2012 Annual Report - Prometic - Life Science, Inc.

2012 Annual Report - Prometic - Life Science, Inc.

2012 Annual Report - Prometic - Life Science, Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

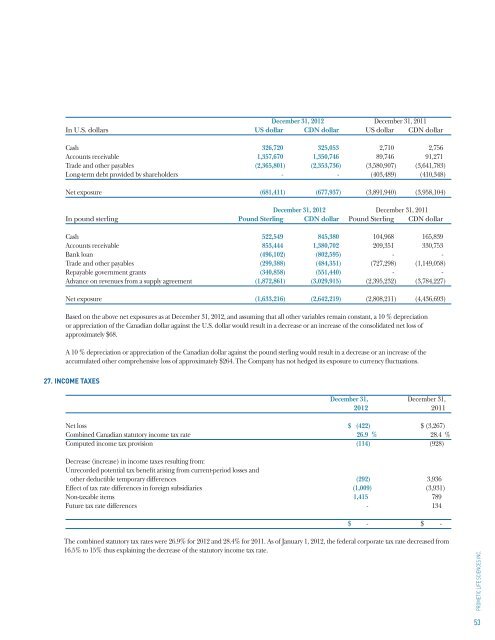

December 31, <strong>2012</strong> December 31, 2011<br />

In U.S. dollars US dollar CDN dollar US dollar CDN dollar<br />

Cash 326,720 325,053 2,710 2,756<br />

Accounts receivable 1,357,670 1,350,746 89,746 91,271<br />

Trade and other payables (2,365,801) (2,353,736) (3,580,907) (3,641,783)<br />

Long-term debt provided by shareholders - - (403,489) (410,348)<br />

Net exposure (681,411) (677,937) (3,891,940) (3,958,104)<br />

December 31, <strong>2012</strong> December 31, 2011<br />

In pound sterling Pound Sterling CDN dollar Pound Sterling CDN dollar<br />

Cash 522,549 845,380 104,968 165,839<br />

Accounts receivable 853,444 1,380,702 209,351 330,753<br />

Bank loan (496,102) (802,595) - -<br />

Trade and other payables (299,388) (484,351) (727,298) (1,149,058)<br />

Repayable government grants (340,858) (551,440) - -<br />

Advance on revenues from a supply agreement (1,872,861) (3,029,915) (2,395,232) (3,784,227)<br />

Net exposure (1,633,216) (2,642,219) (2,808,211) (4,436,693)<br />

Based on the above net exposures as at December 31, <strong>2012</strong>, and assuming that all other variables remain constant, a 10 % depreciation<br />

or appreciation of the Canadian dollar against the U.S. dollar would result in a decrease or an increase of the consolidated net loss of<br />

approximately $68.<br />

A 10 % depreciation or appreciation of the Canadian dollar against the pound sterling would result in a decrease or an increase of the<br />

accumulated other comprehensive loss of approximately $264. The Company has not hedged its exposure to currency fluctuations.<br />

27. INCOME TAXES<br />

December 31, December 31,<br />

<strong>2012</strong> 2011<br />

Net loss $ (422) $ (3,267)<br />

Combined Canadian statutory income tax rate 26.9 % 28.4 %<br />

Computed income tax provision (114) (928)<br />

Decrease (increase) in income taxes resulting from:<br />

Unrecorded potential tax benefit arising from current-period losses and<br />

other deductible temporary differences (292) 3,936<br />

Effect of tax rate differences in foreign subsidiaries (1,009) (3,931)<br />

Non-taxable items 1,415 789<br />

Future tax rate differences - 134<br />

$ - $ -<br />

The combined statutory tax rates were 26.9% for <strong>2012</strong> and 28.4% for 2011. As of January 1, <strong>2012</strong>, the federal corporate tax rate decreased from<br />

16.5% to 15% thus explaining the decrease of the statutory income tax rate.<br />

PROMETIC LIFE SCIENCES INC.<br />

53