US ExchangE- TradEd OpTiOnS prOdUcT diSclOSUrE ... - CommSec

US ExchangE- TradEd OpTiOnS prOdUcT diSclOSUrE ... - CommSec

US ExchangE- TradEd OpTiOnS prOdUcT diSclOSUrE ... - CommSec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

pag e 4<br />

U S e xc h a n g e -t r a d e d o p t i o n s<br />

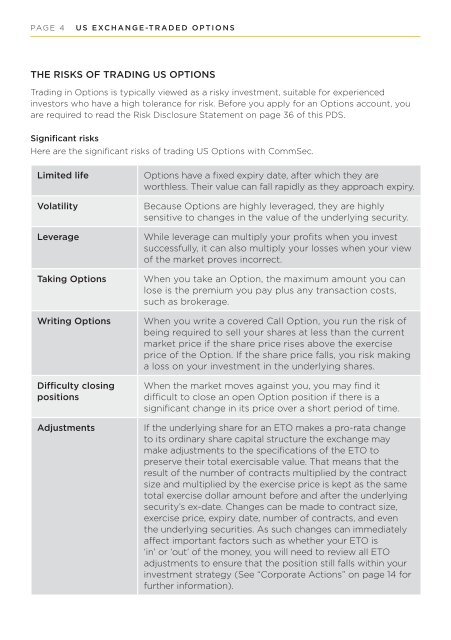

The risks of trading <strong>US</strong> Options<br />

Trading in Options is typically viewed as a risky investment, suitable for experienced<br />

investors who have a high tolerance for risk. Before you apply for an Options account, you<br />

are required to read the Risk Disclosure Statement on page 36 of this PDS.<br />

Significant risks<br />

Here are the significant risks of trading <strong>US</strong> Options with <strong>CommSec</strong>.<br />

Limited life<br />

Volatility<br />

Leverage<br />

Taking Options<br />

Writing Options<br />

Difficulty closing<br />

positions<br />

Adjustments<br />

Options have a fixed expiry date, after which they are<br />

worthless. Their value can fall rapidly as they approach expiry.<br />

Because Options are highly leveraged, they are highly<br />

sensitive to changes in the value of the underlying security.<br />

While leverage can multiply your profits when you invest<br />

successfully, it can also multiply your losses when your view<br />

of the market proves incorrect.<br />

When you take an Option, the maximum amount you can<br />

lose is the premium you pay plus any transaction costs,<br />

such as brokerage.<br />

When you write a covered Call Option, you run the risk of<br />

being required to sell your shares at less than the current<br />

market price if the share price rises above the exercise<br />

price of the Option. If the share price falls, you risk making<br />

a loss on your investment in the underlying shares.<br />

When the market moves against you, you may find it<br />

difficult to close an open Option position if there is a<br />

significant change in its price over a short period of time.<br />

If the underlying share for an ETO makes a pro-rata change<br />

to its ordinary share capital structure the exchange may<br />

make adjustments to the specifications of the ETO to<br />

preserve their total exercisable value. That means that the<br />

result of the number of contracts multiplied by the contract<br />

size and multiplied by the exercise price is kept as the same<br />

total exercise dollar amount before and after the underlying<br />

security’s ex-date. Changes can be made to contract size,<br />

exercise price, expiry date, number of contracts, and even<br />

the underlying securities. As such changes can immediately<br />

affect important factors such as whether your ETO is<br />

‘in’ or ‘out’ of the money, you will need to review all ETO<br />

adjustments to ensure that the position still falls within your<br />

investment strategy (See “Corporate Actions” on page 14 for<br />

further information).