Guide to Freelancing - PCG

Guide to Freelancing - PCG

Guide to Freelancing - PCG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

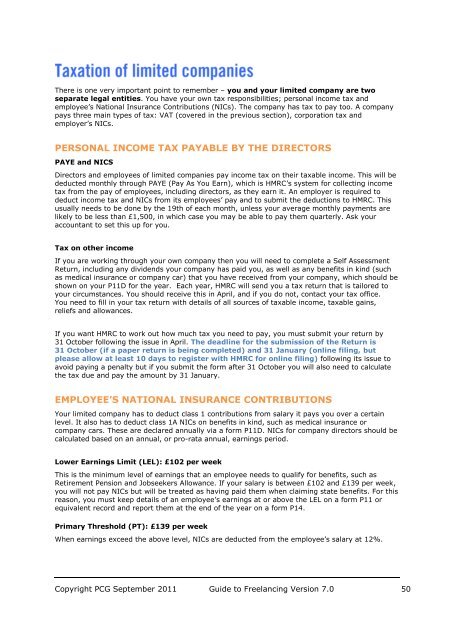

There is one very important point <strong>to</strong> remember – you and your limited company are two<br />

separate legal entities. You have your own tax responsibilities; personal income tax and<br />

employee‟s National Insurance Contributions (NICs). The company has tax <strong>to</strong> pay <strong>to</strong>o. A company<br />

pays three main types of tax: VAT (covered in the previous section), corporation tax and<br />

employer‟s NICs.<br />

PERSONAL INCOME TAX PAYABLE BY THE DIRECTORS<br />

PAYE and NICS<br />

Direc<strong>to</strong>rs and employees of limited companies pay income tax on their taxable income. This will be<br />

deducted monthly through PAYE (Pay As You Earn), which is HMRC‟s system for collecting income<br />

tax from the pay of employees, including direc<strong>to</strong>rs, as they earn it. An employer is required <strong>to</strong><br />

deduct income tax and NICs from its employees‟ pay and <strong>to</strong> submit the deductions <strong>to</strong> HMRC. This<br />

usually needs <strong>to</strong> be done by the 19th of each month, unless your average monthly payments are<br />

likely <strong>to</strong> be less than £1,500, in which case you may be able <strong>to</strong> pay them quarterly. Ask your<br />

accountant <strong>to</strong> set this up for you.<br />

Tax on other income<br />

If you are working through your own company then you will need <strong>to</strong> complete a Self Assessment<br />

Return, including any dividends your company has paid you, as well as any benefits in kind (such<br />

as medical insurance or company car) that you have received from your company, which should be<br />

shown on your P11D for the year. Each year, HMRC will send you a tax return that is tailored <strong>to</strong><br />

your circumstances. You should receive this in April, and if you do not, contact your tax office.<br />

You need <strong>to</strong> fill in your tax return with details of all sources of taxable income, taxable gains,<br />

reliefs and allowances.<br />

If you want HMRC <strong>to</strong> work out how much tax you need <strong>to</strong> pay, you must submit your return by<br />

31 Oc<strong>to</strong>ber following the issue in April. The deadline for the submission of the Return is<br />

31 Oc<strong>to</strong>ber (if a paper return is being completed) and 31 January (online filing, but<br />

please allow at least 10 days <strong>to</strong> register with HMRC for online filing) following its issue <strong>to</strong><br />

avoid paying a penalty but if you submit the form after 31 Oc<strong>to</strong>ber you will also need <strong>to</strong> calculate<br />

the tax due and pay the amount by 31 January.<br />

EMPLOYEE‟S NATIONAL INSURANCE CONTRIBUTIONS<br />

Your limited company has <strong>to</strong> deduct class 1 contributions from salary it pays you over a certain<br />

level. It also has <strong>to</strong> deduct class 1A NICs on benefits in kind, such as medical insurance or<br />

company cars. These are declared annually via a form P11D. NICs for company direc<strong>to</strong>rs should be<br />

calculated based on an annual, or pro-rata annual, earnings period.<br />

Lower Earnings Limit (LEL): £102 per week<br />

This is the minimum level of earnings that an employee needs <strong>to</strong> qualify for benefits, such as<br />

Retirement Pension and Jobseekers Allowance. If your salary is between £102 and £139 per week,<br />

you will not pay NICs but will be treated as having paid them when claiming state benefits. For this<br />

reason, you must keep details of an employee‟s earnings at or above the LEL on a form P11 or<br />

equivalent record and report them at the end of the year on a form P14.<br />

Primary Threshold (PT): £139 per week<br />

When earnings exceed the above level, NICs are deducted from the employee‟s salary at 12%.<br />

Copyright <strong>PCG</strong> September 2011 <strong>Guide</strong> <strong>to</strong> <strong>Freelancing</strong> Version 7.0 50