2008 Annual Report to Shareholders - Lincoln Financial Group

2008 Annual Report to Shareholders - Lincoln Financial Group

2008 Annual Report to Shareholders - Lincoln Financial Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

On November 12, 2007, we signed agreements <strong>to</strong> sell the television stations, sports programming business and certain radio<br />

properties of our former <strong>Lincoln</strong> <strong>Financial</strong> Media segment. The sales closed during the fourth quarter of 2007 and the first quarter<br />

of <strong>2008</strong>. Accordingly, we have reported the results of these businesses as discontinued operations on our Consolidated Statements<br />

of Income and the assets and liabilities as held for sale on our Consolidated Balance Sheets for all periods presented. The results of<br />

the remaining radio properties, which are included in Other Operations, do not qualify as discontinued operations. For further<br />

information, see “Acquisitions and Dispositions” below.<br />

The results of <strong>Lincoln</strong> <strong>Financial</strong> Network (“LFN”) and <strong>Lincoln</strong> <strong>Financial</strong> Distribu<strong>to</strong>rs (“LFD”), our retail and wholesale<br />

distribu<strong>to</strong>rs, respectively, are included in the segments for which they distribute products. LFD distributes our individual as well as<br />

Defined Contribution and Executive Benefits (which includes corporate-owned UL and VUL (“COLI”) and bank-owned UL and<br />

VUL (“BOLI”)) products and services. The distribution occurs primarily through brokers, planners, agents, financial advisors,<br />

third party administra<strong>to</strong>rs (“TPAs”) and other intermediaries. <strong>Group</strong> Protection distributes its products and services primarily<br />

through employee benefit brokers, TPAs and other employee benefit firms. As of December 31, <strong>2008</strong>, LFD had approximately<br />

830 internal and external wholesalers (including sales managers). As of December 31, <strong>2008</strong>, LFN offered LNC and nonproprietary<br />

products and advisory services through a national network of approximately 7,400 active producers who placed<br />

business with us within the last twelve months.<br />

On July 16, <strong>2008</strong>, we announced our change in definitions of segment operating revenues and income from operations <strong>to</strong> better<br />

reflect the underlying economics of our variable and indexed annuities that employ derivative instruments <strong>to</strong> hedge policy benefits<br />

and the manner in which management evaluates that business. For more information regarding this change, see the “MD&A”<br />

below.<br />

<strong>Financial</strong> information in the tables that follow is presented in conformity with accounting principles generally accepted in the<br />

United States of America (“GAAP”), unless otherwise indicated. We provide revenues, income (loss) from operations and assets<br />

attributable <strong>to</strong> each of our business segments and Other Operations, as well as revenues derived inside and outside the U.S. for the<br />

last three fiscal years, in Note 23.<br />

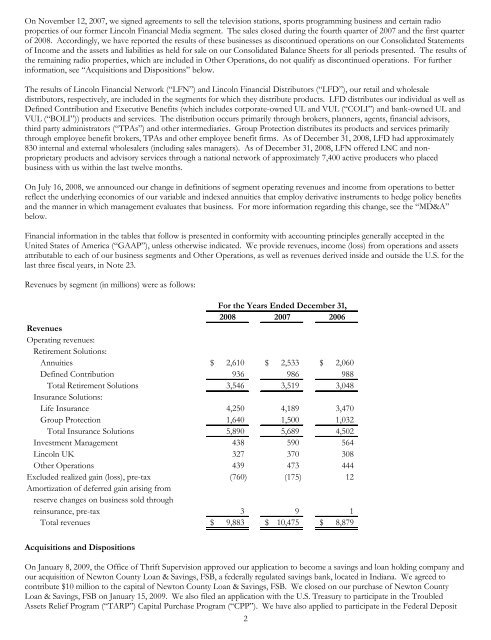

Revenues by segment (in millions) were as follows:<br />

For the Years Ended December 31,<br />

<strong>2008</strong> 2007 2006<br />

Revenues<br />

Operating revenues:<br />

Retirement Solutions:<br />

Annuities $ 2,610 $ 2,533 $ 2,060<br />

Defined Contribution 936 986 988<br />

Total Retirement Solutions 3,546 3,519 3,048<br />

Insurance Solutions:<br />

Life Insurance 4,250 4,189 3,470<br />

<strong>Group</strong> Protection 1,640 1,500 1,032<br />

Total Insurance Solutions 5,890 5,689 4,502<br />

Investment Management 438 590 564<br />

<strong>Lincoln</strong> UK 327 370 308<br />

Other Operations 439 473 444<br />

Excluded realized gain (loss), pre-tax (760) (175) 12<br />

Amortization of deferred gain arising from<br />

reserve changes on business sold through<br />

reinsurance, pre-tax 3 9 1<br />

Total revenues $ 9,883 $ 10,475 $ 8,879<br />

Acquisitions and Dispositions<br />

On January 8, 2009, the Office of Thrift Supervision approved our application <strong>to</strong> become a savings and loan holding company and<br />

our acquisition of New<strong>to</strong>n County Loan & Savings, FSB, a federally regulated savings bank, located in Indiana. We agreed <strong>to</strong><br />

contribute $10 million <strong>to</strong> the capital of New<strong>to</strong>n County Loan & Savings, FSB. We closed on our purchase of New<strong>to</strong>n County<br />

Loan & Savings, FSB on January 15, 2009. We also filed an application with the U.S. Treasury <strong>to</strong> participate in the Troubled<br />

Assets Relief Program (“TARP”) Capital Purchase Program (“CPP”). We have also applied <strong>to</strong> participate in the Federal Deposit<br />

2