northgate redevelopment implementation plan - City of College Station

northgate redevelopment implementation plan - City of College Station

northgate redevelopment implementation plan - City of College Station

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NORTHGATE REDEVELOPMENT IMPLEMENTATION PLAN<br />

BACKGROUND: MULTI-FAMILY HOUSING<br />

Multifamily Market Driven by <strong>College</strong><br />

Students<br />

Garden apartment complexes, privately owned<br />

dorms, apartment complexes with two and four<br />

bedroom suites with individual or shared baths<br />

dominate the market. These are <strong>of</strong>ten leased by<br />

the bedroom.<br />

Multifamily Demand<br />

The spring 2002 apartment occupancy rate was<br />

89% down from the fall 2001 occupancy rate <strong>of</strong><br />

91%. Fall 2002 occupancy rate was 88%.<br />

Multi-Family Form Type<br />

Low-density apartment development is the<br />

norm in Bryan/ <strong>College</strong> <strong>Station</strong> due to seemingly<br />

unlimited available land, low land prices,<br />

and one dominant customer market segment.<br />

Multi-Family Future Trends<br />

As TAMU strives to recruit and keep research<br />

faculty and graduate students from other more<br />

urbanized parts <strong>of</strong> the United States and<br />

abroad, the housing market will need to adapt<br />

to meet that market.<br />

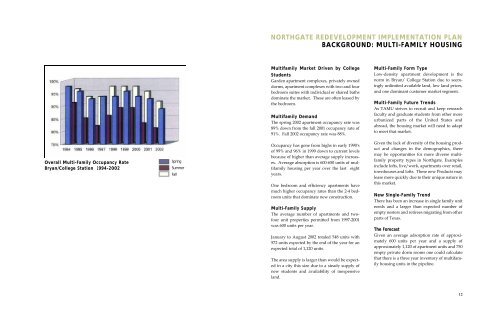

Overall Multi-Family Occupancy Rate<br />

Bryan/<strong>College</strong> <strong>Station</strong> 1994-2002<br />

Spring<br />

Summer<br />

Fall<br />

Occupancy has gone from highs in early 1990's<br />

<strong>of</strong> 99% and 96% in 1999 down to current levels<br />

because <strong>of</strong> higher than average supply increases.<br />

Average absorption is 600-650 units <strong>of</strong> multifamily<br />

housing per year over the last eight<br />

years.<br />

One bedroom and efficiency apartments have<br />

much higher occupancy rates than the 2-4 bedroom<br />

units that dominate new construction.<br />

Multi-Family Supply<br />

The average number <strong>of</strong> apartments and tw<strong>of</strong>our<br />

unit properties permitted from 1997-2001<br />

was 600 units per year.<br />

January to August 2002 totaled 548 units with<br />

572 units expected by the end <strong>of</strong> the year for an<br />

expected total <strong>of</strong> 1,120 units.<br />

The area supply is larger than would be expected<br />

in a city this size due to a steady supply <strong>of</strong><br />

new students and availability <strong>of</strong> inexpensive<br />

land.<br />

Given the lack <strong>of</strong> diversity <strong>of</strong> the housing product<br />

and changes in the demographics, there<br />

may be opportunities for more diverse multifamily<br />

property types in Northgate. Examples<br />

include l<strong>of</strong>ts, live/work, apartments over retail,<br />

townhouses and l<strong>of</strong>ts. These new Products may<br />

lease more quickly due to their unique nature in<br />

this market.<br />

New Single-Family Trend<br />

There has been an increase in single family unit<br />

needs and a larger than expected number <strong>of</strong><br />

empty nesters and retirees migrating from other<br />

parts <strong>of</strong> Texas.<br />

The Forecast<br />

Given an average adsorption rate <strong>of</strong> approximately<br />

600 units per year and a supply <strong>of</strong><br />

approximately 1,120 <strong>of</strong> apartment units and 750<br />

empty private dorm rooms one could calculate<br />

that there is a three year inventory <strong>of</strong> multifamily<br />

housing units in the pipeline.<br />

12