BASEL II: PROBLEMS AND USAGE

BASEL II: PROBLEMS AND USAGE

BASEL II: PROBLEMS AND USAGE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

y weights of the business lines, which range from 12 to 18 percent. In<br />

contrast, in the AMA a bank can calculate the capital requirements for operational<br />

risk using an internal model. This method requires a prior approval<br />

of the FFSA. Another opportunity laid down by the Solvency Regulation<br />

is the partial use of the AMA, i.e. the bank may use the AMA to<br />

calculate the capital charge for only a part of the bank. In order to facilitate<br />

the application of the Solvency Regulation, the FFSA provides guidelines<br />

and interpretations of the Solvency Regulation’s requirements.<br />

The Solvency Regulation also incorporates the new disclosure requirements<br />

of pillar <strong>II</strong>I of Basel <strong>II</strong>, according to which banks have to publish<br />

all necessary information either annually or semiannually, depending<br />

on the bank’s type. This information includes capital structure, capital adequacy,<br />

and information on market, credit and operational risk as well as risk<br />

management procedures. In case of banking groups, disclosure requirements<br />

are applicable to the top of the group. In addition, banks are not required to<br />

disclose legally protected or confidential information. However, in the two<br />

latter cases banks are obliged to publish more general information about the<br />

facts that they are not able to disclose.<br />

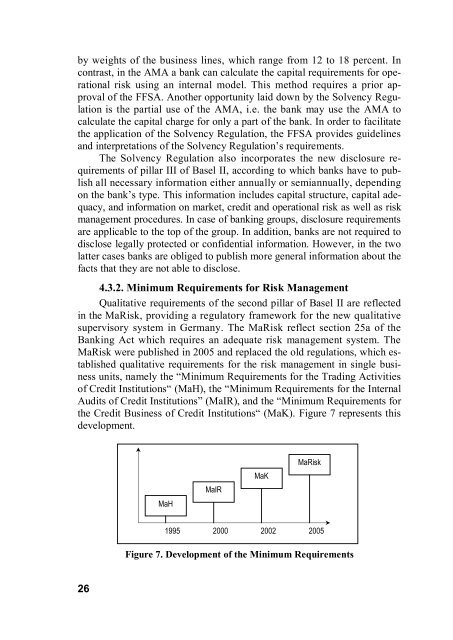

4.3.2. Minimum Requirements for Risk Management<br />

Qualitative requirements of the second pillar of Basel <strong>II</strong> are reflected<br />

in the MaRisk, providing a regulatory framework for the new qualitative<br />

supervisory system in Germany. The MaRisk reflect section 25a of the<br />

Banking Act which requires an adequate risk management system. The<br />

MaRisk were published in 2005 and replaced the old regulations, which established<br />

qualitative requirements for the risk management in single business<br />

units, namely the “Minimum Requirements for the Trading Activities<br />

of Credit Institutions“ (MaH), the “Minimum Requirements for the Internal<br />

Audits of Credit Institutions” (MaIR), and the “Minimum Requirements for<br />

the Credit Business of Credit Institutions“ (MaK). Figure 7 represents this<br />

development.<br />

MaH<br />

MaIR<br />

MaK<br />

MaRisk<br />

1995<br />

2000<br />

2002 2005<br />

Figure 7. Development of the Minimum Requirements<br />

26