Notes to the Consolidated Financial Statements - Uni-Asia Finance ...

Notes to the Consolidated Financial Statements - Uni-Asia Finance ...

Notes to the Consolidated Financial Statements - Uni-Asia Finance ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Realising A Sustainable Future<br />

33<br />

Corporate Governance Report<br />

<strong>Uni</strong>-<strong>Asia</strong> <strong>Finance</strong> Corporation (<strong>the</strong> “Company”) is committed <strong>to</strong> maintaining a high standard of corporate governance within <strong>the</strong><br />

Company and its subsidiaries (<strong>the</strong> “Group”). The board of direc<strong>to</strong>rs of <strong>the</strong> Company (<strong>the</strong> “Board”) recognises <strong>the</strong> importance of good<br />

corporate governance and <strong>the</strong> offering of high standards of accountability <strong>to</strong> <strong>the</strong> shareholders. This report outlines <strong>the</strong> Company’s<br />

corporate governance processes and activities with specific reference <strong>to</strong> <strong>the</strong> Code of Corporate Governance 2005 (<strong>the</strong> “Code”).<br />

The Board confirms that for <strong>the</strong> financial year ended 31 December 2009, <strong>the</strong> Company has adhered <strong>to</strong> <strong>the</strong> principles and guidelines<br />

as set out in <strong>the</strong> Code, where applicable, and has specified and explained <strong>the</strong> deviation from <strong>the</strong> Code in this report.<br />

Board Matters<br />

Principle 1:<br />

The Board’s Conduct<br />

of its Affairs<br />

Guideline1.3:<br />

Delegation of<br />

authority on certain<br />

Board matters<br />

Guideline 1.4:<br />

Meetings of <strong>the</strong><br />

Board and Board<br />

Committees<br />

The Board oversees <strong>the</strong> business affairs of <strong>the</strong> Company and assumes responsibility for <strong>the</strong> Group’s overall<br />

strategic plans, key operational initiatives, major funding and investment proposals, financial performance<br />

reviews and corporate governance practices.<br />

The Board is supported by <strong>the</strong> Audit Committee (“AC”), <strong>the</strong> Nominating Committee (“NC”) and <strong>the</strong><br />

Remuneration Committee (“RC”), each of whose members are drawn from members of <strong>the</strong> Board<br />

(<strong>to</strong>ge<strong>the</strong>r “Board Committees” and each a “Board Committee”). Each of <strong>the</strong>se Board Committees operate under<br />

delegated authority from <strong>the</strong> Board.<br />

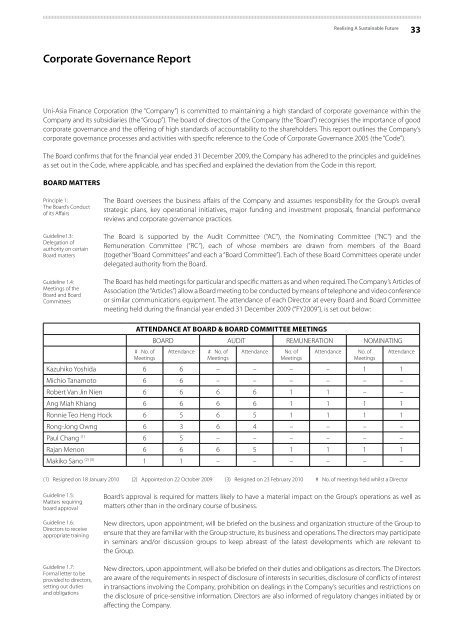

The Board has held meetings for particular and specific matters as and when required. The Company’s Articles of<br />

Association (<strong>the</strong> “Articles”) allow a Board meeting <strong>to</strong> be conducted by means of telephone and video conference<br />

or similar communications equipment. The attendance of each Direc<strong>to</strong>r at every Board and Board Committee<br />

meeting held during <strong>the</strong> financial year ended 31 December 2009 (“FY2009”), is set out below:<br />

ATTENDANCE AT BOARD & BOARD COMMITTEE MEETINGS<br />

# No. of<br />

Meetings<br />

BOARD AUDIT REMUNERATION NOMINATING<br />

Attendance<br />

# No. of<br />

Meetings<br />

Attendance<br />

No. of<br />

Meetings<br />

Attendance<br />

No. of<br />

Meetings<br />

Kazuhiko Yoshida 6 6 – – – – 1 1<br />

Michio Tanamo<strong>to</strong> 6 6 – – – – – –<br />

Robert Van Jin Nien 6 6 6 6 1 1 – –<br />

Ang Miah Khiang 6 6 6 6 1 1 1 1<br />

Ronnie Teo Heng Hock 6 5 6 5 1 1 1 1<br />

Rong-Jong Owng 6 3 6 4 – – – –<br />

Paul Chang (1) 6 5 – – – – – –<br />

Rajan Menon 6 6 6 5 1 1 1 1<br />

Makiko Sano (2) (3) 1 1 – – – – – –<br />

Attendance<br />

(1) Resigned on 18 January 2010 (2) Appointed on 22 Oc<strong>to</strong>ber 2009 (3) Resigned on 23 February 2010 # No. of meetings held whilst a Direc<strong>to</strong>r<br />

Guideline 1.5:<br />

Matters requiring<br />

board approval<br />

Guideline 1.6:<br />

Direc<strong>to</strong>rs <strong>to</strong> receive<br />

appropriate training<br />

Guideline 1.7:<br />

Formal letter <strong>to</strong> be<br />

provided <strong>to</strong> direc<strong>to</strong>rs,<br />

setting out duties<br />

and obligations<br />

Board’s approval is required for matters likely <strong>to</strong> have a material impact on <strong>the</strong> Group’s operations as well as<br />

matters o<strong>the</strong>r than in <strong>the</strong> ordinary course of business.<br />

New direc<strong>to</strong>rs, upon appointment, will be briefed on <strong>the</strong> business and organization structure of <strong>the</strong> Group <strong>to</strong><br />

ensure that <strong>the</strong>y are familiar with <strong>the</strong> Group structure, its business and operations. The direc<strong>to</strong>rs may participate<br />

in seminars and/or discussion groups <strong>to</strong> keep abreast of <strong>the</strong> latest developments which are relevant <strong>to</strong><br />

<strong>the</strong> Group.<br />

New direc<strong>to</strong>rs, upon appointment, will also be briefed on <strong>the</strong>ir duties and obligations as direc<strong>to</strong>rs. The Direc<strong>to</strong>rs<br />

are aware of <strong>the</strong> requirements in respect of disclosure of interests in securities, disclosure of conflicts of interest<br />

in transactions involving <strong>the</strong> Company, prohibition on dealings in <strong>the</strong> Company’s securities and restrictions on<br />

<strong>the</strong> disclosure of price-sensitive information. Direc<strong>to</strong>rs are also informed of regula<strong>to</strong>ry changes initiated by or<br />

affecting <strong>the</strong> Company.