ANNUAL REPORT 2013

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

31 December <strong>2013</strong> and 2012 (Expressed in United States Dollars)<br />

A. Underwriting risk<br />

Underwriting risk consists of premium risk, catastrophe risk and reserve risk.<br />

Underwriting risk may be due to either the acceptance of risks that do not comply with the Company’s underwriting guidelines and corporate strategy,<br />

or the acceptance of risks that result in losses and expenses greater than it had anticipated at the time of underwriting.<br />

As a reinsurance company, TMR AG is in the business of taking underwriting risk and therefore has a high appetite for underwriting risk. TMR AG’s risk<br />

limits are defined in the TMR AG Risk Appetite and Risk Tolerance/Limit Policy for underwriting risk and reserve risk combined.<br />

The Company has underwriting guidelines in place that clearly define the territorial scope, risks to be written, business to be avoided, acceptance limits,<br />

maximum policy period, maximum net retention, outward reinsurance, security requirement (for retrocessionaires) and underwriting authority.<br />

As a part of the risk control strategy and governance at TMR AG, all contracts must be reviewed and approved by an Underwriting Committee before<br />

they can be bound.<br />

The Company employs experienced catastrophe analysts and modelers, as well as experienced and credentialed actuaries, to perform pricing analyses<br />

to ensure that each risk is adequately priced.<br />

Premium risk<br />

Premium risk is the risk that the premium to be earned over the next twelve-month period from the in-force, new or renewal reinsurance contracts is<br />

insufficient to cover the claim costs, claim adjustment expenses as well as the acquisition costs to be incurred by those contracts over the same period.<br />

The Company has purchased retrocessions in the past several years to enhance the diversity of the portfolio, improve capital efficiency, manage the<br />

net retention and protect the capital of TMR AG. The Company will continue to utilise this important risk management tool when the pricing and risk<br />

mitigation impact justifies doing so.<br />

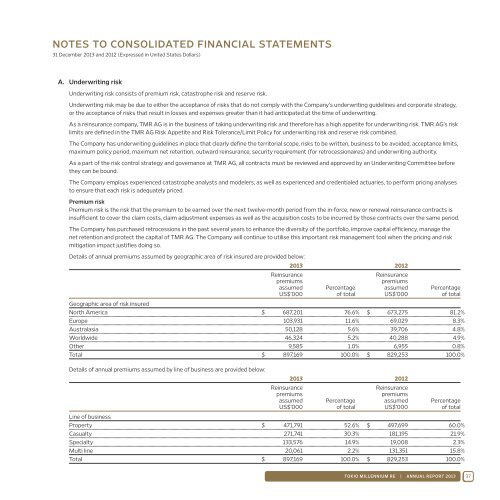

Details of annual premiums assumed by geographic area of risk insured are provided below:<br />

<strong>2013</strong> 2012<br />

Reinsurance<br />

Reinsurance<br />

premiums<br />

premiums<br />

assumed Percentage assumed Percentage<br />

US$’000 of total US$’000 of total<br />

Geographic area of risk insured<br />

North America $ 687,201 76.6 % $ 673,275 81.2 %<br />

Europe 103,931 11.6 % 69,029 8.3 %<br />

Australasia 50,128 5.6 % 39,706 4.8 %<br />

Worldwide 46,324 5.2 % 40,288 4.9 %<br />

Other 9,585 1.0 % 6,955 0.8 %<br />

Total $ 897,169 100.0 % $ 829,253 100.0 %<br />

Details of annual premiums assumed by line of business are provided below:<br />

<strong>2013</strong> 2012<br />

Reinsurance<br />

Reinsurance<br />

premiums<br />

premiums<br />

assumed Percentage assumed Percentage<br />

US$’000 of total US$’000 of total<br />

Line of business<br />

Property $ 471,791 52.6 % $ 497,699 60.0 %<br />

Casualty 271,741 30.3 % 181,195 21.9 %<br />

Specialty 133,576 14.9 % 19,008 2.3 %<br />

Multi line 20,061 2.2 % 131,351 15.8 %<br />

Total $ 897,169 100.0 % $ 829,253 100.0 %<br />

TOKIO MILLENNIUM RE | <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2013</strong> 37