2012 Annual Report - Prometic - Life Science, Inc.

2012 Annual Report - Prometic - Life Science, Inc.

2012 Annual Report - Prometic - Life Science, Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

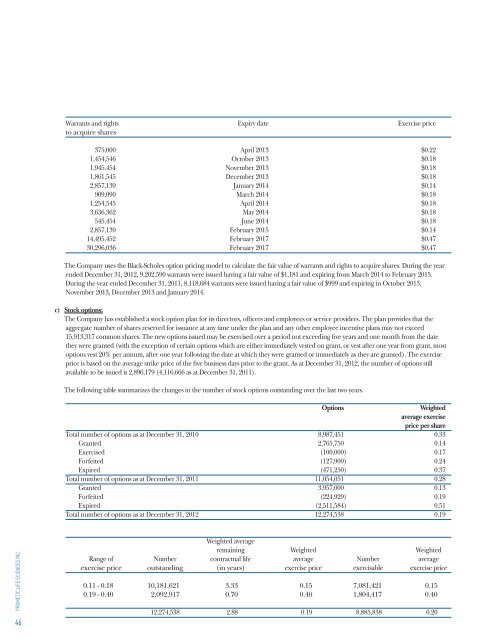

Warrants and rights Expiry date Exercise price<br />

to acquire shares<br />

375,000 April 2013 $0.22<br />

1,454,546 October 2013 $0.18<br />

1,945,454 November 2013 $0.18<br />

1,861,545 December 2013 $0.18<br />

2,857,139 January 2014 $0.14<br />

909,090 March 2014 $0.18<br />

1,254,545 April 2014 $0.18<br />

3,636,362 May 2014 $0.18<br />

545,454 June 2014 $0.18<br />

2,857,139 February 2015 $0.14<br />

14,495,452 February 2017 $0.47<br />

30,296,036 February 2017 $0.47<br />

The Company uses the Black-Scholes option pricing model to calculate the fair value of warrants and rights to acquire shares. During the year<br />

ended December 31, <strong>2012</strong>, 9,202,590 warrants were issued having a fair value of $1,181 and expiring from March 2014 to February 2015.<br />

During the year ended December 31, 2011, 8,118,684 warrants were issued having a fair value of $999 and expiring in October 2013,<br />

November 2013, December 2013 and January 2014.<br />

c) Stock options:<br />

The Company has established a stock option plan for its directors, officers and employees or service providers. The plan provides that the<br />

aggregate number of shares reserved for issuance at any time under the plan and any other employee incentive plans may not exceed<br />

15,913,317 common shares. The new options issued may be exercised over a period not exceeding five years and one month from the date<br />

they were granted (with the exception of certain options which are either immediately vested on grant, or vest after one year from grant, most<br />

options vest 20% per annum, after one year following the date at which they were granted or immediately as they are granted). The exercise<br />

price is based on the average strike price of the five business days prior to the grant. As at December 31, <strong>2012</strong>, the number of options still<br />

available to be issued is 2,896,179 (4,116,666 as at December 31, 2011).<br />

The following table summarizes the changes in the number of stock options outstanding over the last two years.<br />

Options<br />

Weighted<br />

average exercise<br />

price per share<br />

Total number of options as at December 31, 2010 8,987,451 0.33<br />

Granted 2,765,750 0.14<br />

Exercised (100,000) 0.17<br />

Forfeited (127,900) 0.24<br />

Expired (471,250) 0.37<br />

Total number of options as at December 31, 2011 11,054,051 0.28<br />

Granted 3,957,000 0.13<br />

Forfeited (224,929) 0.19<br />

Expired (2,511,584) 0.51<br />

Total number of options as at December 31, <strong>2012</strong> 12,274,538 0.19<br />

PROMETIC LIFE SCIENCES INC.<br />

46<br />

Weighted average<br />

remaining Weighted Weighted<br />

Range of Number contractual life average Number average<br />

exercise price outstanding (in years) exercise price exercisable exercise price<br />

0.11 - 0.18 10,181,621 3.33 0.15 7,081,421 0.15<br />

0.19 - 0.40 2,092,917 0.70 0.40 1,804,417 0.40<br />

12,274,538 2.88 0.19 8,885,838 0.20