Guide to Freelancing - PCG

Guide to Freelancing - PCG

Guide to Freelancing - PCG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

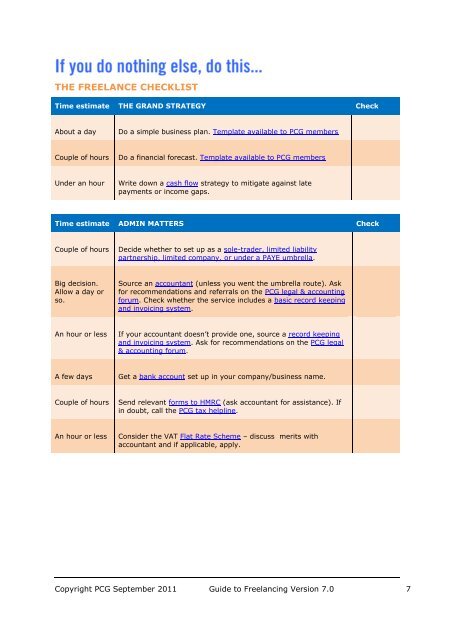

THE FREELANCE CHECKLIST<br />

Time estimate THE GRAND STRATEGY Check<br />

About a day<br />

Do a simple business plan. Template available <strong>to</strong> <strong>PCG</strong> members<br />

Couple of hours<br />

Do a financial forecast. Template available <strong>to</strong> <strong>PCG</strong> members<br />

Under an hour<br />

Write down a cash flow strategy <strong>to</strong> mitigate against late<br />

payments or income gaps.<br />

Time estimate ADMIN MATTERS Check<br />

Couple of hours<br />

Decide whether <strong>to</strong> set up as a sole-trader, limited liability<br />

partnership, limited company, or under a PAYE umbrella.<br />

Big decision.<br />

Allow a day or<br />

so.<br />

Source an accountant (unless you went the umbrella route). Ask<br />

for recommendations and referrals on the <strong>PCG</strong> legal & accounting<br />

forum. Check whether the service includes a basic record keeping<br />

and invoicing system.<br />

An hour or less<br />

If your accountant doesn‟t provide one, source a record keeping<br />

and invoicing system. Ask for recommendations on the <strong>PCG</strong> legal<br />

& accounting forum.<br />

A few days<br />

Get a bank account set up in your company/business name.<br />

Couple of hours<br />

Send relevant forms <strong>to</strong> HMRC (ask accountant for assistance). If<br />

in doubt, call the <strong>PCG</strong> tax helpline.<br />

An hour or less<br />

Consider the VAT Flat Rate Scheme – discuss merits with<br />

accountant and if applicable, apply.<br />

Copyright <strong>PCG</strong> September 2011 <strong>Guide</strong> <strong>to</strong> <strong>Freelancing</strong> Version 7.0 7