FINANCIAL REPORT 2012 - Keolis

FINANCIAL REPORT 2012 - Keolis

FINANCIAL REPORT 2012 - Keolis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6 1. MANAGEMENT<br />

ALLOCATION OF PROFIT<br />

We propose to allocate the profit for the year, which totalled<br />

€59,750,216.58, in the following manner:<br />

EMPLOYEE SHARES IN CAPITAL<br />

On 31 st December <strong>2012</strong>, there were no employee shares in the<br />

Company’s capital.<br />

Profit for the year €59,750,216.58<br />

DISTRIBUTABLE PROFIT €59,750,216.58<br />

Allocation:<br />

Distribution of dividends €19,130,937.70<br />

Other reserves €40,619,278.88<br />

Consequently, the allocation of a €4.90 dividend per share<br />

will be proposed.<br />

These dividends are not eligible for the 40% deduction since<br />

they are fully distributed to legal entities subject to corporation<br />

tax.<br />

In accordance with legal requirements, you are requested<br />

to note that the amount of the dividend distributed and that<br />

of the corresponding dividend tax credit for the three previous<br />

financial years were as follows:<br />

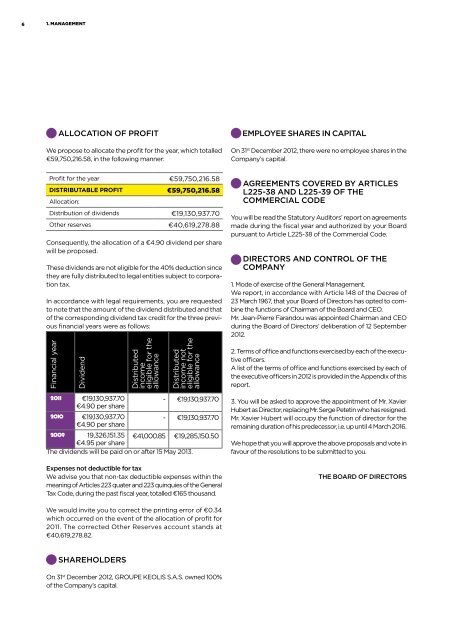

Financial year<br />

Dividend<br />

2011 €19,130,937.70<br />

€4.90 per share<br />

2010 €19,130,937.70<br />

€4.90 per share<br />

Distributed<br />

income<br />

eligible for the<br />

allowance<br />

Distributed<br />

income not<br />

eligible for the<br />

allowance<br />

- €19,130,937.70<br />

- €19,130,937.70<br />

2009 19,326,151.35 €41,000.85 €19,285,150.50<br />

€4.95 per share<br />

The dividends will be paid on or after 15 May 2013.<br />

Expenses not deductible for tax<br />

We advise you that non-tax deductible expenses within the<br />

meaning of Articles 223 quater and 223 quinquies of the General<br />

Tax Code, during the past fiscal year, totalled €165 thousand.<br />

AGREEMENTS COVERED BY ARTICLES<br />

L225-38 AND L225-39 OF THE<br />

COMMERCIAL CODE<br />

You will be read the Statutory Auditors’ report on agreements<br />

made during the fiscal year and authorized by your Board<br />

pursuant to Article L225-38 of the Commercial Code.<br />

DIRECTORS AND CONTROL OF THE<br />

COMPANY<br />

1. Mode of exercise of the General Management.<br />

We report, in accordance with Article 148 of the Decree of<br />

23 March 1967, that your Board of Directors has opted to combine<br />

the functions of Chairman of the Board and CEO.<br />

Mr. Jean-Pierre Farandou was appointed Chairman and CEO<br />

during the Board of Directors’ deliberation of 12 September<br />

<strong>2012</strong>.<br />

2. Terms of office and functions exercised by each of the executive<br />

officers.<br />

A list of the terms of office and functions exercised by each of<br />

the executive officers in <strong>2012</strong> is provided in the Appendix of this<br />

report.<br />

3. You will be asked to approve the appointment of Mr. Xavier<br />

Hubert as Director, replacing Mr. Serge Petetin who has resigned.<br />

Mr. Xavier Hubert will occupy the function of director for the<br />

remaining duration of his predecessor, i.e. up until 4 March 2016.<br />

We hope that you will approve the above proposals and vote in<br />

favour of the resolutions to be submitted to you.<br />

THE BOARD OF DIRECTORS<br />

We would invite you to correct the printing error of €0.34<br />

which occurred on the event of the allocation of profit for<br />

2011. The corrected Other Reserves account stands at<br />

€40,619,278.82.<br />

SHAREHOLDERS<br />

On 31 st December <strong>2012</strong>, GROUPE KEOLIS S.A.S. owned 100%<br />

of the Company’s capital.