Guide to Freelancing - PCG

Guide to Freelancing - PCG

Guide to Freelancing - PCG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

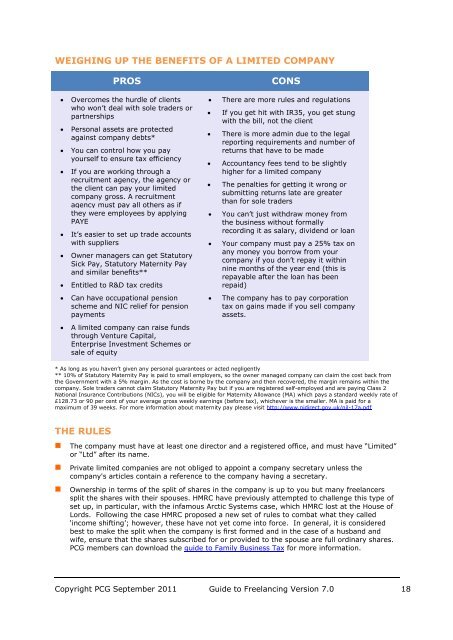

WEIGHING UP THE BENEFITS OF A LIMITED COMPANY<br />

PROS<br />

CONS<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Overcomes the hurdle of clients<br />

who won‟t deal with sole traders or<br />

partnerships<br />

Personal assets are protected<br />

against company debts*<br />

You can control how you pay<br />

yourself <strong>to</strong> ensure tax efficiency<br />

If you are working through a<br />

recruitment agency, the agency or<br />

the client can pay your limited<br />

company gross. A recruitment<br />

agency must pay all others as if<br />

they were employees by applying<br />

PAYE<br />

It‟s easier <strong>to</strong> set up trade accounts<br />

with suppliers<br />

Owner managers can get Statu<strong>to</strong>ry<br />

Sick Pay, Statu<strong>to</strong>ry Maternity Pay<br />

and similar benefits**<br />

Entitled <strong>to</strong> R&D tax credits<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

There are more rules and regulations<br />

If you get hit with IR35, you get stung<br />

with the bill, not the client<br />

There is more admin due <strong>to</strong> the legal<br />

reporting requirements and number of<br />

returns that have <strong>to</strong> be made<br />

Accountancy fees tend <strong>to</strong> be slightly<br />

higher for a limited company<br />

The penalties for getting it wrong or<br />

submitting returns late are greater<br />

than for sole traders<br />

You can‟t just withdraw money from<br />

the business without formally<br />

recording it as salary, dividend or loan<br />

Your company must pay a 25% tax on<br />

any money you borrow from your<br />

company if you don‟t repay it within<br />

nine months of the year end (this is<br />

repayable after the loan has been<br />

repaid)<br />

<br />

Can have occupational pension<br />

scheme and NIC relief for pension<br />

payments<br />

<br />

The company has <strong>to</strong> pay corporation<br />

tax on gains made if you sell company<br />

assets.<br />

<br />

A limited company can raise funds<br />

through Venture Capital,<br />

Enterprise Investment Schemes or<br />

sale of equity<br />

* As long as you haven‟t given any personal guarantees or acted negligently<br />

** 10% of Statu<strong>to</strong>ry Maternity Pay is paid <strong>to</strong> small employers, so the owner managed company can claim the cost back from<br />

the Government with a 5% margin. As the cost is borne by the company and then recovered, the margin remains within the<br />

company. Sole traders cannot claim Statu<strong>to</strong>ry Maternity Pay but if you are registered self-employed and are paying Class 2<br />

National Insurance Contributions (NICs), you will be eligible for Maternity Allowance (MA) which pays a standard weekly rate of<br />

£128.73 or 90 per cent of your average gross weekly earnings (before tax), whichever is the smaller. MA is paid for a<br />

maximum of 39 weeks. For more information about maternity pay please visit http://www.nidirect.gov.uk/nil-17a.pdf<br />

THE RULES<br />

• The company must have at least one direc<strong>to</strong>r and a registered office, and must have “Limited”<br />

or “Ltd” after its name.<br />

• Private limited companies are not obliged <strong>to</strong> appoint a company secretary unless the<br />

company's articles contain a reference <strong>to</strong> the company having a secretary.<br />

• Ownership in terms of the split of shares in the company is up <strong>to</strong> you but many freelancers<br />

split the shares with their spouses. HMRC have previously attempted <strong>to</strong> challenge this type of<br />

set up, in particular, with the infamous Arctic Systems case, which HMRC lost at the House of<br />

Lords. Following the case HMRC proposed a new set of rules <strong>to</strong> combat what they called<br />

„income shifting‟; however, these have not yet come in<strong>to</strong> force. In general, it is considered<br />

best <strong>to</strong> make the split when the company is first formed and in the case of a husband and<br />

wife, ensure that the shares subscribed for or provided <strong>to</strong> the spouse are full ordinary shares.<br />

<strong>PCG</strong> members can download the guide <strong>to</strong> Family Business Tax for more information.<br />

Copyright <strong>PCG</strong> September 2011 <strong>Guide</strong> <strong>to</strong> <strong>Freelancing</strong> Version 7.0 18