BASEL II: PROBLEMS AND USAGE

BASEL II: PROBLEMS AND USAGE

BASEL II: PROBLEMS AND USAGE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

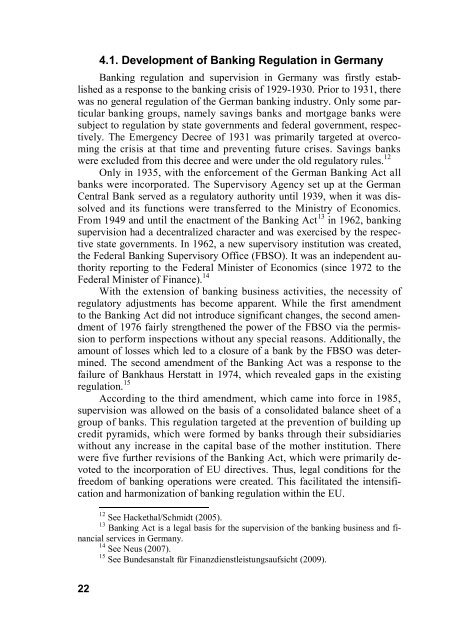

4.1. Development of Banking Regulation in Germany<br />

Banking regulation and supervision in Germany was firstly established<br />

as a response to the banking crisis of 1929-1930. Prior to 1931, there<br />

was no general regulation of the German banking industry. Only some particular<br />

banking groups, namely savings banks and mortgage banks were<br />

subject to regulation by state governments and federal government, respectively.<br />

The Emergency Decree of 1931 was primarily targeted at overcoming<br />

the crisis at that time and preventing future crises. Savings banks<br />

were excluded from this decree and were under the old regulatory rules. 12<br />

Only in 1935, with the enforcement of the German Banking Act all<br />

banks were incorporated. The Supervisory Agency set up at the German<br />

Central Bank served as a regulatory authority until 1939, when it was dissolved<br />

and its functions were transferred to the Ministry of Economics.<br />

From 1949 and until the enactment of the Banking Act 13 in 1962, banking<br />

supervision had a decentralized character and was exercised by the respective<br />

state governments. In 1962, a new supervisory institution was created,<br />

the Federal Banking Supervisory Office (FBSO). It was an independent authority<br />

reporting to the Federal Minister of Economics (since 1972 to the<br />

Federal Minister of Finance). 14<br />

With the extension of banking business activities, the necessity of<br />

regulatory adjustments has become apparent. While the first amendment<br />

to the Banking Act did not introduce significant changes, the second amendment<br />

of 1976 fairly strengthened the power of the FBSO via the permission<br />

to perform inspections without any special reasons. Additionally, the<br />

amount of losses which led to a closure of a bank by the FBSO was determined.<br />

The second amendment of the Banking Act was a response to the<br />

failure of Bankhaus Herstatt in 1974, which revealed gaps in the existing<br />

regulation. 15<br />

According to the third amendment, which came into force in 1985,<br />

supervision was allowed on the basis of a consolidated balance sheet of a<br />

group of banks. This regulation targeted at the prevention of building up<br />

credit pyramids, which were formed by banks through their subsidiaries<br />

without any increase in the capital base of the mother institution. There<br />

were five further revisions of the Banking Act, which were primarily devoted<br />

to the incorporation of EU directives. Thus, legal conditions for the<br />

freedom of banking operations were created. This facilitated the intensification<br />

and harmonization of banking regulation within the EU.<br />

12 See Hackethal/Schmidt (2005).<br />

13 Banking Act is a legal basis for the supervision of the banking business and financial<br />

services in Germany.<br />

14 See Neus (2007).<br />

15 See Bundesanstalt für Finanzdienstleistungsaufsicht (2009).<br />

22