FINANCIAL REPORT 2012 - Keolis

FINANCIAL REPORT 2012 - Keolis

FINANCIAL REPORT 2012 - Keolis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

36 2. CONSOLIDATED <strong>FINANCIAL</strong> STATEMENTS<br />

The changes in goodwill during the <strong>2012</strong> financial year are explained by:<br />

The acquisition by Eurobus Holding of Sprl Bertrand in September <strong>2012</strong>, generating €1 million of goodwill.<br />

The payment of the remainder of the acquisition price for <strong>Keolis</strong> Transit America, generating €1 million of goodwill.<br />

The cessation of Maritimes activities in Groupe Orleans Express, generating an impairment charge of €4 million.<br />

The allocation of KTA’s goodwill composed of contractual rights and trademarks for an amount of €15 million.<br />

The main assumptions made for impairment tests are as follows:<br />

Discount rate:<br />

The discount rate used is based on the average cost of capital reflecting current market assessments of the time value of<br />

money and the risks specific to the tested asset.<br />

The average weighted cost of capital has been determined with a combination of two methods: the “Capital Asset Pricing<br />

Model” (CAPM) method and the average weighted cost of capital method for comparable listed companies. In view of these<br />

factors, the cost of capital used to discount future cash flows was set at 7% in <strong>2012</strong>, as against 6.8% in 2011.<br />

These discount rates are rates after tax applied to cash flows after tax. Use thereof determines the recoverable amounts<br />

identical to those obtained by using pre-tax rates applied to non-taxable cash flows, in accordance with IAS 36.<br />

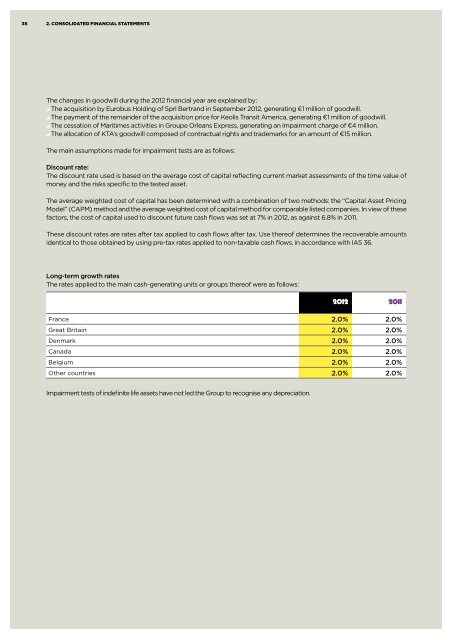

Long-term growth rates<br />

The rates applied to the main cash-generating units or groups thereof were as follows:<br />

<strong>2012</strong> 2011<br />

France 2.0% 2.0%<br />

Great Britain 2.0% 2.0%<br />

Denmark 2.0% 2.0%<br />

Canada 2.0% 2.0%<br />

Belgium 2.0% 2.0%<br />

Other countries 2.0% 2.0%<br />

Impairment tests of indefinite life assets have not led the Group to recognise any depreciation.