Annual Report 2004/05 - Special Investigating Unit

Annual Report 2004/05 - Special Investigating Unit

Annual Report 2004/05 - Special Investigating Unit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT <strong>2004</strong>/<strong>05</strong><br />

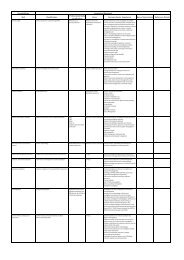

NOTES TO THE<br />

ANNUAL FINANCIAL STATEMENTS<br />

for the year ended 31 March 20<strong>05</strong><br />

<strong>2004</strong>/<strong>05</strong><br />

R<br />

2003/04<br />

R<br />

14. NOTES TO THE CASH FLOW STATEMENT<br />

14.1 Reconciliation of profit/(loss) to cash generated from operations<br />

Operating profi t/(loss) 4 169 546 (1 288 362)<br />

Adjustments for:<br />

Depreciation 1 790 566 1 782 822<br />

Interest received (300 513) (335 825)<br />

Surplus on sale of moveable property and equipment - (53 456)<br />

Operating profi t before working capital changes 5 659 599 1<strong>05</strong> 179<br />

Decrease/(increase) in inventory 4 704 (3 888)<br />

(Increase)/decrease in trade receivables (3 679 284) 1 138 167<br />

(Increase)/decrease in pre-payments (25 024) 46 689<br />

Increase in trade payables 1 451 283 262 970<br />

Increase in revenue received in advance 19 350 000 50 000<br />

17 101 679 1 493 938<br />

Cash generated from operations 22 761 278 1 599 117<br />

14.2 Cash and cash equivalents<br />

Bank balances 20 7<strong>05</strong> 325 497 953<br />

15. FINANCIAL INSTRUMENTS<br />

Risks<br />

Credit Risk<br />

Financial assets that could subject the <strong>Unit</strong> to credit risk consist principally of cash at bank and cash equivalents, deposits and<br />

accounts receivable. The <strong>Unit</strong>’s cash equivalents are placed with high credit quality financial institutions.<br />

Interest Rate Risk<br />

The cash fl ow is not signifi cantly affected by fl uctuations in interest rates. All cash is placed with reputable financial institutions.<br />

Fair Values<br />

The carrying amount of cash and cash equivalents, deposits, accounts receivable and accounts payable approximated their fair values<br />

due to the short-term maturities of those assets and liabilities.<br />

46