FINANCIAL REPORT 2012 - Keolis

FINANCIAL REPORT 2012 - Keolis

FINANCIAL REPORT 2012 - Keolis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

87<br />

6<br />

NOTES ON THE INCOME STATEMENT<br />

6.1. Details of other income and expenses<br />

(€ thousand)<br />

Other operating income<br />

Gains on diesel hedging 3,842<br />

Supplier discounts 4,797<br />

Other 1<br />

TOTAL 8,640<br />

Other operating expenses<br />

Losses on diesel hedging 437<br />

Royalties 284<br />

Bad debts 136<br />

Other 2<br />

TOTAL 859<br />

6.2. Transfer of expenses<br />

(€ thousand)<br />

Staff-related expenditure 115<br />

Refunds, governmental vocational training agency 719<br />

TOTAL 834<br />

6.3. Financial income and expense<br />

(€ thousand)<br />

Income from investments 39,496<br />

Charges for depreciation, amortisation and provisions (48,202)<br />

Interest on current accounts 3,797<br />

Reversals of provisions and expense transfers 49,088<br />

Foreign exchange gains / losses (1,344)<br />

Income from sale of marketable securities 90<br />

Share of deficit <strong>Keolis</strong> Deutschland Co.KG (22,785)<br />

Other financial income and expense (1,365)<br />

TOTAL 18,775<br />

6.4. Exceptional gains and losses<br />

(€ thousand)<br />

Charges to provisions, net of reversals (780)<br />

Staff-related expenditure (3,408)<br />

Income / (loss) from intangible asset disposals (410)<br />

Income / (loss) from real estate disposals 701<br />

Income / (loss) from other asset disposals (97)<br />

Income / (loss) from financial asset disposals 227<br />

Tax penalties (4)<br />

Other exceptional items 15<br />

TOTAL (3,756)<br />

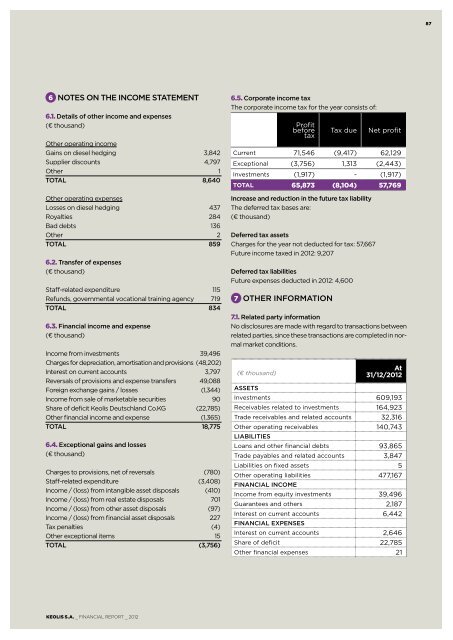

6.5. Corporate income tax<br />

The corporate income tax for the year consists of:<br />

Profit<br />

before<br />

tax<br />

Tax due<br />

Net profit<br />

Current 71,546 (9,417) 62,129<br />

Exceptional (3,756) 1,313 (2,443)<br />

Investments (1,917) - (1,917)<br />

TOTAL 65,873 (8,104) 57,769<br />

Increase and reduction in the future tax liability<br />

The deferred tax bases are:<br />

(€ thousand)<br />

Deferred tax assets<br />

Charges for the year not deducted for tax: 57,667<br />

Future income taxed in <strong>2012</strong>: 9,207<br />

Deferred tax liabilities<br />

Future expenses deducted in <strong>2012</strong>: 4,600<br />

7<br />

OTHER INFORMATION<br />

7.1. Related party information<br />

No disclosures are made with regard to transactions between<br />

related parties, since these transactions are completed in normal<br />

market conditions.<br />

(€ thousand)<br />

ASSETS<br />

At<br />

31/12/<strong>2012</strong><br />

Investments 609,193<br />

Receivables related to investments 164,923<br />

Trade receivables and related accounts 32,316<br />

Other operating receivables 140,743<br />

LIABILITIES<br />

Loans and other financial debts 93,865<br />

Trade payables and related accounts 3,847<br />

Liabilities on fixed assets 5<br />

Other operating liabilities 477,167<br />

<strong>FINANCIAL</strong> INCOME<br />

Income from equity investments 39,496<br />

Guarantees and others 2,187<br />

Interest on current accounts 6,442<br />

<strong>FINANCIAL</strong> EXPENSES<br />

Interest on current accounts 2,646<br />

Share of deficit 22,785<br />

Other financial expenses 21<br />

KEOLIS S.A. _ <strong>FINANCIAL</strong> <strong>REPORT</strong> _ <strong>2012</strong>