ECO-IEST President, Alternative Member to the IPBES Bureau

ECO-IEST President, Alternative Member to the IPBES Bureau

ECO-IEST President, Alternative Member to the IPBES Bureau

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

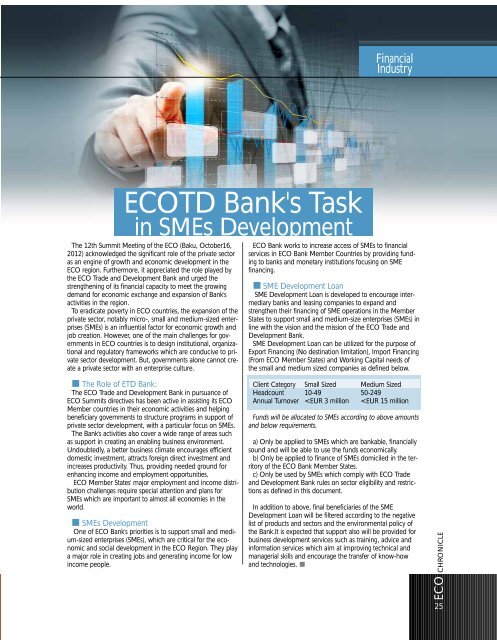

Financial<br />

Industry<br />

<strong>ECO</strong>TD Bank's Task<br />

in SMEs Development<br />

The 12th Summit Meeting of <strong>the</strong> <strong>ECO</strong> (Baku, Oc<strong>to</strong>ber16,<br />

2012) acknowledged <strong>the</strong> significant role of <strong>the</strong> private sec<strong>to</strong>r<br />

as an engine of growth and economic development in <strong>the</strong><br />

<strong>ECO</strong> region. Fur<strong>the</strong>rmore, it appreciated <strong>the</strong> role played by<br />

<strong>the</strong> <strong>ECO</strong> Trade and Development Bank and urged <strong>the</strong><br />

streng<strong>the</strong>ning of its financial capacity <strong>to</strong> meet <strong>the</strong> growing<br />

demand for economic exchange and expansion of Bank's<br />

activities in <strong>the</strong> region.<br />

To eradicate poverty in <strong>ECO</strong> countries, <strong>the</strong> expansion of <strong>the</strong><br />

private sec<strong>to</strong>r, notably micro-, small and medium-sized enterprises<br />

(SMEs) is an influential fac<strong>to</strong>r for economic growth and<br />

job creation. However, one of <strong>the</strong> main challenges for governments<br />

in <strong>ECO</strong> countries is <strong>to</strong> design institutional, organizational<br />

and regula<strong>to</strong>ry frameworks which are conducive <strong>to</strong> private<br />

sec<strong>to</strong>r development. But, governments alone cannot create<br />

a private sec<strong>to</strong>r with an enterprise culture.<br />

<strong>ECO</strong> Bank works <strong>to</strong> increase access of SMEs <strong>to</strong> financial<br />

services in <strong>ECO</strong> Bank <strong>Member</strong> Countries by providing funding<br />

<strong>to</strong> banks and monetary institutions focusing on SME<br />

financing.<br />

SME Development Loan<br />

SME Development Loan is developed <strong>to</strong> encourage intermediary<br />

banks and leasing companies <strong>to</strong> expand and<br />

streng<strong>the</strong>n <strong>the</strong>ir financing of SME operations in <strong>the</strong> <strong>Member</strong><br />

States <strong>to</strong> support small and medium-size enterprises (SMEs) in<br />

line with <strong>the</strong> vision and <strong>the</strong> mission of <strong>the</strong> <strong>ECO</strong> Trade and<br />

Development Bank.<br />

SME Development Loan can be utilized for <strong>the</strong> purpose of<br />

Export Financing (No destination limitation), Import Financing<br />

(From <strong>ECO</strong> <strong>Member</strong> States) and Working Capital needs of<br />

<strong>the</strong> small and medium sized companies as defined below.<br />

The Role of ETD Bank:<br />

The <strong>ECO</strong> Trade and Development Bank in pursuance of<br />

<strong>ECO</strong> Summits directives has been active in assisting its <strong>ECO</strong><br />

<strong>Member</strong> countries in <strong>the</strong>ir economic activities and helping<br />

beneficiary governments <strong>to</strong> structure programs in support of<br />

private sec<strong>to</strong>r development, with a particular focus on SMEs.<br />

The Bank's activities also cover a wide range of areas such<br />

as support in creating an enabling business environment.<br />

Undoubtedly, a better business climate encourages efficient<br />

domestic investment, attracts foreign direct investment and<br />

increases productivity. Thus, providing needed ground for<br />

enhancing income and employment opportunities.<br />

<strong>ECO</strong> <strong>Member</strong> States' major employment and income distribution<br />

challenges require special attention and plans for<br />

SMEs which are important <strong>to</strong> almost all economies in <strong>the</strong><br />

world.<br />

SMEs Development<br />

One of <strong>ECO</strong> Bank's priorities is <strong>to</strong> support small and medium-sized<br />

enterprises (SMEs), which are critical for <strong>the</strong> economic<br />

and social development in <strong>the</strong> <strong>ECO</strong> Region. They play<br />

a major role in creating jobs and generating income for low<br />

income people.<br />

Client Category Small Sized Medium Sized<br />

Headcount 10-49 50-249<br />

Annual Turnover