Notes to the Consolidated Financial Statements - Uni-Asia Finance ...

Notes to the Consolidated Financial Statements - Uni-Asia Finance ...

Notes to the Consolidated Financial Statements - Uni-Asia Finance ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

84<br />

<strong>Uni</strong>-<strong>Asia</strong> <strong>Finance</strong> Corporation Annual Report 2009<br />

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong><br />

Year ended 31 December 2009<br />

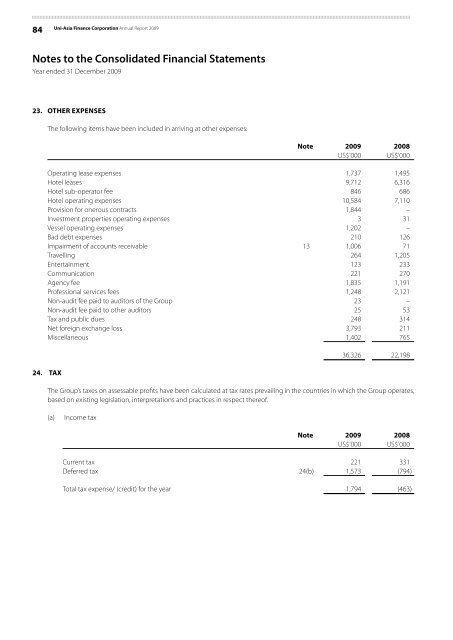

23. OTHER EXPENSES<br />

The following items have been included in arriving at o<strong>the</strong>r expenses:<br />

Note 2009 2008<br />

US$’000 US$’000<br />

Operating lease expenses 1,737 1,495<br />

Hotel leases 9,712 6,316<br />

Hotel sub-opera<strong>to</strong>r fee 846 686<br />

Hotel operating expenses 10,584 7,110<br />

Provision for onerous contracts 1,844 –<br />

Investment properties operating expenses 3 31<br />

Vessel operating expenses 1,202 –<br />

Bad debt expenses 210 126<br />

Impairment of accounts receivable 13 1,006 71<br />

Travelling 264 1,205<br />

Entertainment 123 233<br />

Communication 221 270<br />

Agency fee 1,835 1,191<br />

Professional services fees 1,248 2,121<br />

Non-audit fee paid <strong>to</strong> audi<strong>to</strong>rs of <strong>the</strong> Group 23 –<br />

Non-audit fee paid <strong>to</strong> o<strong>the</strong>r audi<strong>to</strong>rs 25 53<br />

Tax and public dues 248 314<br />

Net foreign exchange loss 3,793 211<br />

Miscellaneous 1,402 765<br />

24. TAX<br />

36,326 22,198<br />

The Group’s taxes on assessable profits have been calculated at tax rates prevailing in <strong>the</strong> countries in which <strong>the</strong> Group operates,<br />

based on existing legislation, interpretations and practices in respect <strong>the</strong>reof.<br />

(a)<br />

Income tax<br />

Note 2009 2008<br />

US$’000 US$’000<br />

Current tax 221 331<br />

Deferred tax 24(b) 1,573 (794)<br />

Total tax expense/ (credit) for <strong>the</strong> year 1,794 (463)