US ExchangE- TradEd OpTiOnS prOdUcT diSclOSUrE ... - CommSec

US ExchangE- TradEd OpTiOnS prOdUcT diSclOSUrE ... - CommSec

US ExchangE- TradEd OpTiOnS prOdUcT diSclOSUrE ... - CommSec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

pag e 1 6<br />

U S E xc h a n g e -t r a d e d o p t i o n s<br />

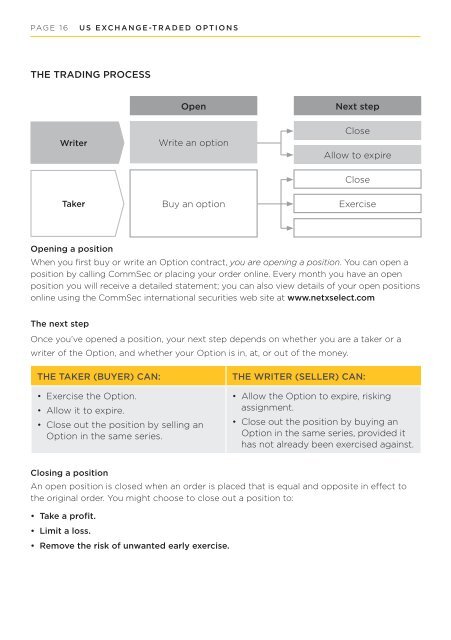

The trading process<br />

Open<br />

Next step<br />

Writer<br />

Write an option<br />

Close<br />

Allow to expire<br />

Close<br />

Taker<br />

Buy an option<br />

Exercise<br />

Opening a position<br />

When you first buy or write an Option contract, you are opening a position. You can open a<br />

position by calling <strong>CommSec</strong> or placing your order online. Every month you have an open<br />

position you will receive a detailed statement; you can also view details of your open positions<br />

online using the <strong>CommSec</strong> international securities web site at www.netxselect.com<br />

The next step<br />

Once you’ve opened a position, your next step depends on whether you are a taker or a<br />

writer of the Option, and whether your Option is in, at, or out of the money.<br />

The taker (buyer) can:<br />

• Exercise the Option.<br />

• Allow it to expire.<br />

• Close out the position by selling an<br />

Option in the same series.<br />

The writer (seller) can:<br />

• Allow the Option to expire, risking<br />

assignment.<br />

• Close out the position by buying an<br />

Option in the same series, provided it<br />

has not already been exercised against.<br />

Closing a position<br />

An open position is closed when an order is placed that is equal and opposite in effect to<br />

the original order. You might choose to close out a position to:<br />

• Take a profit.<br />

• Limit a loss.<br />

• Remove the risk of unwanted early exercise.