2008 Annual Report to Shareholders - Lincoln Financial Group

2008 Annual Report to Shareholders - Lincoln Financial Group

2008 Annual Report to Shareholders - Lincoln Financial Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview<br />

Retirement Solutions – Defined Contribution<br />

The Defined Contribution segment provides employers the ability <strong>to</strong> offer tax-deferred retirement savings plans <strong>to</strong> their<br />

employees, primarily through 403(b) and 401(k) retirement savings plans. We provide a variety of plan investment vehicles,<br />

including individual and group variable annuities, group fixed annuities and mutual funds. We also offer a broad array of plan<br />

services including plan recordkeeping, compliance testing, participant education and other related services.<br />

Defined contribution (“DC”) plans are a popular employee benefit offered by many employers across a wide spectrum of<br />

industries and by employers large and small. Some plans include employer matching of contributions, which can increase<br />

participation by employees. Growth in the number of DC plans has occurred as these plans have been used as replacements for<br />

frozen or eliminated defined benefit retirement plans. In general, DC plans offer tax-deferred contributions and investment<br />

growth, thereby deferring the tax consequences of both the contributions and investment growth until withdrawals are made from<br />

the accumulated values, often at lower tax rates occurring during retirement.<br />

<strong>Lincoln</strong>’s 403(b) assets accounted for 60% of <strong>to</strong>tal assets under management in this segment as of December 31, <strong>2008</strong>. The 401(k)<br />

business accounted for 46% of our new deposits during <strong>2008</strong> for this segment.<br />

Products and Services<br />

The Defined Contribution segment currently offers four primary offerings <strong>to</strong> the employer-sponsored market: LINCOLN<br />

DIRECTOR SM group variable annuity, LINCOLN ALLIANCE® program, <strong>Lincoln</strong> SmartFuture® program and Multi-Fund®<br />

variable annuity.<br />

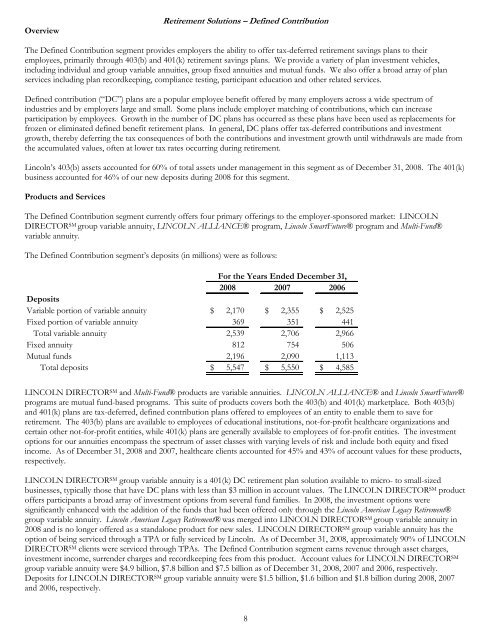

The Defined Contribution segment’s deposits (in millions) were as follows:<br />

For the Years Ended December 31,<br />

<strong>2008</strong> 2007 2006<br />

Deposits<br />

Variable portion of variable annuity $ 2,170 $ 2,355 $ 2,525<br />

Fixed portion of variable annuity 369 351 441<br />

Total variable annuity 2,539 2,706 2,966<br />

Fixed annuity 812 754 506<br />

Mutual funds 2,196 2,090 1,113<br />

Total deposits $ 5,547 $ 5,550 $ 4,585<br />

LINCOLN DIRECTOR SM and Multi-Fund® products are variable annuities. LINCOLN ALLIANCE® and <strong>Lincoln</strong> SmartFuture®<br />

programs are mutual fund-based programs. This suite of products covers both the 403(b) and 401(k) marketplace. Both 403(b)<br />

and 401(k) plans are tax-deferred, defined contribution plans offered <strong>to</strong> employees of an entity <strong>to</strong> enable them <strong>to</strong> save for<br />

retirement. The 403(b) plans are available <strong>to</strong> employees of educational institutions, not-for-profit healthcare organizations and<br />

certain other not-for-profit entities, while 401(k) plans are generally available <strong>to</strong> employees of for-profit entities. The investment<br />

options for our annuities encompass the spectrum of asset classes with varying levels of risk and include both equity and fixed<br />

income. As of December 31, <strong>2008</strong> and 2007, healthcare clients accounted for 45% and 43% of account values for these products,<br />

respectively.<br />

LINCOLN DIRECTOR SM group variable annuity is a 401(k) DC retirement plan solution available <strong>to</strong> micro- <strong>to</strong> small-sized<br />

businesses, typically those that have DC plans with less than $3 million in account values. The LINCOLN DIRECTOR SM product<br />

offers participants a broad array of investment options from several fund families. In <strong>2008</strong>, the investment options were<br />

significantly enhanced with the addition of the funds that had been offered only through the <strong>Lincoln</strong> American Legacy Retirement®<br />

group variable annuity. <strong>Lincoln</strong> American Legacy Retirement® was merged in<strong>to</strong> LINCOLN DIRECTOR SM group variable annuity in<br />

<strong>2008</strong> and is no longer offered as a standalone product for new sales. LINCOLN DIRECTOR SM group variable annuity has the<br />

option of being serviced through a TPA or fully serviced by <strong>Lincoln</strong>. As of December 31, <strong>2008</strong>, approximately 90% of LINCOLN<br />

DIRECTOR SM clients were serviced through TPAs. The Defined Contribution segment earns revenue through asset charges,<br />

investment income, surrender charges and recordkeeping fees from this product. Account values for LINCOLN DIRECTOR SM<br />

group variable annuity were $4.9 billion, $7.8 billion and $7.5 billion as of December 31, <strong>2008</strong>, 2007 and 2006, respectively.<br />

Deposits for LINCOLN DIRECTOR SM group variable annuity were $1.5 billion, $1.6 billion and $1.8 billion during <strong>2008</strong>, 2007<br />

and 2006, respectively.<br />

8