FINANCIAL REPORT 2012 - Keolis

FINANCIAL REPORT 2012 - Keolis

FINANCIAL REPORT 2012 - Keolis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

47<br />

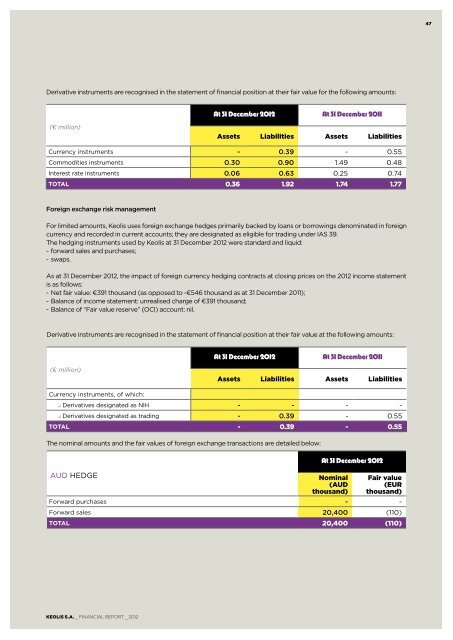

Derivative instruments are recognised in the statement of financial position at their fair value for the following amounts:<br />

At 31 December <strong>2012</strong> At 31 December 2011<br />

(€ million)<br />

Assets Liabilities Assets Liabilities<br />

Currency instruments - 0.39 - 0.55<br />

Commodities instruments 0.30 0.90 1.49 0.48<br />

Interest rate instruments 0.06 0.63 0.25 0.74<br />

TOTAL 0.36 1.92 1.74 1.77<br />

Foreign exchange risk management<br />

For limited amounts, <strong>Keolis</strong> uses foreign exchange hedges primarily backed by loans or borrowings denominated in foreign<br />

currency and recorded in current accounts; they are designated as eligible for trading under IAS 39.<br />

The hedging instruments used by <strong>Keolis</strong> at 31 December <strong>2012</strong> were standard and liquid:<br />

- forward sales and purchases;<br />

- swaps.<br />

As at 31 December <strong>2012</strong>, the impact of foreign currency hedging contracts at closing prices on the <strong>2012</strong> income statement<br />

is as follows:<br />

- Net fair value: €391 thousand (as opposed to -€546 thousand as at 31 December 2011);<br />

- Balance of income statement: unrealised charge of €391 thousand;<br />

- Balance of “Fair value reserve” (OCI) account: nil.<br />

Derivative instruments are recognised in the statement of financial position at their fair value at the following amounts:<br />

At 31 December <strong>2012</strong> At 31 December 2011<br />

(€ million)<br />

Assets Liabilities Assets Liabilities<br />

Currency instruments, of which:<br />

Derivatives designated as NIH - - - -<br />

Derivatives designated as trading - 0.39 - 0.55<br />

TOTAL - 0.39 - 0.55<br />

The nominal amounts and the fair values of foreign exchange transactions are detailed below:<br />

AUD HEDGE<br />

At 31 December <strong>2012</strong><br />

Nominal<br />

(AUD<br />

thousand)<br />

Fair value<br />

(EUR<br />

thousand)<br />

Forward purchases - -<br />

Forward sales 20,400 (110)<br />

TOTAL 20,400 (110)<br />

KEOLIS S.A. _ <strong>FINANCIAL</strong> <strong>REPORT</strong> _ <strong>2012</strong>