Implementing LDI with swaptions - Russell Investments

Implementing LDI with swaptions - Russell Investments

Implementing LDI with swaptions - Russell Investments

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

RUSSELL INVESTMENTS<br />

In today’s low interest rate environment,<br />

many plan sponsors have been reluctant<br />

to fully eliminate the interest rate risk<br />

in their plans but have preferred a more<br />

incremental approach to <strong>LDI</strong>. In this sense,<br />

one application of LRAA is to increase<br />

the duration of a plan’s fixed income<br />

investments incrementally as the allocation<br />

to fixed income increases overall. 2 While this<br />

approach has some merit, the unfortunate<br />

outcome for most plans in the very early<br />

stages of their LRAA and/or <strong>LDI</strong> programs<br />

has been that they remain in very shortduration<br />

positions vis-à-vis liabilities, and<br />

funding levels have suffered in the recent<br />

declining interest rate environment.<br />

The ultimate goal in an <strong>LDI</strong> portfolio is to<br />

increase the duration exposure of fixed<br />

income investments, and we know that<br />

plan sponsors want protection against<br />

declining interest rates. One version of a<br />

swaption trade—the “zero-cost collar,”<br />

discussed below—provides this type of<br />

exposure by offering protection against<br />

declining interest rates in exchange for the<br />

promise to enter a swap at a certain interest<br />

rate above current rates. While there are<br />

many moving parts in this version, these<br />

higher rates can potentially be aligned at<br />

levels along the LRAA schedule, where<br />

the plan sponsor would be increasing the<br />

duration exposure of the fixed income<br />

portfolio in any case.<br />

An example of a swaption trade:<br />

the zero-cost collar<br />

The swaption trade we describe below is<br />

based on buying a receiver swaption at a<br />

low interest rate (to offer the protection<br />

we’d like to have, should rates fall) matched<br />

by selling a payer swaption 3 at a higher<br />

rate (the rate at which we are likely to be<br />

seeking longer-duration exposure anyway).<br />

For convenience, the terms of the two deals<br />

can be chosen such that the premium paid<br />

for buying the protection of the receiver<br />

swaption is equal to the premium collected<br />

for selling the payer swaption.<br />

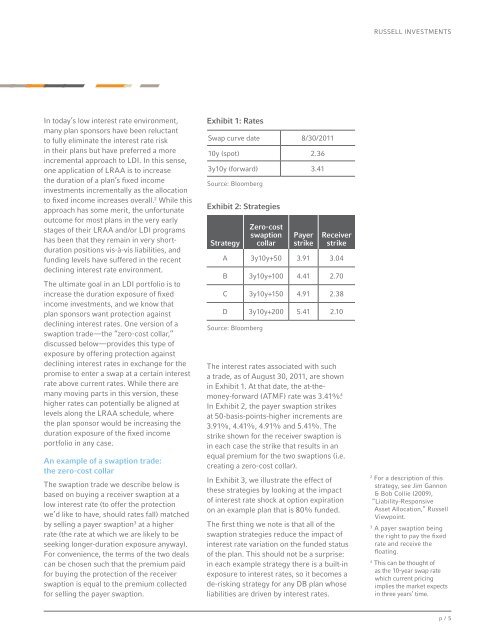

Exhibit 1: Rates<br />

Swap curve date 8/30/2011<br />

10y (spot) 2.36<br />

3y10y (forward) 3.41<br />

Source: Bloomberg<br />

Exhibit 2: Strategies<br />

Strategy<br />

Zero-cost<br />

swaption<br />

collar<br />

Payer<br />

strike<br />

Receiver<br />

strike<br />

A 3y10y+50 3.91 3.04<br />

B 3y10y+100 4.41 2.70<br />

C 3y10y+150 4.91 2.38<br />

D 3y10y+200 5.41 2.10<br />

Source: Bloomberg<br />

The interest rates associated <strong>with</strong> such<br />

a trade, as of August 30, 2011, are shown<br />

in Exhibit 1. At that date, the at-themoney-forward<br />

(ATMF) rate was 3.41% 4 .<br />

In Exhibit 2, the payer swaption strikes<br />

at 50-basis-points-higher increments are<br />

3.91%, 4.41%, 4.91% and 5.41%. The<br />

strike shown for the receiver swaption is<br />

in each case the strike that results in an<br />

equal premium for the two <strong>swaptions</strong> (i.e.<br />

creating a zero-cost collar).<br />

In Exhibit 3, we illustrate the effect of<br />

these strategies by looking at the impact<br />

of interest rate shock at option expiration<br />

on an example plan that is 80% funded.<br />

The first thing we note is that all of the<br />

swaption strategies reduce the impact of<br />

interest rate variation on the funded status<br />

of the plan. This should not be a surprise:<br />

in each example strategy there is a built-in<br />

exposure to interest rates, so it becomes a<br />

de-risking strategy for any DB plan whose<br />

liabilities are driven by interest rates.<br />

2<br />

For a description of this<br />

strategy, see Jim Gannon<br />

& Bob Collie (2009),<br />

“Liability-Responsive<br />

Asset Allocation,” <strong>Russell</strong><br />

Viewpoint.<br />

3<br />

A payer swaption being<br />

the right to pay the fixed<br />

rate and receive the<br />

floating.<br />

4<br />

This can be thought of<br />

as the 10-year swap rate<br />

which current pricing<br />

implies the market expects<br />

in three years’ time.<br />

p / 5