ANNUAL REPORT 2013

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

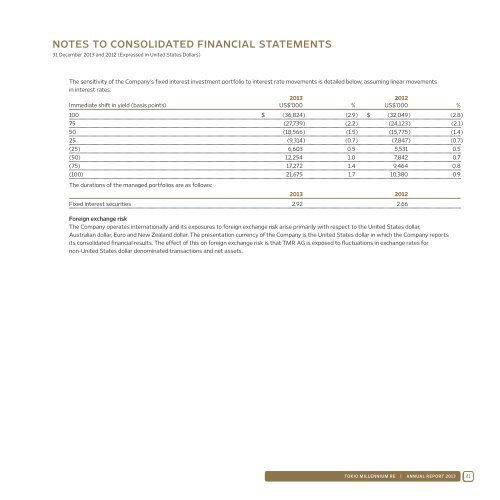

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

31 December <strong>2013</strong> and 2012 (Expressed in United States Dollars)<br />

The sensitivity of the Company’s fixed interest investment portfolio to interest rate movements is detailed below, assuming linear movements<br />

in interest rates:<br />

<strong>2013</strong> 2012<br />

Immediate shift in yield (basis points) US$’000 % US$’000 %<br />

100 $ (36,824) (2.9) $ (32,049) (2.8)<br />

75 (27,739 ) (2.2) (24,123) (2.1)<br />

50 (18,566) (1.5) (15,775) (1.4)<br />

25 (9,314) (0.7) (7,847 ) (0.7)<br />

(25) 6,603 0.5 5,531 0.5<br />

(50) 12,254 1.0 7,842 0.7<br />

(75) 17,272 1.4 9,464 0.8<br />

(100) 21,675 1.7 10,380 0.9<br />

The durations of the managed portfolios are as follows:<br />

<strong>2013</strong> 2012<br />

Fixed interest securities 2.92 2.66<br />

Foreign exchange risk<br />

The Company operates internationally and its exposures to foreign exchange risk arise primarily with respect to the United States dollar,<br />

Australian dollar, Euro and New Zealand dollar. The presentation currency of the Company is the United States dollar in which the Company reports<br />

its consolidated financial results. The effect of this on foreign exchange risk is that TMR AG is exposed to fluctuations in exchange rates for<br />

non-United States dollar denominated transactions and net assets.<br />

TOKIO MILLENNIUM RE | <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2013</strong> 41