BOARD FOR INDUSTRIAL AND FINANCIAL RECONSTRUCTION

BOARD FOR INDUSTRIAL AND FINANCIAL RECONSTRUCTION

BOARD FOR INDUSTRIAL AND FINANCIAL RECONSTRUCTION

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

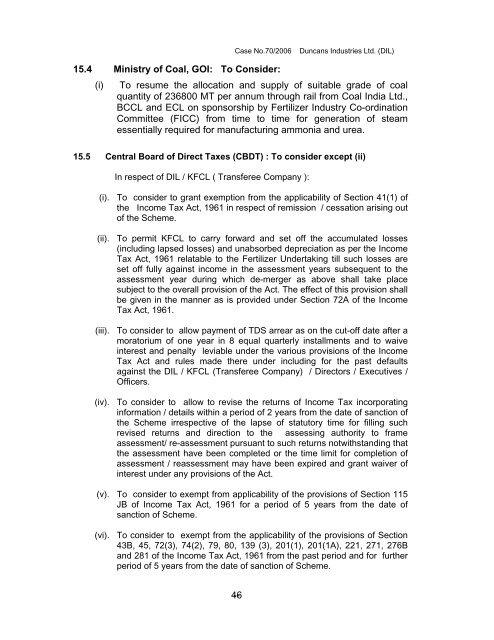

15.4 Ministry of Coal, GOI: To Consider:<br />

(i)<br />

Case No.70/2006 Duncans Industries Ltd. (DIL)<br />

To resume the allocation and supply of suitable grade of coal<br />

quantity of 236800 MT per annum through rail from Coal India Ltd.,<br />

BCCL and ECL on sponsorship by Fertilizer Industry Co-ordination<br />

Committee (FICC) from time to time for generation of steam<br />

essentially required for manufacturing ammonia and urea.<br />

15.5 Central Board of Direct Taxes (CBDT) : To consider except (ii)<br />

In respect of DIL / KFCL ( Transferee Company ):<br />

(i). To consider to grant exemption from the applicability of Section 41(1) of<br />

the Income Tax Act, 1961 in respect of remission / cessation arising out<br />

of the Scheme.<br />

(ii). To permit KFCL to carry forward and set off the accumulated losses<br />

(including lapsed losses) and unabsorbed depreciation as per the Income<br />

Tax Act, 1961 relatable to the Fertilizer Undertaking till such losses are<br />

set off fully against income in the assessment years subsequent to the<br />

assessment year during which de-merger as above shall take place<br />

subject to the overall provision of the Act. The effect of this provision shall<br />

be given in the manner as is provided under Section 72A of the Income<br />

Tax Act, 1961.<br />

(iii). To consider to allow payment of TDS arrear as on the cut-off date after a<br />

moratorium of one year in 8 equal quarterly installments and to waive<br />

interest and penalty leviable under the various provisions of the Income<br />

Tax Act and rules made there under including for the past defaults<br />

against the DIL / KFCL (Transferee Company) / Directors / Executives /<br />

Officers.<br />

(iv). To consider to allow to revise the returns of Income Tax incorporating<br />

information / details within a period of 2 years from the date of sanction of<br />

the Scheme irrespective of the lapse of statutory time for filling such<br />

revised returns and direction to the assessing authority to frame<br />

assessment/ re-assessment pursuant to such returns notwithstanding that<br />

the assessment have been completed or the time limit for completion of<br />

assessment / reassessment may have been expired and grant waiver of<br />

interest under any provisions of the Act.<br />

(v). To consider to exempt from applicability of the provisions of Section 115<br />

JB of Income Tax Act, 1961 for a period of 5 years from the date of<br />

sanction of Scheme.<br />

(vi). To consider to exempt from the applicability of the provisions of Section<br />

43B, 45, 72(3), 74(2), 79, 80, 139 (3), 201(1), 201(1A), 221, 271, 276B<br />

and 281 of the Income Tax Act, 1961 from the past period and for further<br />

period of 5 years from the date of sanction of Scheme.<br />

46 --