2008 Annual Report to Shareholders - Lincoln Financial Group

2008 Annual Report to Shareholders - Lincoln Financial Group

2008 Annual Report to Shareholders - Lincoln Financial Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

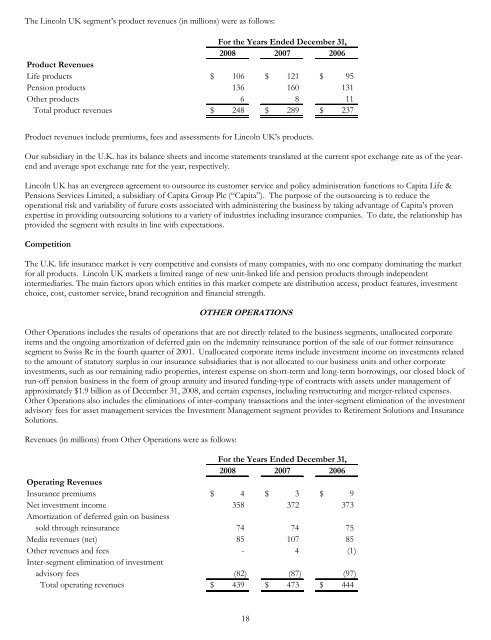

The <strong>Lincoln</strong> UK segment’s product revenues (in millions) were as follows:<br />

For the Years Ended December 31,<br />

<strong>2008</strong> 2007 2006<br />

Product Revenues<br />

Life products $ 106 $ 121 $ 95<br />

Pension products 136 160 131<br />

Other products 6 8 11<br />

Total product revenues $ 248 $ 289 $ 237<br />

Product revenues include premiums, fees and assessments for <strong>Lincoln</strong> UK’s products.<br />

Our subsidiary in the U.K. has its balance sheets and income statements translated at the current spot exchange rate as of the yearend<br />

and average spot exchange rate for the year, respectively.<br />

<strong>Lincoln</strong> UK has an evergreen agreement <strong>to</strong> outsource its cus<strong>to</strong>mer service and policy administration functions <strong>to</strong> Capita Life &<br />

Pensions Services Limited, a subsidiary of Capita <strong>Group</strong> Plc (“Capita”). The purpose of the outsourcing is <strong>to</strong> reduce the<br />

operational risk and variability of future costs associated with administering the business by taking advantage of Capita’s proven<br />

expertise in providing outsourcing solutions <strong>to</strong> a variety of industries including insurance companies. To date, the relationship has<br />

provided the segment with results in line with expectations.<br />

Competition<br />

The U.K. life insurance market is very competitive and consists of many companies, with no one company dominating the market<br />

for all products. <strong>Lincoln</strong> UK markets a limited range of new unit-linked life and pension products through independent<br />

intermediaries. The main fac<strong>to</strong>rs upon which entities in this market compete are distribution access, product features, investment<br />

choice, cost, cus<strong>to</strong>mer service, brand recognition and financial strength.<br />

OTHER OPERATIONS<br />

Other Operations includes the results of operations that are not directly related <strong>to</strong> the business segments, unallocated corporate<br />

items and the ongoing amortization of deferred gain on the indemnity reinsurance portion of the sale of our former reinsurance<br />

segment <strong>to</strong> Swiss Re in the fourth quarter of 2001. Unallocated corporate items include investment income on investments related<br />

<strong>to</strong> the amount of statu<strong>to</strong>ry surplus in our insurance subsidiaries that is not allocated <strong>to</strong> our business units and other corporate<br />

investments, such as our remaining radio properties, interest expense on short-term and long-term borrowings, our closed block of<br />

run-off pension business in the form of group annuity and insured funding-type of contracts with assets under management of<br />

approximately $1.9 billion as of December 31, <strong>2008</strong>, and certain expenses, including restructuring and merger-related expenses.<br />

Other Operations also includes the eliminations of inter-company transactions and the inter-segment elimination of the investment<br />

advisory fees for asset management services the Investment Management segment provides <strong>to</strong> Retirement Solutions and Insurance<br />

Solutions.<br />

Revenues (in millions) from Other Operations were as follows:<br />

For the Years Ended December 31,<br />

<strong>2008</strong> 2007 2006<br />

Operating Revenues<br />

Insurance premiums $ 4 $ 3 $ 9<br />

Net investment income 358 372 373<br />

Amortization of deferred gain on business<br />

sold through reinsurance 74 74 75<br />

Media revenues (net) 85 107 85<br />

Other revenues and fees - 4 (1)<br />

Inter-segment elimination of investment<br />

advisory fees (82) (87) (97)<br />

Total operating revenues $ 439 $ 473 $ 444<br />

18