2012 Annual Report - Prometic - Life Science, Inc.

2012 Annual Report - Prometic - Life Science, Inc.

2012 Annual Report - Prometic - Life Science, Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

As at December 31, <strong>2012</strong>, the cash position was $1.2 million compared<br />

to $0.3 million as at December 31, 2011.<br />

Current assets totaled $17.3 million as at December 31, <strong>2012</strong>, and<br />

$3.2 million as at December 31, 2011. Accounts receivable were<br />

$4.8 million as at December 31, <strong>2012</strong>, compared to $1.4 million as<br />

at December 31, 2011. Accounts receivable consist mostly of trade<br />

receivables related to the sale of resin, licensing agreements as well<br />

as research and development tax credits receivable related to the<br />

activities of the Therapeutics and the Protein Technology Units. The<br />

current assets also include an amount of $9.8 million for the share<br />

subscription receivable relating to the Hepalink investment in ProMetic<br />

which was received on January 7th, 2013. The net capital assets were<br />

at $1.1 million as at December 31, <strong>2012</strong> compared to $0.9 million as at<br />

December 31, 2011.<br />

<strong>Inc</strong>luded in Current liabilities is an amount of $5.1 million relating to<br />

Trade and other payables. This balance although improving, is still<br />

high, partly as a result of the company’s cash situation, and partly due to<br />

increased working capital requirements to service the growing revenue<br />

stream. The recent improvements in the Company’s liquidity noted<br />

herein are expected to improve upon this during fiscal 2013.<br />

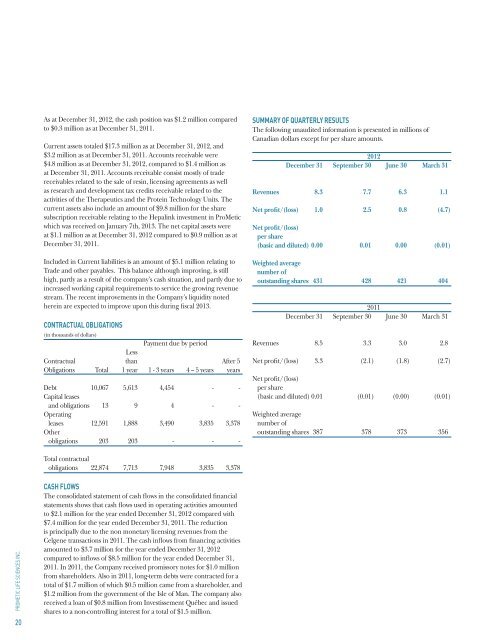

CONTRACTUAL OBLIGATIONS<br />

(in thousands of dollars)<br />

Payment due by period<br />

Less<br />

Contractual than After 5<br />

Obligations Total 1 year 1 - 3 years 4 – 5 years years<br />

Debt 10,067 5,613 4,454 - -<br />

Capital leases<br />

and obligations 13 9 4 - -<br />

Operating<br />

leases 12,591 1,888 3,490 3,835 3,378<br />

Other<br />

obligations 203 203 - - -<br />

SUMMARY OF QUARTERLY RESULTS<br />

The following unaudited information is presented in millions of<br />

Canadian dollars except for per share amounts.<br />

<strong>2012</strong><br />

December 31 September 30 June 30 March 31<br />

Revenues 8.3 7.7 6.3 1.1<br />

Net profit/(loss) 1.0 2.5 0.8 (4.7)<br />

Net profit/(loss)<br />

per share<br />

(basic and diluted) 0.00 0.01 0.00 (0.01)<br />

Weighted average<br />

number of<br />

outstanding shares 431 428 421 404<br />

2011<br />

December 31 September 30 June 30 March 31<br />

Revenues 8.5 3.3 3.0 2.8<br />

Net profit/(loss) 3.3 (2.1) (1.8) (2.7)<br />

Net profit/(loss)<br />

per share<br />

(basic and diluted) 0.01 (0.01) (0.00) (0.01)<br />

Weighted average<br />

number of<br />

outstanding shares 387 378 373 356<br />

Total contractual<br />

obligations 22,874 7,713 7,948 3,835 3,378<br />

PROMETIC LIFE SCIENCES INC.<br />

20<br />

CASH FLOWS<br />

The consolidated statement of cash flows in the consolidated financial<br />

statements shows that cash flows used in operating activities amounted<br />

to $2.1 million for the year ended December 31, <strong>2012</strong> compared with<br />

$7.4 million for the year ended December 31, 2011. The reduction<br />

is principally due to the non monetary licensing revenues from the<br />

Celgene transactions in 2011. The cash inflows from financing activities<br />

amounted to $3.7 million for the year ended December 31, <strong>2012</strong><br />

compared to inflows of $8.5 million for the year ended December 31,<br />

2011. In 2011, the Company received promissory notes for $1.0 million<br />

from shareholders. Also in 2011, long-term debts were contracted for a<br />

total of $1.7 million of which $0.5 million came from a shareholder, and<br />

$1.2 million from the government of the Isle of Man. The company also<br />

received a loan of $0.8 million from Investissement Québec and issued<br />

shares to a non-controlling interest for a total of $1.5 million.