Rettledning for utenlandske arbeidstakere og ... - Skatteetaten

Rettledning for utenlandske arbeidstakere og ... - Skatteetaten

Rettledning for utenlandske arbeidstakere og ... - Skatteetaten

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

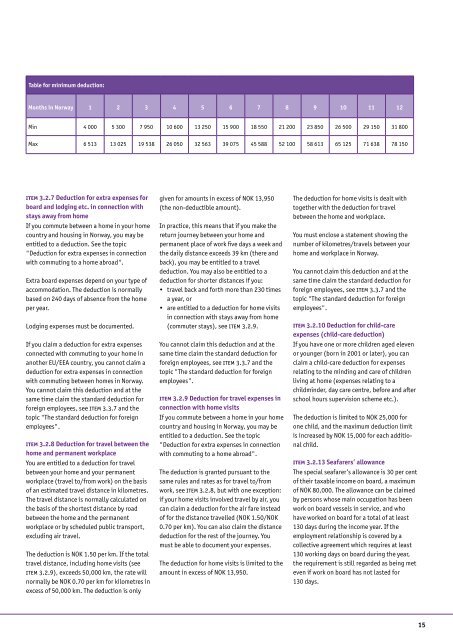

Table <strong>for</strong> minimum deduction:<br />

Months in Norway 1 2 3 4 5 6 7 8 9 10 11 12<br />

Min 4 000 5 300 7 950 10 600 13 250 15 900 18 550 21 200 23 850 26 500 29 150 31 800<br />

Max 6 513 13 025 19 538 26 050 32 563 39 075 45 588 52 100 58 613 65 125 71 638 78 150<br />

Item 3.2.7 Deduction <strong>for</strong> extra expenses <strong>for</strong><br />

board and lodging etc. in connection with<br />

stays away from home<br />

If you commute between a home in your home<br />

country and housing in Norway, you may be<br />

entitled to a deduction. See the topic<br />

"Deduction <strong>for</strong> extra expenses in connection<br />

with commuting to a home abroad".<br />

Extra board expenses depend on your type of<br />

accommodation. The deduction is normally<br />

based on 240 days of absence from the home<br />

per year.<br />

Lodging expenses must be documented.<br />

If you claim a deduction <strong>for</strong> extra expenses<br />

connected with commuting to your home in<br />

another EU/EEA country, you cannot claim a<br />

deduction <strong>for</strong> extra expenses in connection<br />

with commuting between homes in Norway.<br />

You cannot claim this deduction and at the<br />

same time claim the standard deduction <strong>for</strong><br />

<strong>for</strong>eign employees, see item 3.3.7 and the<br />

topic "The standard deduction <strong>for</strong> <strong>for</strong>eign<br />

employees".<br />

Item 3.2.8 Deduction <strong>for</strong> travel between the<br />

home and permanent workplace<br />

You are entitled to a deduction <strong>for</strong> travel<br />

between your home and your permanent<br />

workplace (travel to/from work) on the basis<br />

of an estimated travel distance in kilometres.<br />

The travel distance is normally calculated on<br />

the basis of the shortest distance by road<br />

between the home and the permanent<br />

workplace or by scheduled public transport,<br />

excluding air travel.<br />

The deduction is NOK 1.50 per km. If the total<br />

travel distance, including home visits (see<br />

item 3.2.9), exceeds 50,000 km, the rate will<br />

normally be NOK 0.70 per km <strong>for</strong> kilometres in<br />

excess of 50,000 km. The deduction is only<br />

given <strong>for</strong> amounts in excess of NOK 13,950<br />

(the non-deductible amount).<br />

In practice, this means that if you make the<br />

return journey between your home and<br />

permanent place of work five days a week and<br />

the daily distance exceeds 39 km (there and<br />

back), you may be entitled to a travel<br />

deduction. You may also be entitled to a<br />

deduction <strong>for</strong> shorter distances if you:<br />

• travel back and <strong>for</strong>th more than 230 times<br />

a year, or<br />

• are entitled to a deduction <strong>for</strong> home visits<br />

in connection with stays away from home<br />

(commuter stays), see item 3.2.9.<br />

You cannot claim this deduction and at the<br />

same time claim the standard deduction <strong>for</strong><br />

<strong>for</strong>eign employees, see item 3.3.7 and the<br />

topic "The standard deduction <strong>for</strong> <strong>for</strong>eign<br />

employees".<br />

Item 3.2.9 Deduction <strong>for</strong> travel expenses in<br />

connection with home visits<br />

If you commute between a home in your home<br />

country and housing in Norway, you may be<br />

entitled to a deduction. See the topic<br />

"Deduction <strong>for</strong> extra expenses in connection<br />

with commuting to a home abroad".<br />

The deduction is granted pursuant to the<br />

same rules and rates as <strong>for</strong> travel to/from<br />

work, see item 3.2.8, but with one exception:<br />

if your home visits involved travel by air, you<br />

can claim a deduction <strong>for</strong> the air fare instead<br />

of <strong>for</strong> the distance travelled (NOK 1.50/NOK<br />

0.70 per km). You can also claim the distance<br />

deduction <strong>for</strong> the rest of the journey. You<br />

must be able to document your expenses.<br />

The deduction <strong>for</strong> home visits is limited to the<br />

amount in excess of NOK 13,950.<br />

The deduction <strong>for</strong> home visits is dealt with<br />

t<strong>og</strong>ether with the deduction <strong>for</strong> travel<br />

between the home and workplace.<br />

You must enclose a statement showing the<br />

number of kilometres/travels between your<br />

home and workplace in Norway.<br />

You cannot claim this deduction and at the<br />

same time claim the standard deduction <strong>for</strong><br />

<strong>for</strong>eign employees, see item 3.3.7 and the<br />

topic "The standard deduction <strong>for</strong> <strong>for</strong>eign<br />

employees".<br />

Item 3.2.10 Deduction <strong>for</strong> child-care<br />

expenses (child-care deduction)<br />

If you have one or more children aged eleven<br />

or younger (born in 2001 or later), you can<br />

claim a child-care deduction <strong>for</strong> expenses<br />

relating to the minding and care of children<br />

living at home (expenses relating to a<br />

childminder, day care centre, be<strong>for</strong>e and after<br />

school hours supervision scheme etc.).<br />

The deduction is limited to NOK 25,000 <strong>for</strong><br />

one child, and the maximum deduction limit<br />

is increased by NOK 15,000 <strong>for</strong> each additional<br />

child.<br />

Item 3.2.13 Seafarers’ allowance<br />

The special seafarer’s allowance is 30 per cent<br />

of their taxable income on board, a maximum<br />

of NOK 80,000. The allowance can be claimed<br />

by persons whose main occupation has been<br />

work on board vessels in service, and who<br />

have worked on board <strong>for</strong> a total of at least<br />

130 days during the income year. If the<br />

employment relationship is covered by a<br />

collective agreement which requires at least<br />

130 working days on board during the year,<br />

the requirement is still regarded as being met<br />

even if work on board has not lasted <strong>for</strong><br />

130 days.<br />

15