FINANCIAL REPORT 2012 - Keolis

FINANCIAL REPORT 2012 - Keolis

FINANCIAL REPORT 2012 - Keolis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

33<br />

4.5. Share in profit for the year from equity-accounted associates<br />

The contribution to consolidated results from associates is neither individually nor globally material to the Group’s earnings.<br />

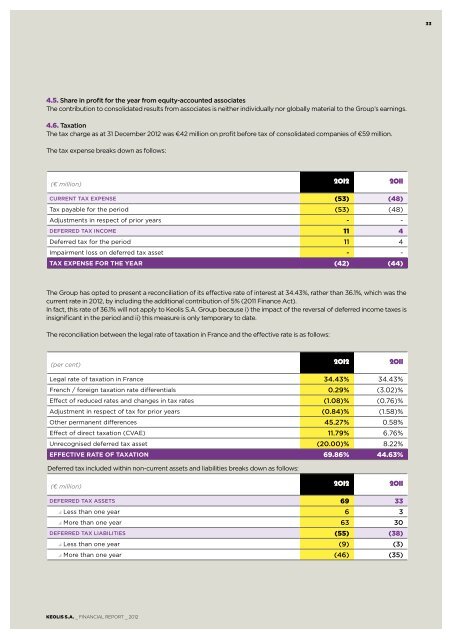

4.6. Taxation<br />

The tax charge as at 31 December <strong>2012</strong> was €42 million on profit before tax of consolidated companies of €59 million.<br />

The tax expense breaks down as follows:<br />

(€ million) <strong>2012</strong> 2011<br />

CURRENT TAX EXPENSE (53) (48)<br />

Tax payable for the period (53) (48)<br />

Adjustments in respect of prior years - -<br />

DEFERRED TAX INCOME 11 4<br />

Deferred tax for the period 11 4<br />

Impairment loss on deferred tax asset - -<br />

TAX EXPENSE FOR THE YEAR (42) (44)<br />

The Group has opted to present a reconciliation of its effective rate of interest at 34.43%, rather than 36.1%, which was the<br />

current rate in <strong>2012</strong>, by including the additional contribution of 5% (2011 Finance Act).<br />

In fact, this rate of 36.1% will not apply to <strong>Keolis</strong> S.A. Group because i) the impact of the reversal of deferred income taxes is<br />

insignificant in the period and ii) this measure is only temporary to date.<br />

The reconciliation between the legal rate of taxation in France and the effective rate is as follows:<br />

(per cent) <strong>2012</strong> 2011<br />

Legal rate of taxation in France 34.43% 34.43%<br />

French / foreign taxation rate differentials 0.29% (3.02)%<br />

Effect of reduced rates and changes in tax rates (1.08)% (0.76)%<br />

Adjustment in respect of tax for prior years (0.84)% (1.58)%<br />

Other permanent differences 45.27% 0.58%<br />

Effect of direct taxation (CVAE) 11.79% 6.76%<br />

Unrecognised deferred tax asset (20.00)% 8.22%<br />

EFFECTIVE RATE OF TAXATION 69.86% 44.63%<br />

Deferred tax included within non-current assets and liabilities breaks down as follows:<br />

(€ million) <strong>2012</strong> 2011<br />

DEFERRED TAX ASSETS 69 33<br />

Less than one year 6 3<br />

More than one year 63 30<br />

DEFERRED TAX LIABILITIES (55) (38)<br />

Less than one year (9) (3)<br />

More than one year (46) (35)<br />

KEOLIS S.A. _ <strong>FINANCIAL</strong> <strong>REPORT</strong> _ <strong>2012</strong>