US ExchangE- TradEd OpTiOnS prOdUcT diSclOSUrE ... - CommSec

US ExchangE- TradEd OpTiOnS prOdUcT diSclOSUrE ... - CommSec

US ExchangE- TradEd OpTiOnS prOdUcT diSclOSUrE ... - CommSec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

pag e 1 0<br />

U S E xc h a n g e -t r a d e d o p t i o n s<br />

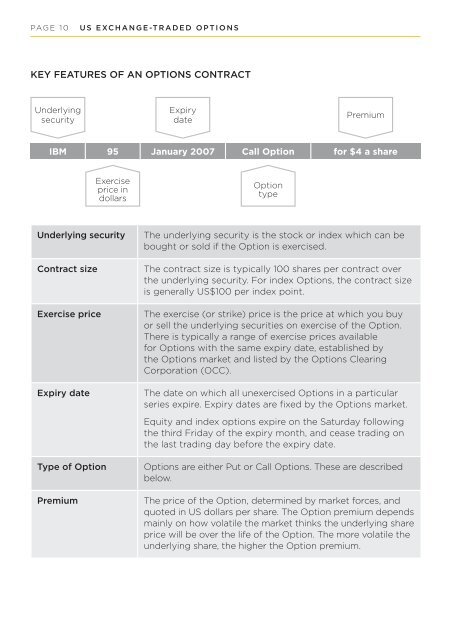

Key features of an Options contract<br />

Underlying<br />

security<br />

Expiry<br />

date<br />

Premium<br />

IBM 95 January 2007 Call Option for $4 a share<br />

Exercise<br />

price in<br />

dollars<br />

Option<br />

type<br />

Underlying security<br />

Contract size<br />

Exercise price<br />

Expiry date<br />

Type of Option<br />

Premium<br />

The underlying security is the stock or index which can be<br />

bought or sold if the Option is exercised.<br />

The contract size is typically 100 shares per contract over<br />

the underlying security. For index Options, the contract size<br />

is generally <strong>US</strong>$100 per index point.<br />

The exercise (or strike) price is the price at which you buy<br />

or sell the underlying securities on exercise of the Option.<br />

There is typically a range of exercise prices available<br />

for Options with the same expiry date, established by<br />

the Options market and listed by the Options Clearing<br />

Corporation (OCC).<br />

The date on which all unexercised Options in a particular<br />

series expire. Expiry dates are fixed by the Options market.<br />

Equity and index options expire on the Saturday following<br />

the third Friday of the expiry month, and cease trading on<br />

the last trading day before the expiry date.<br />

Options are either Put or Call Options. These are described<br />

below.<br />

The price of the Option, determined by market forces, and<br />

quoted in <strong>US</strong> dollars per share. The Option premium depends<br />

mainly on how volatile the market thinks the underlying share<br />

price will be over the life of the Option. The more volatile the<br />

underlying share, the higher the Option premium.