You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

annual appeal<br />

Carolyn & William Nosanchuk<br />

Rebecca & Nat Pernick<br />

Patti & Rick Phillips<br />

Rachel & Jack Pludwinski<br />

Norma & Nelson Pont<br />

Marilyn & Herbert Racklin<br />

Nanci Rands<br />

Sally & Donald Reinicke<br />

Pamela & Paul Renusch<br />

Frayda & Donald Riger<br />

Maria & Edward Risov<br />

Judy & Scott Roberts & Family<br />

Shelley & Jeffrey Roberts<br />

Mitzi & Dale Robinson<br />

Sidney Rose<br />

Raymond Rosenfeld & Janelle<br />

McCammon<br />

Sandra & Glen Rosin<br />

Collette & Bernard Rosner<br />

Marge & Bill Sandy<br />

Susan Saraquse<br />

Betty & Jerry Schare<br />

Suzanne Schatz<br />

Vera Schey<br />

Cynthia & Bud Schiller<br />

Carole & Martin Schock<br />

Ann & Herman Schonberg<br />

Joan & Arthur Schott<br />

Carol Schwartz<br />

Sydell & Douglas Schubot<br />

Florence Brown Schuman<br />

Shirley & Jerry Shagrin<br />

Llillian Shaye<br />

Julie & Michael Sher<br />

Marci & Jay Shienbaum<br />

Bella & Lev Shleypak<br />

Dr.& Mrs. Sheldon Siegel<br />

Geri & Richard Sills<br />

Cynthia & Harlan Simmons<br />

Evelyn & Fred Simon<br />

Shirley Sklar<br />

Jane Smitt<br />

Janice Sobel<br />

Margaret & Walter Stark<br />

Bertha Stearn<br />

Cindy & Bruce Stein<br />

Ailene Steinborn<br />

Frank Stella<br />

Jessie & Dr. Sheldon Stern<br />

Sydney & Norman Stern<br />

Sheryl & David Stoddard<br />

Renee S.Stone<br />

Sara & Greg Tatchio<br />

Carol & Steven Tarnowsky<br />

Roberta & Sheldon Toll<br />

Lee Turner<br />

Dorothy & Robert Vernan<br />

Barbara & Joel Waldbott<br />

Lauren & David Weinberg<br />

Anne & L. Steven Weiner<br />

Mary & Jeff Weinger<br />

Shelly & Morrey Weinner<br />

Lois Weintraub<br />

Deloris Weinstein-Hall<br />

Regina & Bill Weiss<br />

Hyla Williams<br />

Stephanie & Robert Wineman<br />

Katherine & Fred Yaffe<br />

Shari & Sheldon Yarsike<br />

Chuck Zamek<br />

Carol & Michael Ziecik<br />

Audrey Zupmore<br />

Marc Zupmore<br />

*Donors as of October 14, 2009<br />

ONE MORE BITE OF THE APPLE: USE YOUR IRA<br />

TO MAKE A DIFFERENCE<br />

by Miriam Imerman, Chair of Long Range Planning<br />

Members and friends of <strong>Temple</strong> age 70-1/2 and older who would like a very simple way to<br />

support their favorite TBE program or the general <strong>Temple</strong> endowment have until December 31<br />

of this year to take advantage of a great opportunity. The Emergency Economic Stabilization Act<br />

of 2008 includes a renewal of the IRA rollover provisions that were first passed in 2006, and which<br />

became very popular with charitable taxpayers and the organizations they supported. The IRA<br />

rollover can be used to make a tax-free transfer of up to $100,000 directly from a traditional or<br />

Roth IRA to a qualified charitable organization such as <strong>Temple</strong> <strong>Beth</strong> <strong>El</strong>. For most donors, using<br />

the direct rollover will be much better than taking a withdrawal from an IRA, paying taxes on the<br />

funds, and then making a donation. Here are some of the benefits of using the IRA rollover:<br />

• If you don’t normally itemize your deductions, you can use the IRA rollover and get<br />

the equivalent of a charitable deduction for your gift in addition to your standard<br />

deduction.<br />

• If you do itemize, but are close to the “ceiling” for deduction of charitable gifts (the<br />

30% and 50% rules), you can make the IRA rollover, and avoid the ceiling, because the<br />

rollover will act like a full charitable deduction for your gift.<br />

• Because the charitable IRA rollover amount is never recognized as income to the taxpayer,<br />

you may be able to avoid tax deduction reductions based on income levels (that is, the<br />

7.5% floor on medical deductions, the 2% floor on miscellaneous itemized deductions,<br />

etc.).<br />

• The charitable IRA rollover may reduce the amount of your social security payments that<br />

are subject to tax.<br />

• It is easy to do. Just contact your plan administrator, who should have a short form for<br />

you to complete and return, directing him/her to transfer the amount you select (up to<br />

$100,000) directly to <strong>Temple</strong> <strong>Beth</strong> <strong>El</strong>. No muss, no fuss.<br />

• Of course, only those individuals who are sure they will not need the funds at a later date<br />

should consider the IRA rollover.<br />

Please be aware that while every effort has been made in this article to provide accurate<br />

information, it does not purport to offer legal or financial advice, and <strong>Temple</strong> friends are strongly<br />

advised to seek competent professional counsel to handle any issues or questions that may arise.<br />

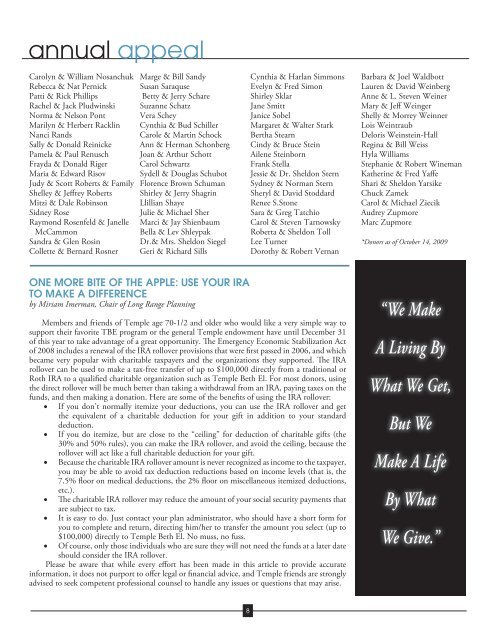

“We Make<br />

A Living By<br />

What We Get,<br />

But We<br />

Make A Life<br />

By What<br />

We Give.”<br />

8