ANNUAL REPORT 2013

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

31 December <strong>2013</strong> and 2012 (Expressed in United States Dollars)<br />

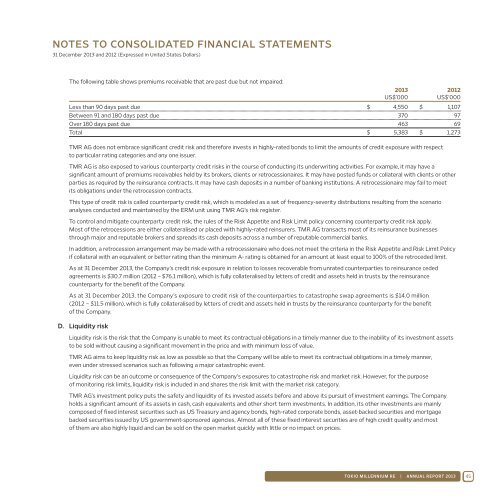

The following table shows premiums receivable that are past due but not impaired:<br />

<strong>2013</strong> 2012<br />

US$’000 US$’000<br />

Less than 90 days past due $ 4,550 $ 1,107<br />

Between 91 and 180 days past due 370 97<br />

Over 180 days past due 463 69<br />

Total $ 5,383 $ 1,273<br />

TMR AG does not embrace significant credit risk and therefore invests in highly-rated bonds to limit the amounts of credit exposure with respect<br />

to particular rating categories and any one issuer.<br />

TMR AG is also exposed to various counterparty credit risks in the course of conducting its underwriting activities. For example, it may have a<br />

significant amount of premiums receivables held by its brokers, clients or retrocessionaires. It may have posted funds or collateral with clients or other<br />

parties as required by the reinsurance contracts. It may have cash deposits in a number of banking institutions. A retrocessionaire may fail to meet<br />

its obligations under the retrocession contracts.<br />

This type of credit risk is called counterparty credit risk, which is modeled as a set of frequency-severity distributions resulting from the scenario<br />

analyses conducted and maintained by the ERM unit using TMR AG’s risk register.<br />

To control and mitigate counterparty credit risk, the rules of the Risk Appetite and Risk Limit policy concerning counterparty credit risk apply.<br />

Most of the retrocessions are either collateralised or placed with highly-rated reinsurers. TMR AG transacts most of its reinsurance businesses<br />

through major and reputable brokers and spreads its cash deposits across a number of reputable commercial banks.<br />

In addition, a retrocession arrangement may be made with a retrocessionaire who does not meet the criteria in the Risk Appetite and Risk Limit Policy<br />

if collateral with an equivalent or better rating than the minimum A- rating is obtained for an amount at least equal to 100% of the retroceded limit.<br />

As at 31 December <strong>2013</strong>, the Company’s credit risk exposure in relation to losses recoverable from unrated counterparties to reinsurance ceded<br />

agreements is $30.7 million (2012 – $76.1 million), which is fully collateralised by letters of credit and assets held in trusts by the reinsurance<br />

counterparty for the benefit of the Company.<br />

As at 31 December <strong>2013</strong>, the Company’s exposure to credit risk of the counterparties to catastrophe swap agreements is $14.0 million<br />

(2012 – $11.5 million), which is fully collateralised by letters of credit and assets held in trusts by the reinsurance counterparty for the benefit<br />

of the Company.<br />

D. Liquidity risk<br />

Liquidity risk is the risk that the Company is unable to meet its contractual obligations in a timely manner due to the inability of its investment assets<br />

to be sold without causing a significant movement in the price and with minimum loss of value.<br />

TMR AG aims to keep liquidity risk as low as possible so that the Company will be able to meet its contractual obligations in a timely manner,<br />

even under stressed scenarios such as following a major catastrophic event.<br />

Liquidity risk can be an outcome or consequence of the Company’s exposures to catastrophe risk and market risk. However, for the purpose<br />

of monitoring risk limits, liquidity risk is included in and shares the risk limit with the market risk category.<br />

TMR AG’s investment policy puts the safety and liquidity of its invested assets before and above its pursuit of investment earnings. The Company<br />

holds a significant amount of its assets in cash, cash equivalents and other short term investments. In addition, its other investments are mainly<br />

composed of fixed interest securities such as US Treasury and agency bonds, high-rated corporate bonds, asset-backed securities and mortgage<br />

backed securities issued by US government-sponsored agencies. Almost all of these fixed interest securities are of high credit quality and most<br />

of them are also highly liquid and can be sold on the open market quickly with little or no impact on prices.<br />

TOKIO MILLENNIUM RE | <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2013</strong> 45