City of Fruita Municipal Code

City of Fruita Municipal Code

City of Fruita Municipal Code

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>City</strong> <strong>of</strong> <strong>Fruita</strong><br />

<strong>Municipal</strong> <strong>Code</strong><br />

Updated through September 1, 2010

Revised 09/01/2010 i Table <strong>of</strong> Contents<br />

Title 1: GENERAL PROVISIONS<br />

FRUITA MUNICIPAL CODE<br />

SEPTEMBER 1, 2010<br />

TABLE OF CONTENTS<br />

1.01 <strong>Code</strong> Adoption .............................................................................................................. 1-3<br />

1.04 General Provisions ........................................................................................................... 1-6<br />

1.08 <strong>City</strong> Seal ........................................................................................................................... 1-9<br />

1.12 Ordinances ..................................................................................................................... 1-10<br />

1.16 Precincts ......................................................................................................................... 1-11<br />

1.20 Criminal Proceedings ..................................................................................................... 1-12<br />

1.24 Right <strong>of</strong> Entry for Inspection ......................................................................................... 1-13<br />

1.28 General Penalty .............................................................................................................. 1-14<br />

Title 2: ADMINISTRATION AND PERSONNEL<br />

2.04 <strong>City</strong> Officers, General Provisions .................................................................................... 2-3<br />

2.08 <strong>City</strong> Administrator ........................................................................................................... 2-4<br />

2.12 <strong>City</strong> Clerk ......................................................................................................................... 2-6<br />

2.14 <strong>City</strong> Treasurer .................................................................................................................. 2-7<br />

2.16 <strong>City</strong> Attorney ................................................................................................................... 2-8<br />

2.18 Council and Mayor .......................................................................................................... 2-9<br />

2.19 Elections ......................................................................................................................... 2-10<br />

2.20 Electrical Inspector ........................................................................................................ 2-11<br />

2.24 Superintendent <strong>of</strong> Streets ............................................................................................... 2-12<br />

2.25 <strong>Code</strong> Enforcement Officer ............................................................................................. 2-13<br />

2.28 <strong>Municipal</strong> Court ............................................................................................................. 2-14<br />

2.29 Teen Court Program ....................................................................................................... 2-23<br />

2.36 Police Department .......................................................................................................... 2-26<br />

2.37 Private Patrol Systems ................................................................................................... 2-29<br />

2.39 Planning Commission .................................................................................................... 2-31<br />

2.40 Board <strong>of</strong> Adjustment ...................................................................................................... 2-34<br />

2.41 Police Commission ........................................................................................................ 2-38<br />

2.42 Parks and Recreation Commission ................................................................................ 2-40<br />

2.44 Officers’ Oath and Bonds .............................................................................................. 2-42<br />

2.48 Officers’ Salaries and Fees ............................................................................................ 2-43<br />

2.52 Retirement Plan .............................................................................................................. 2-44<br />

2.56 Building Department ...................................................................................................... 2-45<br />

2.60 Rules Governing Administrative Proceedings ............................................................... 2-47<br />

2.65 Disposition <strong>of</strong> Unclaimed Property ............................................................................... 2-50<br />

2.70 <strong>Code</strong> <strong>of</strong> Ethics for <strong>City</strong> Officials ................................................................................... 2-56

Revised 09/01/2010 ii Table <strong>of</strong> Contents<br />

Title 3: REVENUE AND FINANCE<br />

3.04 Sewer Fund ...................................................................................................................... 3-3<br />

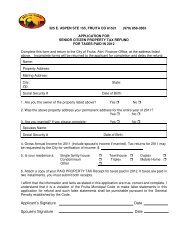

3.05 Senior Citizen Property Tax............................................................................................. 3-4<br />

3.08 Special Revenue Sharing Trust Fund ............................................................................... 3-6<br />

3.12 Sales Tax .......................................................................................................................... 3-7<br />

3.15 Use Tax - Building Materials -Vehicles ........................................................................ 3-24<br />

3.16 Community Center Fund................................................................................................ 3-34<br />

3.18 <strong>Fruita</strong> Lodger’s Tax ....................................................................................................... 3-35<br />

3.19 <strong>Fruita</strong> Medical Marijuana Tax ....................................................................................... 3-46<br />

3.20 Uniform Collection ........................................................................................................ 3-56<br />

Title 4: RESERVED<br />

Title 5: BUSINESS LICENSES AND REGULATIONS<br />

5.04 Business Licenses in General........................................................................................... 5-2<br />

5.05 Licensing Officer ............................................................................................................. 5-5<br />

5.08 Amusements ..................................................................................................................... 5-7<br />

5.12 Dance Halls ...................................................................................................................... 5-9<br />

5.15 Medical Marijuana Dispensaries .................................................................................... 5-11<br />

5.16 Intoxicating Liquor ........................................................................................................ 5-12<br />

5.20 Alcoholic Beverage Licenses ......................................................................................... 5-13<br />

5.24 Junkyards and Automobile Wrecking and Salvage Yards ............................................. 5-19<br />

5.30 Pawnbrokers ................................................................................................................... 5-22<br />

5.40 Sexually Oriented Businesses ........................................................................................ 5-26<br />

5.50 Issuance and Conditions <strong>of</strong> Licenses ............................................................................. 5-38<br />

5.60 Qualifications <strong>of</strong> Applicants .......................................................................................... 5-40<br />

5.70 Suspension and Revocation Procedures ......................................................................... 5-41<br />

Title 6: ANIMALS<br />

6.04 Definitions........................................................................................................................ 6-2<br />

6.08 Dogs at Large ................................................................................................................... 6-6<br />

6.09 Animal Nuisances ............................................................................................................ 6-8<br />

6.10 Quantity <strong>of</strong> Household Pets Restricted .......................................................................... 6-10<br />

6.11 Dangerous Animals Prohibited; Failure to Control Animals ......................................... 6-11<br />

6.12 Impoundment ................................................................................................................. 6-13<br />

6.13 Redemption and Disposition .......................................................................................... 6-15<br />

6.16 Licensing and Vaccination/Dogs and Cats .................................................................... 6-17<br />

6.17 Guard Dogs .................................................................................................................... 6-19<br />

6.18 Prohibition against Ownership or Sale <strong>of</strong> Certain Animals; Wild Animals at Large .... 6-21<br />

6.24 Cruelty to Animals–Neglect <strong>of</strong> Animals ........................................................................ 6-22<br />

6.28 Kennels .......................................................................................................................... 6-23

Revised 09/01/2010 iii Table <strong>of</strong> Contents<br />

6.29 Enforcement ................................................................................................................... 6-24<br />

6.30 Unlawful Violation & Penalties ..................................................................................... 6-26<br />

Title 7: RESERVED<br />

Title 8: HEALTH AND SAFETY<br />

8.04 Weeds, Brush and Rubbish .............................................................................................. 8-3<br />

8.06 Tree Care and Maintenance ............................................................................................. 8-5<br />

8.08 Garbage and Solid Waste ................................................................................................. 8-9<br />

8.12 Burning Restrictions ...................................................................................................... 8-14<br />

8.14 Wood Stove Regulations ................................................................................................ 8-15<br />

8.15 Trailers ........................................................................................................................... 8-18<br />

8.20 Smoking Prohibited in <strong>Fruita</strong> <strong>City</strong> Hall Except in those Areas Designated for<br />

Smoking 8-19<br />

Title 9: PUBLIC PEACE, MORALS AND WELFARE<br />

9.01 Public Peace, Morals and Welfare ................................................................................... 9-2<br />

9.02 Noise .............................................................................................................................. 9-19<br />

9.03 Parks and Public Grounds .............................................................................................. 9-21<br />

9.05 Weapons ......................................................................................................................... 9-24<br />

9.08 Alcohol and Drugs ......................................................................................................... 9-27<br />

9.10 Sale and Possession <strong>of</strong> Tobacco Products ..................................................................... 9-35<br />

9.11 Public Nuisances ............................................................................................................9–38<br />

9.12 Injury to Property ...........................................................................................................9–45<br />

9.14 Aiding and Abetting .......................................................................................................9–48<br />

Title 10: VEHICLES AND TRAFFIC<br />

10.04 <strong>Municipal</strong> Traffic <strong>Code</strong> .................................................................................................. 10-3<br />

10.06 Golf Carts/Golf Course Maintenance Vehicles on Public Rights-<strong>of</strong>-Way .................... 10-7<br />

10.08 Parades ......................................................................................................................... 10-10<br />

10.12 Abandoned Vehicles .................................................................................................... 10-11<br />

10.14 Restricted Truck Routes ............................................................................................... 10-13<br />

Title 11: RESERVED<br />

Title 12: PUBLIC IMPROVEMENTS<br />

12.04 Construction and Repair <strong>of</strong> Public Improvements ......................................................... 12-3<br />

12.08 Excavations .................................................................................................................... 12-5<br />

12.12 Obstruction <strong>of</strong> Streets and Sidewalks ............................................................................ 12-7<br />

12.14 Sidewalk Restaurants ..................................................................................................... 12-8

Revised 09/01/2010 iv Table <strong>of</strong> Contents<br />

12.16 Removal <strong>of</strong> Snow ......................................................................................................... 12-11<br />

12.20 Street Naming and Numbering .................................................................................... 12-12<br />

Title 13: WATER AND SEWER<br />

13.04 Water Regulations .......................................................................................................... 13-3<br />

13.08 Water Rates and Charges ............................................................................................... 13-6<br />

13.12 <strong>Municipal</strong> Irrigation System .......................................................................................... 13-8<br />

13.16 Sewer Definitions......................................................................................................... 13-11<br />

13.20 Sewer Connections -- Permits ...................................................................................... 13-13<br />

13.24 Sewer Service Regulations .......................................................................................... 13-16<br />

13.28 Sewer Rates and Charges ............................................................................................. 13-23<br />

Title 14: RESERVED<br />

Title 15: BUILDING AND CONSTRUCTION<br />

15.04 International Building <strong>Code</strong> ........................................................................................... 15-3<br />

15.08 Uniform Plumbing <strong>Code</strong> ................................................................................................ 15-7<br />

15.12 International Mechanical <strong>Code</strong> ...................................................................................... 15-9<br />

15.16 International Fuel Gas <strong>Code</strong> ........................................................................................ 15-10<br />

15.20 International Property Maintenance <strong>Code</strong> .................................................................. 15-12<br />

15.22 International Residential <strong>Code</strong> ..................................................................................... 15-13<br />

15.24 International Fire <strong>Code</strong> ................................................................................................ 15-16<br />

15.28 International Energy Conservation <strong>Code</strong> ..................................................................... 15-24<br />

15.32 National Electric <strong>Code</strong> ................................................................................................. 15-25<br />

15.40 Administration and Enforcement ................................................................................. 15-26<br />

15.42 Building Board <strong>of</strong> Appeals .......................................................................................... 15-29<br />

15.44 Structure Moving Regulations ..................................................................................... 15-31<br />

15.50 Violations and Penalties ............................................................................................... 15-33<br />

Title 16: RESERVED<br />

Title 17: LAND USE CODE<br />

17.01 General Provisions ......................................................................................................... 17-2<br />

17.03 Basic Definitions and Interpretation ............................................................................ 17-13<br />

17.04 Land Use Categories .................................................................................................... 17-54<br />

17.05 Land Development Applications - General Provisions ............................................... 17-76<br />

17.06 Annexations ................................................................................................................. 17-84<br />

17.07 Zoning - Uses and General Requirements ................................................................... 17-87<br />

17.08 Density Bonuses......................................................................................................... 17-125<br />

17.09 Transfer <strong>of</strong> Development Rights/Credits ................................................................... 17-139<br />

17.11 Design Standards ....................................................................................................... 17-143

Revised 09/01/2010 v Table <strong>of</strong> Contents<br />

Title 17: LAND USE CODE (CONTINUED)<br />

17.13 Zoning Review and Amendment Procedures ............................................................ 17-172<br />

17.15 Subdivisions ............................................................................................................... 17-178<br />

17.17 Planned Unit Developments ...................................................................................... 17-194<br />

17.19 Public Dedications and Impact Fees .......................................................................... 17-199<br />

17.21 Subdivision and Development Improvements Agreements ....................................... 17-222<br />

17.23 Manufactured Housing and Mobile Home Standards ................................................ 17-228<br />

17.25 Manufactured and Mobile Home Parks and Subdivisions ......................................... 17-231<br />

17.27 Recreational Vehicle Parks and Campgrounds .......................................................... 17-241<br />

17.29 Parks, Open Spaces and Trails ................................................................................... 17-260<br />

Landscape Appendix for Parks, Open Spaces and Trails .............................. 17-268<br />

17.31 Mineral Extraction and Mining Operations ............................................................... 17-286<br />

17.33 Animal Regulations ................................................................................................... 17-291<br />

17.35 Sexually Oriented Business ....................................................................................... 17-293<br />

17.37 Historic Preservation .................................................................................................. 17-297<br />

17.39 Parking Standards ...................................................................................................... 17-309<br />

17.41 Sign <strong>Code</strong> ................................................................................................................... 17-323<br />

17.43 Transportation System Planning and Development ................................................... 17-344<br />

17.45 Floodways, Floodplains, and Flood Hazard Prevention ............................................ 17-353<br />

17.47 Vested Property Rights .............................................................................................. 17-370

Revised 09/01/2010 1-1 General Provisions<br />

Chapters:<br />

1.01 <strong>Code</strong> Adoption<br />

1.04 General Provisions<br />

1.08 <strong>City</strong> Seal<br />

1.12 Ordinances<br />

1.16 Precincts<br />

1.20 Criminal Proceedings<br />

1.24 Right <strong>of</strong> Entry for Inspection<br />

1.28 General Penalty<br />

TITLE 1<br />

GENERAL PROVISIONS

Revised 09/01/2010 1-2 General Provisions<br />

THIS PAGE INTENTIONALLY LEFT BLANK

Revised 09/01/2010 1-3 General Provisions<br />

Sections:<br />

Chapter 1.01<br />

CODE ADOPTION<br />

1.01.010 Generally<br />

1.01.040 Repeal <strong>of</strong> prior ordinances<br />

1.01.050 Matters not affected by repeal <strong>of</strong> ordinances<br />

1.01.060 Ordinances saved from repeal<br />

1.01.070 Title, Chapter and Section headings Non-applicable<br />

1.01.080 Reference to specific ordinances<br />

1.01.090 <strong>Code</strong>s kept on file<br />

1.01.100 Ordinances passed prior to adoption <strong>of</strong> the code<br />

1.01.110 Sale <strong>of</strong> code copies<br />

1.01.010 GENERALLY. The <strong>Fruita</strong> <strong>Municipal</strong> <strong>Code</strong> as promulgated by the <strong>City</strong> <strong>of</strong> <strong>Fruita</strong>,<br />

Colorado, is adopted and enacted by reference. The purpose <strong>of</strong> this code is to codify the<br />

ordinances <strong>of</strong> the <strong>City</strong> which are <strong>of</strong> a general and permanent nature. The subject matter <strong>of</strong> this<br />

code includes provisions concerning the application and interpretation <strong>of</strong> the code, the<br />

administration and organization <strong>of</strong> the city, animals, buildings, abandoned automobiles, peddlers,<br />

finances, streets, nuisances, traffic, <strong>of</strong>fenses, civil defense, elections and zoning. (Ord. 339, S1<br />

(a), 1976)<br />

1.01.040 REPEAL OF PRIOR ORDINANCES. All ordinances <strong>of</strong> the city, <strong>of</strong> a general and<br />

permanent nature which were finally adopted on or before May 12, 1975, whether or not in legal<br />

effect at that date are repealed, except as hereinafter provided, and except as the <strong>Fruita</strong> <strong>Municipal</strong><br />

<strong>Code</strong> expressly saves any ordinance or part there<strong>of</strong> from repeal. If any section, subsection,<br />

sentence, clause or phrase <strong>of</strong> this code or ordinance is for any reason held to be invalid or<br />

unconstitutional, such decision shall not affect the validity <strong>of</strong> the remaining portions. The<br />

Council declares that it would have passed this code and ordinance, and each section, subsection,<br />

sentence, clause and phrase there<strong>of</strong>, irrespective <strong>of</strong> the fact that any one or more sections,<br />

subsections, sentences, clauses or phrases had been declared invalid or unconstitutional. If for<br />

any reason this code should be declared invalid or unconstitutional, then the original ordinance<br />

or ordinances shall be in full force and effect. (Ord. 339, S5, 1976)<br />

1.01.050 MATTERS NOT AFFECTED BY REPEAL OF ORDINANCES. The repeal <strong>of</strong><br />

ordinances and parts <strong>of</strong> ordinances <strong>of</strong> a permanent or general nature by Section 1.01.040 <strong>of</strong> this<br />

chapter shall not affect any <strong>of</strong>fense committed or act done, any penalty or forfeiture incurred or<br />

any contract, right or obligation established prior to the time when the ordinances and parts <strong>of</strong><br />

ordinances are repealed. (Ord. 339, S6, 1976)<br />

1.01.060 ORDINANCES SAVED FROM REPEAL. The repeal <strong>of</strong> ordinances <strong>of</strong> a general<br />

and permanent nature by Section 1.01.040 <strong>of</strong> this chapter shall not repeal any ordinance or part<br />

there<strong>of</strong> saved from specific repeal by the <strong>Fruita</strong> municipal <strong>Code</strong>; nor shall such repeal affect any<br />

ordinance:

Revised 09/01/2010 1-4 General Provisions<br />

A. Promising, guaranteeing or authorizing the payment <strong>of</strong> money by or for the city;<br />

B. Authorizing or relating to specific issuances <strong>of</strong> bonds or other evidences <strong>of</strong> indebtedness;<br />

C. Granting a franchise;<br />

D. Establishing the compensation <strong>of</strong> city <strong>of</strong>ficers or employees;<br />

E. Levying taxes, making appropriations or adopting a budget;<br />

F. Creating specific local improvement districts;<br />

G. Making special assessments for local improvements;<br />

H. Vacating, accepting, establishing, locating, relocating or opening any street or public<br />

way;<br />

I. Affecting the corporate limits <strong>of</strong> the city;<br />

J. Which is <strong>of</strong> a special or temporary nature;<br />

K. Dedicating or accepting any plat or subdivision.<br />

(Ord. 339, S7, 1976)<br />

1.01.070 TITLE, CHAPTER AND SECTION HEADINGS, NON-APPLICABLE. Title,<br />

chapter and section headings contained in this code shall not be deemed to govern, limit, modify<br />

or in any manner affect the scope, meaning or intent <strong>of</strong> the provisions <strong>of</strong> any title, chapter or<br />

section there<strong>of</strong>. (Ord. 339, S8, 1976)<br />

1.01.080 REFERENCE TO SPECIFIC ORDINANCES The provisions <strong>of</strong> this code shall not<br />

in any manner affect matters <strong>of</strong> record which refer to, or are otherwise connected with<br />

ordinances which are therein specifically designated by number or otherwise and which are<br />

included within the code, but such reference shall be construed to apply to the corresponding<br />

provisions contained within the code. (Ord. 339, S9, 1976)<br />

1.01.090 CODES KEPT ON FILE.<br />

A. At least three copies <strong>of</strong> the <strong>Fruita</strong> <strong>Municipal</strong> <strong>Code</strong>, and <strong>of</strong> each secondary code adopted<br />

therein, all certified by the mayor and the city clerk to be true copies <strong>of</strong> such codes as<br />

they were adopted by the ordinance codified in this chapter, shall be kept on file in the<br />

<strong>of</strong>fice <strong>of</strong> the city clerk available for public inspection. One copy <strong>of</strong> each such code may<br />

be kept in the <strong>of</strong>fice <strong>of</strong> the chief enforcement <strong>of</strong>ficer there<strong>of</strong>.<br />

B. The city clerk shall prepare and publish revised sheets <strong>of</strong> every loose leaf page in need <strong>of</strong><br />

revision by reason <strong>of</strong> amendment, addition or repeal. The city clerk shall distribute the<br />

revised loose leaf sheets for such fee as the <strong>City</strong> Council may direct.

Revised 09/01/2010 1-5 General Provisions<br />

C. In addition to those copies <strong>of</strong> this code specified in subsection A <strong>of</strong> this section, a copy <strong>of</strong><br />

this code shall be kept on file in the <strong>of</strong>fice <strong>of</strong> the city clerk in which it shall be the express<br />

duty <strong>of</strong> the city clerk to insert in their designated places all amendments or ordinances<br />

which are intended to become a part <strong>of</strong> the <strong>Fruita</strong> <strong>Municipal</strong> <strong>Code</strong>, when the same have<br />

been printed or reprinted in page form, and to extract from such code all provisions which<br />

may from time to time be repealed. This copy <strong>of</strong> the <strong>Fruita</strong> <strong>Municipal</strong> <strong>Code</strong> shall be<br />

available to all persons desiring to examine it and shall be considered the <strong>of</strong>ficial <strong>Fruita</strong><br />

<strong>Municipal</strong> <strong>Code</strong>.<br />

(Ord. 339, S10, 1976)<br />

1.01.100 ORDINANCES PASSED PRIOR TO ADOPTION OF THE CODE. The last<br />

ordinance included in the original code is Ordinance 328, passed May 12, 1975. The following<br />

ordinances, passed subsequent to Ordinance 328, but prior to adoption <strong>of</strong> this code, are adopted<br />

and made a part <strong>of</strong> this code: Ordinances 329 through 337 inclusive. (Ord. 339, S11, 1976)<br />

1.01.110 SALE OF CODE COPIES. The city clerk shall maintain a reasonable supply <strong>of</strong><br />

copies <strong>of</strong> this code and <strong>of</strong> all secondary codes incorporated in it by reference, to be available for<br />

purchase by the public at a moderate price. (Ord. 339, S12, 1976)

Revised 09/01/2010 1-6 General Provisions<br />

Sections:<br />

Chapter 1.04<br />

GENERAL PROVISIONS<br />

1.04.010 Definitions<br />

1.04.020 Grammatical interpretation<br />

1.04.030 Prohibited acts include causing or permitting<br />

1.04.040 Construction <strong>of</strong> provisions<br />

1.04.050 Repeal not to revive any ordinances<br />

1.04.010 DEFINITIONS. The following words and phrases whenever used in the ordinances<br />

<strong>of</strong> the city <strong>of</strong> <strong>Fruita</strong>, Colorado, shall be construed as defined in this section unless from the<br />

context a different meaning is intended or unless different meaning is specifically defined and<br />

more particularly directed to the use <strong>of</strong> such words or phrases.<br />

A. "<strong>City</strong>" means the city <strong>of</strong> <strong>Fruita</strong>, Colorado, or the area within the territorial limits <strong>of</strong> the<br />

city <strong>of</strong> <strong>Fruita</strong>, Colorado, and such territory outside <strong>of</strong> the city over which the city has<br />

jurisdiction or control by virtue <strong>of</strong> any constitutional or statutory provision.<br />

B. "Computation <strong>of</strong> time" means the time within which an act is to be done. It shall be<br />

computed by excluding the first day and including the last day; and if the last day be<br />

Sunday or a legal holiday, that day shall be excluded.<br />

C. "Council" means the <strong>City</strong> Council <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Fruita</strong>. "All <strong>of</strong> its members" or "all<br />

councilmen" means the total number <strong>of</strong> councilmen provided by the general laws <strong>of</strong> the<br />

state <strong>of</strong> Colorado.<br />

D. "County" means the county <strong>of</strong> Mesa, Colorado.<br />

E. "Law" denotes applicable federal law, the Constitution and statutes <strong>of</strong> the state <strong>of</strong><br />

Colorado, the ordinances <strong>of</strong> the county and city, and when appropriate, any and all rules<br />

and regulations which may be promulgated thereunder.<br />

F. "May" is permissive.<br />

G. "Month" means a calendar month.<br />

H. "Must" and "shall": Are mandatory.<br />

I. "Oath" shall be construed to include an affirmation or declaration in all cases in which,<br />

by law, an affirmation may be substituted for an oath, and in such cases the words<br />

"swear" and "sworn" shall be equivalent to the words "affirm" and "affirmed."<br />

J. "Ordinance" means a law <strong>of</strong> the city; provided that a temporary or special law,<br />

administrative action, order or directive may be in the form <strong>of</strong> a resolution.

Revised 09/01/2010 1-7 General Provisions<br />

K. "Owner" applied to a building or land includes any part owner, joint owner, tenant in<br />

common, joint tenant or tenant by the entirety, <strong>of</strong> the whole or a part <strong>of</strong> such building or<br />

land.<br />

L. "Person" means natural person, joint venture, joint stock company, partnership,<br />

association, club, company, corporation, business, trust, organization, or the manager,<br />

lessee, agent, servant, <strong>of</strong>ficer or employee <strong>of</strong> any <strong>of</strong> them.<br />

M. "Personal property" includes money, goods, chattels, things in action and evidences <strong>of</strong><br />

debt.<br />

N. "Preceding" and "following" mean next before and next after, respectively.<br />

O. "Property" includes real and personal property.<br />

P. "Real property" includes lands, tenements and hereditaments.<br />

Q. "Sidewalk" means that portion <strong>of</strong> a street between the curb line and the adjacent property<br />

line intended for the use <strong>of</strong> pedestrians.<br />

R. "State" means the state <strong>of</strong> Colorado.<br />

S. "Street" includes all streets, highways, avenues, lanes, alleys, courts, places, squares,<br />

curbs or other public ways in the city which have been or may hereafter be dedicated and<br />

open to public use, or such other public property so designated in any law <strong>of</strong> this state.<br />

T. Tenant" and "occupant," applied to a building or land, includes any person who occupies<br />

whole or a part <strong>of</strong> such building or land, whether alone or with others.<br />

U. Title <strong>of</strong> <strong>of</strong>fice: Use <strong>of</strong> the title <strong>of</strong> any <strong>of</strong>ficer, employee, board or commission means that<br />

<strong>of</strong>ficer, employee, department, board or commission <strong>of</strong> the city.<br />

V. "Written" includes printed, typewritten, mimeo-graphed or multi-graphed.<br />

W. "Year" means a calendar year.<br />

X. All words and phrases shall be construed and understood according to the common and<br />

approved usage <strong>of</strong> the language; but technical words and phrases and such others as have<br />

acquired a peculiar and appropriate meaning in the law shall be construed and understood<br />

according to such peculiar and appropriate meaning.<br />

Y. When an act is required by an ordinance the same being such that it may be done as well<br />

by an agent as by the principal, such requirement shall be construed as to include all such<br />

acts performed by an authorized agent.<br />

(Ord. 323, S1, 1975; Ord. 2010-05, S1)

Revised 09/01/2010 1-8 General Provisions<br />

1.04.020 GRAMMATICAL INTERPRETATION. The following grammatical rules shall<br />

apply in the ordinances <strong>of</strong> the city:<br />

A. Gender: The masculine gender includes the feminine and neuter genders;<br />

B. Singular and plural: The singular number includes the plural and the plural includes the<br />

singular;<br />

C. Tenses: Words used in the present tense include the past and the future tenses and vice<br />

versa, unless manifestly inapplicable;<br />

D. Use <strong>of</strong> words and phrases: Words and phrases not specifically defined shall be construed<br />

according to the context and approved usage <strong>of</strong> the language.<br />

(Ord. 323, S2, 1975)<br />

1.04.030 PROHIBITED ACTS INCLUDE CAUSING OR PERMITTING. Whenever in the<br />

ordinances <strong>of</strong> the city any act or omission is made unlawful, it shall include causing, allowing,<br />

permitting, aiding, abetting, suffering, or concealing the fact <strong>of</strong> such act or omission. (Ord. 323,<br />

S3, 1975)<br />

1.04.040 CONSTRUCTION OF PROVISIONS. The provisions <strong>of</strong> the ordinances <strong>of</strong> the city,<br />

and all proceedings under them, are to be construed with a view to affect their objects and to<br />

promote justice. (Ord. 323, S4, 1975)<br />

1.04.050 REPEAL NOT TO REVIVE ANY ORDINANCES. The repeal <strong>of</strong> an ordinance<br />

shall not repeal the repealing clause <strong>of</strong> such ordinance or revive any ordinance which has been<br />

repealed thereby. (Ord. 323, S5, 1975)

Revised 09/01/2010 1-9 General Provisions<br />

Sections:<br />

1.08.010 Described<br />

1.08.020 Authority <strong>of</strong> attestations<br />

Chapter 1.08<br />

CITY SEAL<br />

1.08.010 DESCRIBED. A seal the impression <strong>of</strong> which is as follows: In the center the word<br />

"Seal" and around the outer edge the words "<strong>City</strong> <strong>of</strong> <strong>Fruita</strong>, Colorado," shall be and is established<br />

and declared to be the seal <strong>of</strong> the city. Said seal shall be <strong>of</strong> circular shape. (Ord. 13, S1, 1895)<br />

1.08.020 AUTHORITY OF ATTESTATIONS. All attestations made to papers issued under<br />

the authority <strong>of</strong> and attested by the seal <strong>of</strong> the city prior to the date <strong>of</strong> the passage <strong>of</strong> this<br />

ordinance, the impression <strong>of</strong> which seal is as described in the foregoing section, are declared to<br />

have been and now to be the attestations <strong>of</strong> the seal <strong>of</strong> the city. (Ord. 13, S2, 1895)

Revised 09/01/2010 1-10 General Provisions<br />

Sections:<br />

Chapter 1.12<br />

ORDINANCES<br />

1.12.010 Numbering requirements<br />

1.12.020 Method for reenacting<br />

1.12.030 Ordinances approved by mayor<br />

1.12.010 NUMBERING REQUIREMENTS. All ordinances passed by the city council shall<br />

be numbered consecutively on a yearly basis, so that each ordinance will be designated first by<br />

the year in which it was enacted, and then the consecutive ordinance number for that year.<br />

Separate volumes shall be kept by year for the ordinances enacted within that year. (Ord. 1982-<br />

80, S5, 1982)<br />

1.12.020 METHOD FOR REENACTING. No ordinance shall be revived or reenacted by<br />

mere reference to the title or number there<strong>of</strong>, but the same shall be set forth at length as if it were<br />

an original ordinance. (Ord. 10, S6, 1895)<br />

1.12.030 ORDINANCES APPROVED BY MAYOR. Any ordinance adopted, and all<br />

resolutions authorizing the expenditure <strong>of</strong> money or the entering into <strong>of</strong> a contract, require the<br />

approval and signature <strong>of</strong> the mayor before they become valid, except as otherwise provided in<br />

this section. Such ordinance or resolution shall be presented to the mayor within forty-eight<br />

hours after the action <strong>of</strong> the governing body for his signature approving the same. If he<br />

disapproves, he shall return such ordinance or resolution to the governing body at its next regular<br />

meeting with his objections in writing. The governing body shall cause such objections to be<br />

entered at large upon the record and shall proceed at the same or next subsequent meeting to<br />

consider the question: "Shall the ordinance or resolution, notwithstanding the mayor's objections,<br />

be passed?" If two-thirds <strong>of</strong> the members elected to the governing body vote in the affirmative,<br />

such resolution shall be valid, and such ordinance shall become law the same as if it had been<br />

approved by the mayor. If the mayor fails to return to the next subsequent meeting <strong>of</strong> the<br />

governing body any resolution or ordinance presented to him for his approval, the same shall<br />

become a valid ordinance or resolution, as the case may be, in like manner as if it had been<br />

approved by him. (Ord. 522, S4, 1981)

Revised 09/01/2010 1-11 General Provisions<br />

Sections:<br />

Chapter 1.16<br />

PRECINCTS<br />

1.16.010 Precinct established, Elections conducted where<br />

1.16.020 Elections, Voting machines to be used<br />

1.16.010 PRECINCT ESTABLISHED-ELECTIONS CONDUCTED WHERE. The<br />

incorporated area <strong>of</strong> the city shall consist <strong>of</strong> one precinct, precinct no. 1, and all elections shall be<br />

conducted at the <strong>City</strong> Hall. (Ord. 258, S1, 1971)<br />

1.16.020 ELECTIONS--VOTING MACHINES TO BE USED. In all municipal elections<br />

conducted after February 8, 1971, voting machines will be used. (Ord. 258, S2, 1971)

Revised 09/01/2010 1-12 General Provisions<br />

Sections:<br />

Chapter 1.20<br />

CRIMINAL PROCEEDINGS<br />

1.20.010 Jury trial permitted when, Procedures, Payment <strong>of</strong> jurors<br />

1.20.010 JURY TRIAL PERMITTED WHEN, PROCEDURES, PAYMENT OF JURORS.<br />

In any action before the municipal court in which the defendant is entitled to a jury trial by the<br />

Constitution or the general laws <strong>of</strong> the state, such party shall have a jury upon request. The jury<br />

shall consist <strong>of</strong> three jurors unless, a greater number, not to exceed six, is requested by the<br />

defendant. The jury shall be summoned pursuant to procedures established by Administrative<br />

Order issued by the <strong>Municipal</strong> Court Judge. Jurors shall be paid the sum <strong>of</strong> six dollars per day<br />

for actual jury service and three dollars for each day <strong>of</strong> service on the jury panel alone unless<br />

otherwise set by resolution <strong>of</strong> the <strong>City</strong> Council. (Ord. 313, S3 (c), 1974; Ord. 246, S12, 1969;<br />

Ord. 2010-05, S2)

Revised 09/01/2010 1-13 General Provisions<br />

Sections:<br />

1.24.010 Applicability - Procedure required<br />

Chapter 1.24<br />

RIGHT OF ENTRY FOR INSPECTION<br />

1.24.010 APPLICABILITY--PROCEDURE REQUIRED. Whenever necessary to make an<br />

inspection to enforce any ordinance or resolution, or whenever there is reasonable cause to<br />

believe there exists an ordinance or resolution violation in any building or upon any premises<br />

within the jurisdiction <strong>of</strong> the city, any authorized <strong>of</strong>ficial <strong>of</strong> the city may, upon presentation <strong>of</strong><br />

proper credentials, enter such building or premises at all reasonable times to inspect the same or<br />

to perform any duty imposed upon him by ordinance; provided, that except in emergency<br />

situation or when consent <strong>of</strong> the owner and/or occupant to the inspection has been otherwise<br />

obtained, each shall give the owner and/or occupant, if they can be located after reasonable<br />

effort, twenty-four hours written notice <strong>of</strong> the authorized <strong>of</strong>ficial's intention to inspect. The<br />

notice transmitted to the owner and/or occupant shall state that the property owner has the right<br />

to refuse entry, and that in the event such entry is refused, inspection may be made only upon<br />

issuance <strong>of</strong> a search warrant from the <strong>Fruita</strong> <strong>Municipal</strong> Court pursuant to rule 241(B) (2) <strong>of</strong> the<br />

Colorado <strong>Municipal</strong> Court rules <strong>of</strong> procedure in order to conduct the inspection. In the event the<br />

owner and/or occupant refuses entry after such request has been made, the <strong>of</strong>ficial is hereby<br />

empowered to seek assistance from any court <strong>of</strong> competent jurisdiction in obtaining such entry.<br />

(Ord. 308, S1, 1974; Ord. 2002-16, S1)

Revised 09/01/2010 1-14 General Provisions<br />

Sections:<br />

1.28.010 <strong>Municipal</strong> judge powers<br />

1.28.020 Penalty designated<br />

1.28.030 Injunctions<br />

Chapter 1.28<br />

GENERAL PENALTY<br />

1.28.010 MUNICIPAL JUDGE POWERS. In sentencing or fining a violator, the municipal<br />

judge shall not exceed the sentence or fine limitations established by ordinance. The municipal<br />

judge may suspend the sentence or fine <strong>of</strong> any violator and place him on probation for a period<br />

not to exceed one year. The <strong>Municipal</strong> Judge shall be empowered in his discretion to assess costs<br />

against any defendant. Said costs shall be established by resolution <strong>of</strong> the <strong>Fruita</strong> <strong>City</strong> Council<br />

and may be amended from time to time. (Ord. 246, S11, 1969; Ord. 1986-13, S4; Ord. 1994-1,<br />

S1; Ord. 2010-05, S3)<br />

1.28.020 PENALTIES FOR MUNICIPAL VIOLATIONS DESIGNATED.<br />

A. Unless otherwise specifically provided, any person violating any <strong>of</strong> the provisions <strong>of</strong> this<br />

<strong>Code</strong> by performing an act prohibited or declared to be unlawful by this <strong>Code</strong> or failing<br />

to comply with or perform an act required by the mandatory requirements <strong>of</strong> this <strong>Code</strong>, or<br />

valid orders issued pursuant thereto, shall be deemed guilty <strong>of</strong> a municipal <strong>of</strong>fense. All<br />

such <strong>of</strong>fenses are divided into three (3) categories <strong>of</strong> municipal <strong>of</strong>fenses. The three (3)<br />

classifications, and maximum penalties, for each classification are as follows:<br />

CLASS MAXIMUM FINE MAXIMUM IMPRISONMENT<br />

A $1,000.00 1 Year<br />

B $1,000.00 6 Months<br />

Non-criminal $1,000.00 None<br />

If any <strong>of</strong>fense carries a specific penalty, then that penalty shall apply. Any <strong>of</strong>fense not<br />

otherwise classified which does not carry a specific penalty is hereby denominated as a<br />

Class B municipal <strong>of</strong>fense.<br />

B. For the purposes <strong>of</strong> this Section, a “minor <strong>of</strong>fender” shall be defined as any person<br />

accused <strong>of</strong> an <strong>of</strong>fense contrary to this <strong>Code</strong> who, on the date <strong>of</strong> the alleged <strong>of</strong>fense, was<br />

at least 10 years <strong>of</strong> age, but had not yet attained the age <strong>of</strong> 18 years. Except as to alleged<br />

violations <strong>of</strong> the Model Traffic <strong>Code</strong>, as adopted by reference by the <strong>City</strong> <strong>of</strong> <strong>Fruita</strong>, any<br />

minor <strong>of</strong>fender convicted <strong>of</strong> a violation <strong>of</strong> this <strong>Code</strong>, or any rule or regulation<br />

promulgated thereunder, shall be punished by a fine only as set forth above.<br />

Notwithstanding any provision in this <strong>Code</strong> to the contrary, a minor <strong>of</strong>fender shall not be<br />

subject to imprisonment, except as herein provided. As to minor <strong>of</strong>fenders alleged to<br />

have violated any provision <strong>of</strong> the Model Traffic <strong>Code</strong>, as adopted by reference by the

Revised 09/01/2010 1-15 General Provisions<br />

<strong>City</strong> <strong>of</strong> <strong>Fruita</strong>, such persons shall, upon conviction, remain subject to the penalties set<br />

forth above as to any violation <strong>of</strong> the Model Traffic <strong>Code</strong>.<br />

C. Nothing contained herein shall be construed to abrogate, abolish or otherwise limit the<br />

power <strong>of</strong> the <strong>Municipal</strong> Court to punish any person for contempt <strong>of</strong> court, whether by<br />

failure to obey a summons, subpoena, or other lawful order <strong>of</strong> the court, or by personal<br />

conduct before the court. Any person found guilty <strong>of</strong> such contempt, whether a minor<br />

<strong>of</strong>fender or adult, shall be punished as provided in this <strong>Code</strong>, or as permitted by State<br />

law.<br />

D. Each person shall be guilty <strong>of</strong> a separate <strong>of</strong>fense for each and every day during any<br />

portion <strong>of</strong> which any violation <strong>of</strong> any provision <strong>of</strong> this <strong>Code</strong> is committed, continued or<br />

permitted by any such person, and he shall be punished accordingly.<br />

E. Any person who fails to appear in the <strong>Municipal</strong> Court <strong>of</strong> the <strong>City</strong>, pursuant to a<br />

summons and complaint issued in compliance with law shall be guilty <strong>of</strong> the separate<br />

municipal <strong>of</strong>fense <strong>of</strong> “failure to appear,” and upon conviction <strong>of</strong> such <strong>of</strong>fense shall be<br />

punished accordingly for violation <strong>of</strong> a Class A municipal <strong>of</strong>fense.<br />

(Ord. 309; 398; 1989-15, S1; Ord. 1994-11, S1; Ord. 2000-09, S1; Ord. 2010-05, S4 (A); Ord.<br />

2010-05, S5 (E))<br />

1.28.030 INJUNCTIONS. The <strong>City</strong> may, at its discretion, proceed against any violation or<br />

violator <strong>of</strong> ordinances by abatement, injunction or other appropriate civil action, which remedies<br />

shall be cumulative to the penalties herein provided. (Ord. 309, S2, 1974)

Revised 09/01/2010 2-1 Administration and Personnel<br />

Chapters:<br />

TITLE 2<br />

ADMINISTRATION AND PERSONNEL<br />

2.04 <strong>City</strong> Officers, General Provisions<br />

2.08 <strong>City</strong> Administrator<br />

2.12 <strong>City</strong> Clerk<br />

2.14 <strong>City</strong> Treasurer<br />

2.16 <strong>City</strong> Attorney<br />

2.18 <strong>City</strong> Council and Mayor<br />

2.19 Elections<br />

2.20 Electrical Inspector<br />

2.24 Superintendent <strong>of</strong> Streets<br />

2.25 <strong>Code</strong> Enforcement Officer<br />

2.28 <strong>Municipal</strong> Court<br />

2.29 Teen Court Program<br />

2.36 Police Department<br />

2.37 Private Patrol Systems<br />

2.39 Planning Commission<br />

2.40 Board <strong>of</strong> Adjustment<br />

2.41 Police Commission<br />

2.42 Parks and Recreation Commission<br />

2.44 Officers' Oath and Bonds<br />

2.48 Officers' Salaries and Fees<br />

2.52 Retirement Plan<br />

2.56 Building Department<br />

2.60 Rules Governing Administrative Proceedings<br />

2.65 Disposition <strong>of</strong> Unclaimed Property<br />

2.70 <strong>Code</strong> <strong>of</strong> Ethics for <strong>City</strong> Officials

Revised 09/01/2010 2-2 Administration and Personnel<br />

THIS PAGE INTENTIONALLY LEFT BLANK

Revised 09/01/2010 2-3 Administration and Personnel<br />

Sections:<br />

Chapter 2.04<br />

CITY OFFICERS, GENERAL PROVISIONS<br />

2.04.010 Officers, Appointment authority, Term, Compensation<br />

2.04.020 Officers, Duty to deliver documents and other items to successors, Inspection<br />

requirements<br />

2.04.030 Council meetings<br />

2.04.010 OFFICERS, APPOINTMENT AUTHORITY, TERM, COMPENSATION.<br />

Unless otherwise provided, there shall be appointed by the city council after the election in each<br />

year, or as soon thereafter as practicable, one attorney, one clerk, one treasurer, one police chief<br />

and as many policemen as may be respectively during the pleasure <strong>of</strong> the city council. Such<br />

<strong>of</strong>ficers shall receive such compensation for their duties as may be prescribed by the council.<br />

(Ord. 325, S2, 1975; Ord. 319, S1, 1974; Ord. 28 Art. 1 S1, 1907)<br />

2.04.020 OFFICERS, DUTY TO DELIVERY DOCUMENTS AND OTHER ITEMS TO<br />

SUCCESSORS, INSPECTION REQUIREMENTS. Every <strong>of</strong>ficer <strong>of</strong> the city shall, upon<br />

going out <strong>of</strong> his <strong>of</strong>fice, deliver to his successor all money, books, papers, furniture and other<br />

things appertaining to his <strong>of</strong>fice, and shall at all times when required submit the books and<br />

papers <strong>of</strong> his <strong>of</strong>fice to the inspection <strong>of</strong> the mayor or any number <strong>of</strong> the city council. (Ord. 28<br />

Art. 155, 1907)<br />

2.04.030 COUNCIL MEETINGS.<br />

A. The two regular meetings <strong>of</strong> the council shall be held on the first and third Tuesday <strong>of</strong><br />

each month, at seven p.m., in the <strong>Fruita</strong> <strong>City</strong> Hall.<br />

B. If there is a conflict <strong>of</strong> such meeting dates with a holiday or other event, the council may<br />

establish an alternate regular meeting date upon motion and public notice <strong>of</strong> the changed<br />

date. Further, if the council shall determine at a regularly scheduled meeting that the<br />

next following meeting(s) will not be required because <strong>of</strong> lack <strong>of</strong> council matters to be<br />

considered, the council may, by a majority vote, cancel the next following meeting(s).<br />

(Ord. 515, S3, S4, 1981; Ord. 1984-13, S5; Ord. 1997-22; Ord. 1998-14, S4)

Revised 09/01/2010 2-4 Administration and Personnel<br />

Sections:<br />

Chapter 2.08<br />

CITY ADMINISTRATOR<br />

2.08.010 Created - Appointments - Qualifications - Compensation<br />

2.08.020 Functions and duties designated<br />

2.08.030 Administrative organization plan required when - Contents - Appointment <strong>of</strong><br />

<strong>of</strong>ficers<br />

2.08.040 Authority and relationship with council and other <strong>of</strong>ficers<br />

2.08.050 Council responsibility not impaired<br />

2.08.060 Bond required<br />

2.08.010 CREATED - APPOINTMENTS - QUALIFICATIONS - COMPENSATION. The<br />

position <strong>of</strong> the city administrator is created. The administrator shall be appointed by the <strong>City</strong><br />

Council and shall hold <strong>of</strong>fice at the pleasure <strong>of</strong> a majority <strong>of</strong> the council. He shall be selected<br />

solely on the basis <strong>of</strong> his executive and administrative qualifications with special reference to his<br />

training and experience. He shall be compensated for his services as the council may from time<br />

to time determine. (Ord. 420, S1, 1980)<br />

2.08.020 FUNCTIONS AND DUTIES DESIGNATED. The city administrator shall be the<br />

chief administrative <strong>of</strong>ficer <strong>of</strong> the city government. His functions and duties shall be:<br />

A. To be responsible to the council for the efficient administration <strong>of</strong> departments <strong>of</strong> the<br />

city government;<br />

B. To supervise the enforcement <strong>of</strong> all laws and ordinances other than criminal ordinances;<br />

C. To appoint, subject to review by the council, individuals to serve as the head <strong>of</strong> city<br />

departments, other than the municipal judge, city attorney, and police chief and police<br />

<strong>of</strong>ficers;<br />

D. To recommend an annual budget to the council and to administer the budget as finally<br />

adopted, and to keep the council fully advised at all times as to the financial condition <strong>of</strong><br />

the city;<br />

E. To recommend to the council for adoption such measures as he may deem necessary,<br />

and to attend council meetings with the right to take part in discussions but not to vote;<br />

F. To establish, subject to council approval, appropriate personnel rules and regulations<br />

governing <strong>of</strong>ficers and employees <strong>of</strong> the city;<br />

G. Upon adoption <strong>of</strong> a resolution by the <strong>City</strong> Council authorizing an individual <strong>City</strong><br />

Administrator to have the following powers, such <strong>City</strong> Administrator shall have the<br />

power and authority to:<br />

1. Execute any agreement on behalf <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Fruita</strong> that has formally been<br />

approved by the <strong>City</strong> Council;

Revised 09/01/2010 2-5 Administration and Personnel<br />

2. Enter into contracts or agreements on behalf <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Fruita</strong> for the purchase<br />

or provision <strong>of</strong> services, equipment, or that provide for any expenditure <strong>of</strong> funds<br />

so long as adequate funds for such contracts or agreements have been<br />

appropriated by the <strong>City</strong> Council in its annual budget;<br />

3. Enter into other contracts on behalf <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Fruita</strong> obligating the <strong>City</strong> for a<br />

period <strong>of</strong> less than one (1) year;<br />

4. Execute applications for grant funds and administer grants once received.<br />

H. To perform such other duties as may be prescribed by ordinance or by direction <strong>of</strong> the<br />

council.<br />

(Ord. 324, S2, 1975; Ord. 2003-06, S1, S2)<br />

2.08.030 ADMINISTRATIVE ORGANIZATION PLAN REQUIRED WHEN -<br />

CONTENTS -APPOINTMENT OF OFFICERS. The city administrator shall propose a plan<br />

<strong>of</strong> administrative organization to the council within sixty days after his appointment, which, if<br />

approved by the council, shall be adopted by ordinance. The administrative plan shall provide<br />

for such departments and <strong>of</strong>ficers as may be deemed necessary for the efficient administration <strong>of</strong><br />

the city. All such <strong>of</strong>ficers, other than those specified above, shall be appointed by the city<br />

administrator, subject to review by the council. (Ord. 324, S3, 1975)<br />

2.08.040 AUTHORITY AND RELATIONSHIP WITH COUNCIL AND OTHER<br />

OFFICERS. Neither the mayor nor any member <strong>of</strong> the council shall in any way interfere with<br />

the city administrator in his exercise <strong>of</strong> the powers and duties granted by this chapter. Except for<br />

the purpose <strong>of</strong> inquiry, the mayor and members <strong>of</strong> the council shall deal with the city<br />

administrator solely through the city council, and neither the mayor nor any member <strong>of</strong> the<br />

council shall give orders to any <strong>of</strong> the subordinates <strong>of</strong> the city administrator. (Ord. 324, S4,<br />

1975)<br />

2.08.050 COUNCIL RESPONSIBILITY NOT IMPAIRED. Nothing in this chapter shall<br />

impair the responsibility <strong>of</strong> the council for the overall operation <strong>of</strong> the city government as<br />

required by the laws <strong>of</strong> the state <strong>of</strong> Colorado. (Ord. 324, S5, 1975)<br />

2.08.060 BOND REQUIRED. The city administrator shall give bond to the city, with sureties<br />

to be approved by the <strong>City</strong> Council, conditioned on faithful performance <strong>of</strong> his duties in such<br />

amount as required by the council. (Ord. 324, S6, 1975)

Revised 09/01/2010 2-6 Administration and Personnel<br />

Sections:<br />

Chapter 2.12<br />

CITY CLERK<br />

2.12.010 Documents and transcripts to be furnished<br />

2.12.020 Ordinance recording and publication and other duties<br />

2.12.030 Custodial duties<br />

2.12.040 Meeting attendance and fiscal affairs statement required<br />

2.12.050 Acting city treasurer, Duties restricted<br />

2.12.010 DOCUMENTS AND TRANSCRIPTS TO BE FURNISHED. The <strong>City</strong> clerk shall,<br />

in addition to his duties prescribed by the statue, furnish to the city attorney any record or<br />

document in his <strong>of</strong>fice that he may call for and take a receipt therefor, and shall furnish any<br />

necessary transcript <strong>of</strong> the records <strong>of</strong> his <strong>of</strong>fice duly certified. (Ord. 28 Art. 3 S1, 1907)<br />

2.12.020 ORDINANCE RECORDING AND PUBLICATION AND OTHER DUTIES. The<br />

clerk shall cause the ordinances <strong>of</strong> the city to be recorded and published as required by law, shall<br />

superintend the printing there<strong>of</strong> and examine the pro<strong>of</strong> sheets and compare them with the<br />

original rolls, and said recorder shall receive and file all papers proper to be filed among the<br />

records <strong>of</strong> the city. (Ord. 28 Art. 3 S2, 1907)<br />

2.12.030 CUSTODIAL DUTIES. The clerk shall be the custodian <strong>of</strong> all the city's files and<br />

records, other than those records kept by the city treasurer and chief <strong>of</strong> police, which records<br />

shall be open at all reasonable times for inspection by electors <strong>of</strong> the city. In addition, the city<br />

clerk shall be the custodian <strong>of</strong> all bonds <strong>of</strong> all <strong>of</strong>ficers or employees <strong>of</strong> the city, shall issue all<br />

city licenses, and shall be responsible for billing water and sewer fees, and shall provide and<br />

maintain a supply <strong>of</strong> forms, petitions and other documents as required by the city council. (Ord.<br />

363, S1, 1977; Ord. 28 Art. 3 S3, 1907)<br />

2.12.040 MEETING ATTENDANCE AND FISCAL AFFAIRS STATEMENT<br />

REQUIRED. The clerk shall attend all meetings <strong>of</strong> the city council and at the close <strong>of</strong> each<br />

fiscal year make and lay before the city council a full and explicit statement <strong>of</strong> all fiscal affairs <strong>of</strong><br />

the term during the year. (Ord. 28 Art. 3, S5, 1907)<br />

2.12.050 ACTING CITY TREASURER, DUTIES RESTRICTED. The city clerk shall, in<br />

the city treasurer's absence, serve as acting city treasurer, for the sole purpose <strong>of</strong> receiving all<br />

money belonging to the city and recording such receipts in the appropriate journal. (Ord. 363,<br />

S2, 1977)

Revised 09/01/2010 2-7 Administration and Personnel<br />

Section:<br />

2.14.010 <strong>City</strong> Treasurer<br />

Chapter 2.14<br />

CITY TREASURER<br />

2.14.010 CITY TREASURER. There is established the position <strong>of</strong> the city treasurer who shall,<br />

in additions to his duties prescribed by statute, record all financial transactions in receipt and<br />

disbursement journals, post journal entries to the general ledger, issue checks on accounts<br />

payable by the city, prepare and keep records <strong>of</strong> the city's payroll to all employees there<strong>of</strong>,<br />

prepare and keep records <strong>of</strong> all reports required in relation to his accounting and other duties as<br />

city treasurer, and keep the city books and accounts in such manner as may be otherwise<br />

prescribed by law and the city administrator. In addition, the city treasurer shall serve as acting<br />

city clerk in the city clerk's absence. (Ord. 363, S3, 1977)

Revised 09/01/2010 2-8 Administration and Personnel<br />

Sections:<br />

Chapter 2.16<br />

CITY ATTORNEY<br />

2.16.010 Duty to appear on behalf <strong>of</strong> city, Restrictions<br />

2.16.020 Prosecution, affidavit, bond execution and signature authority<br />

2.16.030 Drawing up <strong>of</strong> ordinances, contracts, etc. authorized when<br />

2.16.040 Legal advisory and meeting attendance duties<br />

2.16.050 Right to be heard on council questions or motions<br />

2.16.010 DUTY TO APPEAR ON BEHALF OF CITY, RESTRICTIONS. It shall be the<br />

duty <strong>of</strong> the city attorney to appear in behalf <strong>of</strong> the city in all suits and proceedings which may be<br />

pending in any court wherein the city is a party or in which it may have an interest, and<br />

commence suit and institute proceedings in the name <strong>of</strong> the city; provided, that without the order<br />

<strong>of</strong> the city council, the attorney shall commence no action in the interest <strong>of</strong> the city, except for<br />

the violation <strong>of</strong> an ordinance. (Ord. 319, S3, 1974; Ord. 28 Art. 2, S1, 1907)<br />

2.16.020 PROSECUTION, AFFIDAVIT, BOND EXECUTION AND SIGNATURE<br />

AUTHORITY. Said attorney shall at his discretion prosecute an appeal, writ <strong>of</strong> error or any<br />

other legal writ in any case in which the city shall be concerned, shall make the necessary<br />

affidavits therefore and prepare and execute the necessary bond or bonds in the name <strong>of</strong> the city<br />

or otherwise as the law may require, and shall prepare all other necessary papers in such case and<br />

sign his name as city attorney when necessary for the execution <strong>of</strong> his said authority. (Ord. 28<br />

Art. 2, S2, 1907)<br />

2.16.030 DRAWING UP OF ORDINANCES, CONTRACTS, ETC. AUTHORIZED<br />

WHEN. When required by order <strong>of</strong> the city council or any committee there<strong>of</strong>, said attorney<br />

shall draw up any ordinance, contract, conveyance or other instrument in writing in relation to<br />

the execution <strong>of</strong> corporate powers or corporate business. (Ord. 28 Art. 2, S3, 1907)<br />

2.16.040 LEGAL ADVISORY AND MEETING ATTENDANCE DUTIES. Said attorney<br />

shall act as the legal advisor <strong>of</strong> the city council or any committee, and <strong>of</strong> the city <strong>of</strong>ficers in all<br />

matters relating to the <strong>of</strong>ficial powers or duty <strong>of</strong> any <strong>of</strong>ficer or <strong>of</strong>ficers or to the corporate<br />

business <strong>of</strong> the city. It shall be the duty <strong>of</strong> the city attorney to attend meetings <strong>of</strong> the city council<br />

<strong>of</strong> which he shall be entitled to notice in like manner as members <strong>of</strong> the city council. (Ord. 28<br />

Art. 2, S4, 1907)<br />

2.16.050 RIGHT TO BE HEARD ON COUNCIL QUESTIONS OR MOTIONS. The<br />

attorney shall have the right to be heard upon all questions or motions <strong>of</strong> the city council. (Ord.<br />

28 Art. 2, S5, 1907)

Revised 09/01/2010 2-9 Administration and Personnel<br />

Sections:<br />

Chapter 2.18<br />

CITY COUNCIL AND MAYOR<br />

2.18.010 Council members - Four year term<br />

2.18.030 Vacancy filling<br />

2.18.040 Compensation<br />

2.18.010 COUNCIL MEMBERS - FOUR YEAR TERM. At the April, 1976, regular<br />

election, six council members shall be elected. The three candidates for council receiving the<br />

highest number <strong>of</strong> votes shall be elected for four year terms and the three candidates for council<br />

receiving the next highest number <strong>of</strong> votes shall be elected for two year terms. At the next<br />

subsequent regular election and each regular election thereafter, three council members shall be<br />

elected to serve four year terms. (Ord. 331, S1, 1975)<br />

2.18.030 VACANCY FILLING. The <strong>City</strong> Council shall have power by appointment to fill all<br />

vacancies in the council or any other elected <strong>of</strong>fice, and the person so appointed shall hold <strong>of</strong>fice<br />

until the next regular election, and until his successor is elected and qualified. If the term <strong>of</strong> the<br />

person creating the vacancy was to extend beyond the next regular election, the person elected to<br />

fill the vacancy shall be elected for the unexpired term. Where a vacancy or vacancies exist in<br />

the <strong>of</strong>fice <strong>of</strong> a council member, and its successor or successors are to be elected at the next<br />

election to fill the unexpired term or terms, the three candidates for council member receiving the<br />

highest number <strong>of</strong> votes shall be elected to four year terms and the candidate or candidates<br />

receiving the next highest number <strong>of</strong> votes, in descending order, shall be elected to fill unexpired<br />

term or terms. (Ord. 331, S3, 1975)<br />

2.18.040 COMPENSATION. Each member <strong>of</strong> the <strong>City</strong> Council shall be compensated for<br />

expenses incurred in serving his/her <strong>of</strong>fice in the amount <strong>of</strong> three hundred dollars ($300) per<br />

month. The mayor pro tem shall receive an additional fifty dollars ($50) per month. The mayor<br />

shall be compensated in the amount <strong>of</strong> four hundred seventy five dollars ($475) per month. (Ord.<br />

1982-18, S4; Ord. 337, 1978; Ord. 1984-30, S5; Ord. 1996-04, S4; Ord. 1997-32; Ord. 1999-14,<br />

S4; Ord. 2001-30, S4, 2001; Ord. 2007-09, S4)

Revised 09/01/2010 2-10 Administration and Personnel<br />

Sections:<br />

Chapter 2.19<br />

ELECTIONS<br />

2.19.010 Write-In Candidate Affidavit Required<br />

2.19.020 Election May be Canceled - When<br />

2.19.030 Candidate Nomination Procedures for Mail Ballot Elections<br />

2.19.010 WRITE-IN CANDIDATE AFFIDAVIT REQUIRED. No write-in vote for any<br />

municipal <strong>of</strong>fice shall be counted unless an affidavit <strong>of</strong> intent has been filed with the <strong>City</strong> Clerk<br />

by the person whose name is written in prior to twenty days before the day <strong>of</strong> the day <strong>of</strong> the<br />

election indicating that such person desires the <strong>of</strong>fice and is qualified to assume the duties <strong>of</strong> that<br />

<strong>of</strong>fice if elected. (Ord. 1995-12, S1, 1995)<br />

2.19.020. ELECTION MAY BE CANCELED - WHEN. If the only matter before the voters<br />

is the election <strong>of</strong> persons to <strong>of</strong>fice and if, at the close <strong>of</strong> business on the nineteenth day before the<br />

election, there are not more candidates than <strong>of</strong>fices to be filled at such election, including<br />

candidates who have filed affidavits <strong>of</strong> intent as required by Section 2.19.010 <strong>of</strong> this code, the<br />

<strong>City</strong> Clerk shall certify such fact to the <strong>City</strong> Council, and it shall hold a meeting and may cancel<br />

the election and by resolution declare the candidates elected and, as permitted by C.R.S. 31-10-<br />

507, said candidates shall be deemed elected. The <strong>City</strong> Clerk shall publish notice <strong>of</strong> such<br />

cancellation if possible, in order to inform the electors <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Fruita</strong>, and notice <strong>of</strong> such<br />

cancellation shall be posted at each polling place and in not less than one other public place.<br />

(Ord. 1995-12, S2, 1995)<br />

2.19.030 CANDIDATE NOMINATION PROCEDURES FOR MAIL BALLOT<br />

ELECTIONS. The time periods for circulation and submission <strong>of</strong> nomination petitions for the<br />

<strong>of</strong>fices <strong>of</strong> <strong>City</strong> Council and Mayor for any regular mail ballot election, other than one conducted<br />

as part <strong>of</strong> a coordinated election, shall be as follows:<br />

A. Nomination petitions may be circulated and signed beginning on the seventyseventh<br />

(77 th ) day and ending on the fifty-seventh (57 h ) day prior to the day <strong>of</strong><br />

election.<br />

B. Each nomination petition shall be filed with the <strong>City</strong> Clerk no later than the fiftyseventh<br />

(57 th ) day prior to the day <strong>of</strong> election.<br />

C. Any petition may be amended to correct or replace those signatures which the<br />

<strong>City</strong> Clerk finds are not in apparent conformity with the requirements <strong>of</strong> the<br />

<strong>Municipal</strong> Election <strong>Code</strong> at any time prior to fifty (50) days prior to the day <strong>of</strong><br />

election.<br />

(Ord. 2007-20, S1)

Revised 09/01/2010 2-11 Administration and Personnel<br />

Section:<br />

Chapter 2.20<br />

ELECTRICAL INSPECTOR<br />

2.20.010 <strong>City</strong> Building inspector to perform electrical inspections<br />

2.20.010 CITY BUILDING INSPECTOR TO PERFORM ELECTRICAL<br />

INSPECTIONS. All required electrical inspections within the <strong>City</strong> <strong>of</strong> <strong>Fruita</strong> shall be performed<br />

by the city building inspector. The <strong>City</strong> building inspector may be an employee <strong>of</strong> the city or<br />

may be a person or entity under contract with the <strong>City</strong> to perform building inspections with the<br />

city. (Ord. 1982-96, S4)

Revised 09/01/2010 2-12 Administration and Personnel<br />

Section:<br />

Chapter 2.24<br />

SUPERINTENDENT OF STREETS<br />

2.24.010 Duties designated-Record keeping required<br />

2.24.010 DUTIES DESIGNATED - RECORD KEEPING REQUIRED. The superintendent<br />

<strong>of</strong> streets shall have such duties as the council shall prescribe and shall keep a full and complete<br />

record <strong>of</strong> all tools, hardware, lumber or other materials purchased by him for the use <strong>of</strong> the city,<br />

together with a full and complete record <strong>of</strong> all such property turned over to him by his<br />

predecessor. He shall also whenever any <strong>of</strong> such property has been used for or on behalf <strong>of</strong> the<br />

city, enter in the record book accurately what disposition has been made <strong>of</strong> such property, and he<br />

shall be held personally responsible for all such property for which he is unable to render a<br />

satisfactory account. (Ord. 319, S4, 1974; Ord. 28 Art. 4, S2, 1907)

Revised 09/01/2010 2-13 Administration and Personnel<br />

Sections:<br />

2.25.010 <strong>Code</strong> Enforcement Officer<br />

2.25.020 Designation<br />

2.25.030 Liability<br />

Chapter 2.25<br />

CODE ENFORCEMENT OFFICER<br />

2.25.010 CODE ENFORCEMENT OFFICER. There is hereby established the position <strong>of</strong><br />

<strong>City</strong> <strong>of</strong> <strong>Fruita</strong> <strong>Code</strong> Enforcement Officer which shall be under the administration and operational<br />

control <strong>of</strong> the Community Development Director. Such <strong>Code</strong> Enforcement Officer shall have the<br />

power, together with the Community Development Director and the <strong>City</strong> Attorney, to enforce all<br />