2008 Annual Report to Shareholders - Lincoln Financial Group

2008 Annual Report to Shareholders - Lincoln Financial Group

2008 Annual Report to Shareholders - Lincoln Financial Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

future changes <strong>to</strong> regula<strong>to</strong>ry capital requirements could impact the dividend capacity of our U.K. insurance subsidiaries and cash<br />

flow <strong>to</strong> the holding company.<br />

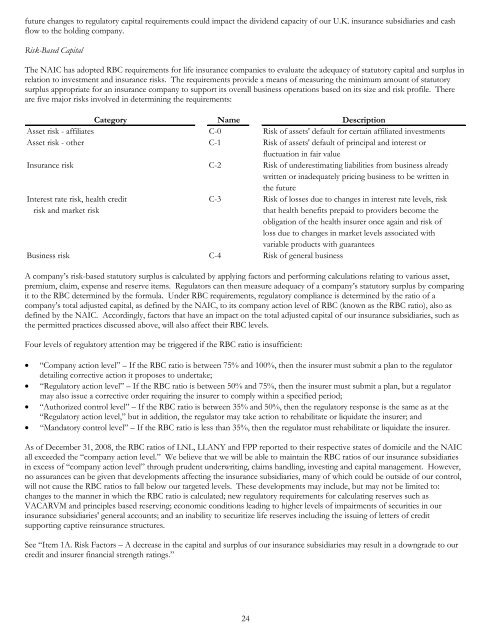

Risk-Based Capital<br />

The NAIC has adopted RBC requirements for life insurance companies <strong>to</strong> evaluate the adequacy of statu<strong>to</strong>ry capital and surplus in<br />

relation <strong>to</strong> investment and insurance risks. The requirements provide a means of measuring the minimum amount of statu<strong>to</strong>ry<br />

surplus appropriate for an insurance company <strong>to</strong> support its overall business operations based on its size and risk profile. There<br />

are five major risks involved in determining the requirements:<br />

Category<br />

Name<br />

Description<br />

Asset risk - affiliates C-0 Risk of assets' default for certain affiliated investments<br />

Asset risk - other C-1 Risk of assets' default of principal and interest or<br />

fluctuation in fair value<br />

Insurance risk C-2 Risk of underestimating liabilities from business already<br />

written or inadequately pricing business <strong>to</strong> be written in<br />

the future<br />

Interest rate risk, health credit C-3 Risk of losses due <strong>to</strong> changes in interest rate levels, risk<br />

risk and market risk<br />

that health benefits prepaid <strong>to</strong> providers become the<br />

obligation of the health insurer once again and risk of<br />

loss due <strong>to</strong> changes in market levels associated with<br />

variable products with guarantees<br />

Business risk C-4 Risk of general business<br />

A company’s risk-based statu<strong>to</strong>ry surplus is calculated by applying fac<strong>to</strong>rs and performing calculations relating <strong>to</strong> various asset,<br />

premium, claim, expense and reserve items. Regula<strong>to</strong>rs can then measure adequacy of a company’s statu<strong>to</strong>ry surplus by comparing<br />

it <strong>to</strong> the RBC determined by the formula. Under RBC requirements, regula<strong>to</strong>ry compliance is determined by the ratio of a<br />

company’s <strong>to</strong>tal adjusted capital, as defined by the NAIC, <strong>to</strong> its company action level of RBC (known as the RBC ratio), also as<br />

defined by the NAIC. Accordingly, fac<strong>to</strong>rs that have an impact on the <strong>to</strong>tal adjusted capital of our insurance subsidiaries, such as<br />

the permitted practices discussed above, will also affect their RBC levels.<br />

Four levels of regula<strong>to</strong>ry attention may be triggered if the RBC ratio is insufficient:<br />

<br />

<br />

<br />

<br />

“Company action level” – If the RBC ratio is between 75% and 100%, then the insurer must submit a plan <strong>to</strong> the regula<strong>to</strong>r<br />

detailing corrective action it proposes <strong>to</strong> undertake;<br />

“Regula<strong>to</strong>ry action level” – If the RBC ratio is between 50% and 75%, then the insurer must submit a plan, but a regula<strong>to</strong>r<br />

may also issue a corrective order requiring the insurer <strong>to</strong> comply within a specified period;<br />

“Authorized control level” – If the RBC ratio is between 35% and 50%, then the regula<strong>to</strong>ry response is the same as at the<br />

“Regula<strong>to</strong>ry action level,” but in addition, the regula<strong>to</strong>r may take action <strong>to</strong> rehabilitate or liquidate the insurer; and<br />

“Manda<strong>to</strong>ry control level” – If the RBC ratio is less than 35%, then the regula<strong>to</strong>r must rehabilitate or liquidate the insurer.<br />

As of December 31, <strong>2008</strong>, the RBC ratios of LNL, LLANY and FPP reported <strong>to</strong> their respective states of domicile and the NAIC<br />

all exceeded the “company action level.” We believe that we will be able <strong>to</strong> maintain the RBC ratios of our insurance subsidiaries<br />

in excess of “company action level” through prudent underwriting, claims handling, investing and capital management. However,<br />

no assurances can be given that developments affecting the insurance subsidiaries, many of which could be outside of our control,<br />

will not cause the RBC ratios <strong>to</strong> fall below our targeted levels. These developments may include, but may not be limited <strong>to</strong>:<br />

changes <strong>to</strong> the manner in which the RBC ratio is calculated; new regula<strong>to</strong>ry requirements for calculating reserves such as<br />

VACARVM and principles based reserving; economic conditions leading <strong>to</strong> higher levels of impairments of securities in our<br />

insurance subsidiaries' general accounts; and an inability <strong>to</strong> securitize life reserves including the issuing of letters of credit<br />

supporting captive reinsurance structures.<br />

See “Item 1A. Risk Fac<strong>to</strong>rs – A decrease in the capital and surplus of our insurance subsidiaries may result in a downgrade <strong>to</strong> our<br />

credit and insurer financial strength ratings.”<br />

24