Annual Report 2004/05 - Special Investigating Unit

Annual Report 2004/05 - Special Investigating Unit

Annual Report 2004/05 - Special Investigating Unit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT <strong>2004</strong>/<strong>05</strong><br />

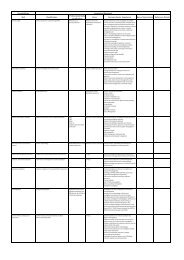

SUMMARY OF ACCOUNTING POLICIES<br />

for the year ended 31 March 20<strong>05</strong><br />

The following are the principal accounting policies of the <strong>Unit</strong> which are<br />

consistent in all material respects with those applied in the previous<br />

year, except as otherwise indicated.<br />

Basis of preparation<br />

The fi nancial statements have been prepared on the historical cost<br />

basis in accordance with South African Statements of Generally<br />

Accepted Accounting Practice.<br />

Moveable property and equipment<br />

Moveable property and equipment are stated at historical cost less<br />

depreciation. Depreciation is calculated on a straight-line method<br />

to write off the cost of each asset over its estimated useful life as<br />

follows:<br />

Cash flows<br />

For purposes of cash flow statement, cash includes cash on hand,<br />

deposits held on call with banks, investments held in money market<br />

instruments and bank overdrafts.<br />

Capital reserve<br />

Reserves equal to the book value of moveable property and equipment<br />

is reflected as capital reserve.<br />

Post-employment benefit costs<br />

The <strong>Unit</strong>’s contributions to the defined contribution provident plan are<br />

charged to the income statement in the year to which they relate.<br />

Financial instruments<br />

Offi ce furniture and equipment<br />

Computer equipment<br />

Books and law reports<br />

Motor vehicles<br />

Computer software<br />

5 years<br />

3 years<br />

5 years<br />

4 years<br />

2 years<br />

Financial instruments carried in the balance sheet include cash and<br />

bank balances, receivables and payables.<br />

Measurement<br />

Financial instruments are initially recognised at trade date and<br />

measured at cost.<br />

Rented assets<br />

All costs relating to rental agreements are charged against income as<br />

incurred.<br />

Revenue<br />

Revenue comprises the annual grant from the Department of Justice<br />

and Constitutional Development, income from other departments in<br />

terms of partnership agreements to carry out specifi c engagements<br />

accounted for on an accrual basis. Incidental grants and donations are<br />

accounted for on a cash basis.<br />

Interest received<br />

Interest received is recognised on a time proportion basis.<br />

Inventory<br />

Consumable stores are valued at average cost.<br />

Subsequent to initial recognition, these instruments are measured as<br />

set out below:<br />

• Trade receivables are stated at their nominal value as reduced by<br />

appropriate allowances for estimated irrecoverable amounts.<br />

• Cash and cash equivalents measured at cost plus interest income<br />

as it accrues.<br />

• Trade and other payables are stated at their nominal value.<br />

Offsetting of financial assets and liabilities<br />

Financial assets and liabilities will not be offset, as there is no such<br />

legally enforceable right, and it will not be settled on a net basis nor<br />

will the asset be realised or the liability settled simultaneously.<br />

Gains and Losses<br />

Gains and losses that arise from a change in the fair value of financial<br />

instruments are included in the income statement in the period in<br />

which they arise.<br />

38