2012 Annual Report - Prometic - Life Science, Inc.

2012 Annual Report - Prometic - Life Science, Inc.

2012 Annual Report - Prometic - Life Science, Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

After application of the equity method, the Company determines whether it is necessary to recognise an additional impairment loss on its<br />

investment in its associate. The Company determines at each reporting date whether there is any objective evidence that the investment in<br />

the associate is impaired. If this is the case, the Company calculates the amount of impairment as the difference between the recoverable<br />

amount of the associate and its carrying value and recognises the amount in the ‘share of profit of an associate’ in the consolidated statement<br />

of operations.<br />

Upon loss of significant influence over the associate, the Company measures and recognises any retaining investment at its fair value. Any<br />

difference between the carrying amount of the associate upon loss of significant influence and the fair value of the retained investment and<br />

proceeds from disposal is recognised in profit or loss.<br />

f) Financial instruments<br />

The classification and measurement of the Company’s financial instruments are as follows:<br />

Financial assets at fair value through profit and loss<br />

Cash and restricted cash are respectively classified and designated as financial assets at fair value through profit and loss. They are measured at<br />

fair value and changes in fair value are recognized in the consolidated statements of operations and comprehensive loss.<br />

Loans and receivables<br />

Accounts receivable and share subscription receivable, excluding tax credits receivable and sales taxes receivable, are classified as loans and<br />

receivables. They are initially recognized at fair value and subsequently carried at amortized cost using the effective interest method.<br />

Available-for-sale assets<br />

The convertible preferred shares of AM-Pharma Holding B.V., a private company, are classified as available-for-sale and are measured at cost.<br />

Financial liabilities<br />

Bank and other loans, trade and other payables, promissory notes from shareholders, repayable government grants and advance on revenues<br />

from a supply agreement are classified as other financial liabilities. They are measured at amortized cost using the effective interest method.<br />

Long-term debt provided by shareholders, finance leases obligations and advance on revenues from a supply agreement are classified as other<br />

financial liabilities. They are measured at amortized cost, using the effective interest method. Financing costs are applied against long-term<br />

debt.<br />

Impairment of investments<br />

When, in management’s opinion, there has been a significant or prolonged decline in value of an investment, the investment is written down to<br />

recognize the loss. In determining the estimated realizable value of its investment, management relies on its judgment and knowledge of each<br />

investment as well as on assumptions about general business and economic conditions that prevail or are expected to prevail.<br />

g) Inventories<br />

Inventories of raw materials, work in progress and finished goods are valued at the lower of cost and net realizable value. Cost is determined<br />

on a first in, first out basis.<br />

h) Capital assets<br />

Capital assets are recorded at cost less any government assistance, accumulated depreciation and accumulated impairment losses, if any.<br />

Depreciation is calculated on a straight-line basis over the estimated useful lives of the assets, as described below.<br />

PROMETIC LIFE SCIENCES INC.<br />

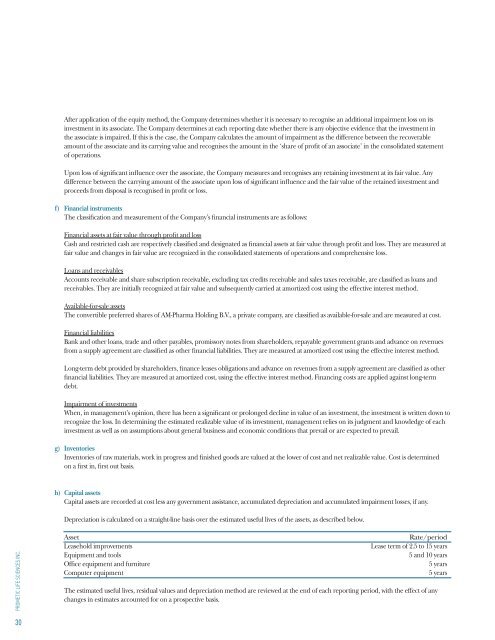

Asset<br />

Leasehold improvements<br />

Equipment and tools<br />

Office equipment and furniture<br />

Computer equipment<br />

Rate/period<br />

Lease term of 2.5 to 15 years<br />

5 and 10 years<br />

5 years<br />

5 years<br />

The estimated useful lives, residual values and depreciation method are reviewed at the end of each reporting period, with the effect of any<br />

changes in estimates accounted for on a prospective basis.<br />

30