />

number <strong>of</strong> contributors to the pension scheme increased in 2008 (Figure 29) as a result <strong>of</strong> a lowered contribution<br />

rate, the fight against informality in the labour market <strong>and</strong> an increase made to the retirement age.<br />

Figure 29. Number <strong>of</strong> contributors 2005–2008<br />

750<br />

718.068<br />

700<br />

650<br />

600<br />

628.637<br />

608.329<br />

653.136<br />

550<br />

500<br />

2005 2006 2007 2008<br />

Source: Social Insurance Institute<br />

Figure 29 shows the number <strong>of</strong> people insured under the social insurance scheme during the four years from<br />

2005 until 2008. The total number insured in 2008 was 14.2 per cent higher than in 2005, while the number <strong>of</strong><br />

contributors employed in the private sector in cities reached 218,000 people, 53.7 per cent more than in 2005.<br />

The scheme dependency rate has improved owing to the growing number <strong>of</strong> contributors <strong>and</strong> implementation<br />

<strong>of</strong> reform to gradually increase the pension age. The ratio <strong>of</strong> contributors for one person <strong>of</strong> pension age rose<br />

from 1.23:1 in 2006 to 1.38:1 in 2008. Pension age in 2008 was 62 years old for men <strong>and</strong> 57 for women. In 2012,<br />

it will be pushed back to 65 years for men <strong>and</strong> 60 for women.<br />

Income from direct contributions in all social insurance categories grew by around 26 per cent <strong>and</strong> household<br />

budget transfers increased by almost 36 per cent (16, 233 billion ALL) in 2008 compared with 2005. Reduction<br />

in the social insurance contribution rate, from 38.5 per cent to 24.5 per cent, favoured business development<br />

<strong>and</strong> encouraged the payment <strong>of</strong> dues. In these four years, the business contribution rate has been reduced by<br />

almost 50 per cent (in 2005, 29% <strong>of</strong> salary, while from May 2009 it shall be only 15% <strong>of</strong> salary).<br />

In the area <strong>of</strong> social insurance, DCM No. 1477 dated 12.11.2008 introduced m<strong>and</strong>atory social insurance to be<br />

paid for all employees, including relatives working full time or part time in the business.<br />

State budget expenditure on pension compensation schemes increased by 3.741 billion ALL (90.5%) IN 2008<br />

compared to 2005. The most important achievement in this sector <strong>and</strong> quite sensitive to beneficiaries was<br />

a progressive rise in pensions <strong>of</strong> both cities <strong>and</strong> rural areas. Government commitment to raise minimum<br />

pensions outside <strong>of</strong> the city to above 50 USD per month <strong>and</strong> those in the city to more than 100 USD per month<br />

became a reality in 2006.<br />

The minimum city pension in 2009 was increased by 30.9 per cent compared to 2005, while the minimum<br />

rural pension was increased by 85 per cent over this period, i.e. nearly doubling, from 3,430 ALL in 2005 to<br />

6,344 ALL in 2009. Maximum rural pensions were raised by round 81 per cent, while both minimum <strong>and</strong><br />

maximum city pensions were raised by 31 per cent. The difference between minimum city <strong>and</strong> rural pensions<br />

shrank to 38 per cent in 2009 from 56 per cent in 2005, <strong>and</strong> for maximum pensions to 62 per cent from 73<br />

per cent, respectively. Minimum income in rural areas <strong>and</strong> cities (including compensation or extra payments)<br />

is 7,234 ALL per month <strong>and</strong> 12,226 ALL per month, respectively. Maximum income in rural areas <strong>and</strong> cities<br />

NSDI 2008 Progress Report | 51