2012 Annual Report - Prometic - Life Science, Inc.

2012 Annual Report - Prometic - Life Science, Inc.

2012 Annual Report - Prometic - Life Science, Inc.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

8. RESTRICTED CASH<br />

The restricted cash is composed of a guaranteed investment certificate, bearing interest at 0.35% per annum (two guaranteed investment<br />

certificates at December 31, 2011, bearing interest at 1.0% and 0.25%, respectively), pledged as collateral for a letter of credit to a landlord in the<br />

amount of $130 as at December 31, <strong>2012</strong> ($168 as at December 31, 2011 for two letters of credit), which automatically renews until the end of the<br />

lease. Restricted cash also includes a Grant Treasury Deposit for a total of $68 as at December 31, <strong>2012</strong> ($65 as at December 31, 2011), pledged in<br />

favour of the Isle of Man government for grants received.<br />

9. OTHER INVESTMENT<br />

The investment is composed of convertible preferred shares of AM-Pharma Holding B.V., a private company based in the Netherlands. During the<br />

year ended December 31, <strong>2012</strong>, no impairment was recorded to the investment ($25 for the year ended December 31, 2011).<br />

10. INVESTMENT IN AN ASSOCIATED COMPANY<br />

On June 29, <strong>2012</strong>, the Company and an unrelated partner established an entity, NantPro Bio<strong>Science</strong>s, LLC (“NantPro”) for the purposes of<br />

developing and commercialising a plasma-derived biopharmaceutical product for the US market.<br />

At inception, in exchange for 66.66% of the equity units in NantPro, the Company contributed a license to certain of its intellectual property. The<br />

other investor in NantPro, NantWorks LLC (“NantWorks”), contributed $2,548 (US$ 2,500,000) in exchange for 33.33% of the equity units. The<br />

Company measured the initial cost of its investment in NantPro based on the implied fair value of its contribution to the extent attributable to the<br />

other investor. Consequently, the initial cost of the investment amounted to $1,699 (US$1,667,000), with a corresponding recognition of licensing<br />

revenue. Concurrent with the initial investment, the Company also granted access to a specific protein to NantPro (the “Technology Access Fee”) for<br />

a non-refundable amount of $2,549 (US$ 2,500,000). Of this sum, $102 (US$ 100,000) has been deferred as at December 31,<strong>2012</strong>. The Company<br />

recognized $815 (US$ 800,160) as licensing revenue, which is based on the extent of the other investor’s interest. The balance of $1,632<br />

(US$ 1,599,840) was recorded as a reduction in the carrying amount of the investment.<br />

As a result of the composition of Nantpro’s board membership, the manner and timing in which substantive financing and operation decisions<br />

will be made, and that NantWorks has the current right to make additional capital contributions that could ultimately decrease the Company’s<br />

investment to 10% of the equity units. The Company has determined that it does not control the investment, but does have the ability to exercise<br />

significant influence and will therefore account for it as an associate. The contributions will be used by NantPro to pay the Company to carry out<br />

the development and manufacturing costs of a plasma-derived product. The additional capital contributions by NantWorks will result in dilution<br />

gains or losses and corresponding adjustments in the carrying value of the investment.<br />

During the year ended December 31, <strong>2012</strong>, the Company provided development services to NantPro and recognized revenues from the rendering<br />

of services of $1,549. As at December 31, <strong>2012</strong>, the Company had a balance receivable from NantPro of $438.<br />

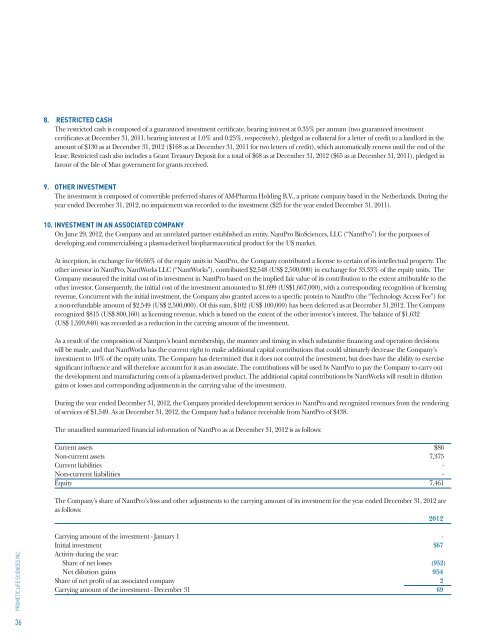

The unaudited summarized financial information of NantPro as at December 31, <strong>2012</strong> is as follows:<br />

Current assets $86<br />

Non-current assets 7,375<br />

Current liabilities -<br />

Non-current liabilities -<br />

Equity 7,461<br />

The Company’s share of NantPro’s loss and other adjustments to the carrying amount of its investment for the year ended December 31, <strong>2012</strong> are<br />

as follows:<br />

<strong>2012</strong><br />

PROMETIC LIFE SCIENCES INC.<br />

Carrying amount of the investment - January 1 -<br />

Initial investment $67<br />

Activity during the year:<br />

Share of net losses (952)<br />

Net dilution gains 954<br />

Share of net profit of an associated company 2<br />

Carrying amount of the investment - December 31 69<br />

36