US ExchangE- TradEd OpTiOnS prOdUcT diSclOSUrE ... - CommSec

US ExchangE- TradEd OpTiOnS prOdUcT diSclOSUrE ... - CommSec

US ExchangE- TradEd OpTiOnS prOdUcT diSclOSUrE ... - CommSec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

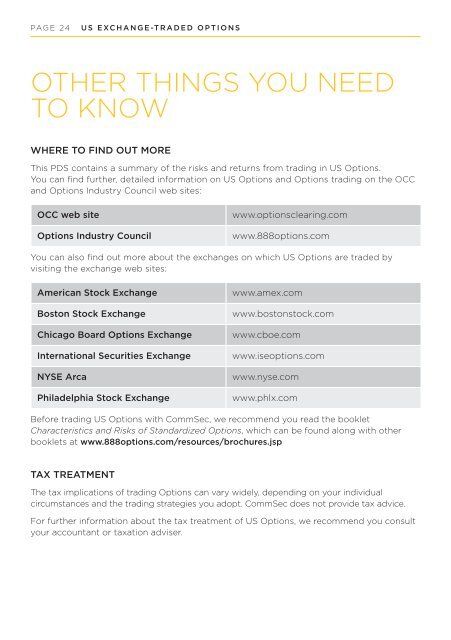

pag e 24<br />

U S e xc h a n g e -t r a d e d o p t i o n s<br />

Other things you need<br />

to know<br />

Where to find out more<br />

This PDS contains a summary of the risks and returns from trading in <strong>US</strong> Options.<br />

You can find further, detailed information on <strong>US</strong> Options and Options trading on the OCC<br />

and Options Industry Council web sites:<br />

OCC web site<br />

Options Industry Council<br />

www.optionsclearing.com<br />

www.888options.com<br />

You can also find out more about the exchanges on which <strong>US</strong> Options are traded by<br />

visiting the exchange web sites:<br />

American Stock Exchange<br />

Boston Stock Exchange<br />

Chicago Board Options Exchange<br />

International Securities Exchange<br />

NYSE Arca<br />

Philadelphia Stock Exchange<br />

www.amex.com<br />

www.bostonstock.com<br />

www.cboe.com<br />

www.iseoptions.com<br />

www.nyse.com<br />

www.phlx.com<br />

Before trading <strong>US</strong> Options with <strong>CommSec</strong>, we recommend you read the booklet<br />

Characteristics and Risks of Standardized Options, which can be found along with other<br />

booklets at www.888options.com/resources/brochures.jsp<br />

Tax treatment<br />

The tax implications of trading Options can vary widely, depending on your individual<br />

circumstances and the trading strategies you adopt. <strong>CommSec</strong> does not provide tax advice.<br />

For further information about the tax treatment of <strong>US</strong> Options, we recommend you consult<br />

your accountant or taxation adviser.