City of Greater Bendigo Budget 2015/2016

The Budget for 2015/2016 will help build a better, healthier and more sustainable Greater Bendigo.

The Budget for 2015/2016 will help build a better, healthier and more sustainable Greater Bendigo.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

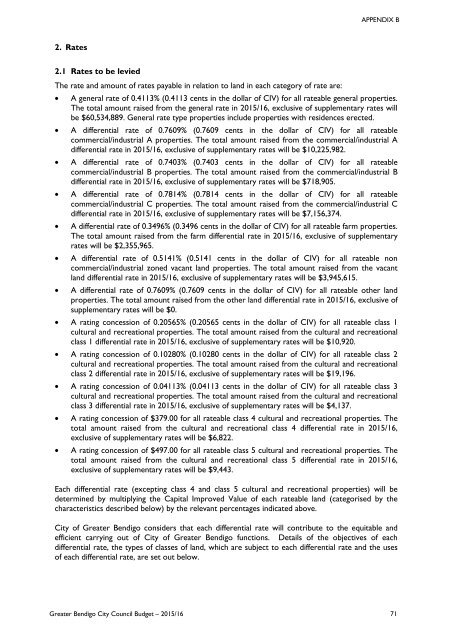

APPENDIX B<br />

2. Rates<br />

2.1 Rates to be levied<br />

The rate and amount <strong>of</strong> rates payable in relation to land in each category <strong>of</strong> rate are:<br />

• A general rate <strong>of</strong> 0.4113% (0.4113 cents in the dollar <strong>of</strong> CIV) for all rateable general properties.<br />

The total amount raised from the general rate in <strong>2015</strong>/16, exclusive <strong>of</strong> supplementary rates will<br />

be $60,534,889. General rate type properties include properties with residences erected.<br />

• A differential rate <strong>of</strong> 0.7609% (0.7609 cents in the dollar <strong>of</strong> CIV) for all rateable<br />

commercial/industrial A properties. The total amount raised from the commercial/industrial A<br />

differential rate in <strong>2015</strong>/16, exclusive <strong>of</strong> supplementary rates will be $10,225,982.<br />

• A differential rate <strong>of</strong> 0.7403% (0.7403 cents in the dollar <strong>of</strong> CIV) for all rateable<br />

commercial/industrial B properties. The total amount raised from the commercial/industrial B<br />

differential rate in <strong>2015</strong>/16, exclusive <strong>of</strong> supplementary rates will be $718,905.<br />

• A differential rate <strong>of</strong> 0.7814% (0.7814 cents in the dollar <strong>of</strong> CIV) for all rateable<br />

commercial/industrial C properties. The total amount raised from the commercial/industrial C<br />

differential rate in <strong>2015</strong>/16, exclusive <strong>of</strong> supplementary rates will be $7,156,374.<br />

• A differential rate <strong>of</strong> 0.3496% (0.3496 cents in the dollar <strong>of</strong> CIV) for all rateable farm properties.<br />

The total amount raised from the farm differential rate in <strong>2015</strong>/16, exclusive <strong>of</strong> supplementary<br />

rates will be $2,355,965.<br />

• A differential rate <strong>of</strong> 0.5141% (0.5141 cents in the dollar <strong>of</strong> CIV) for all rateable non<br />

commercial/industrial zoned vacant land properties. The total amount raised from the vacant<br />

land differential rate in <strong>2015</strong>/16, exclusive <strong>of</strong> supplementary rates will be $3,945,615.<br />

• A differential rate <strong>of</strong> 0.7609% (0.7609 cents in the dollar <strong>of</strong> CIV) for all rateable other land<br />

properties. The total amount raised from the other land differential rate in <strong>2015</strong>/16, exclusive <strong>of</strong><br />

supplementary rates will be $0.<br />

• A rating concession <strong>of</strong> 0.20565% (0.20565 cents in the dollar <strong>of</strong> CIV) for all rateable class 1<br />

cultural and recreational properties. The total amount raised from the cultural and recreational<br />

class 1 differential rate in <strong>2015</strong>/16, exclusive <strong>of</strong> supplementary rates will be $10,920.<br />

• A rating concession <strong>of</strong> 0.10280% (0.10280 cents in the dollar <strong>of</strong> CIV) for all rateable class 2<br />

cultural and recreational properties. The total amount raised from the cultural and recreational<br />

class 2 differential rate in <strong>2015</strong>/16, exclusive <strong>of</strong> supplementary rates will be $19,196.<br />

• A rating concession <strong>of</strong> 0.04113% (0.04113 cents in the dollar <strong>of</strong> CIV) for all rateable class 3<br />

cultural and recreational properties. The total amount raised from the cultural and recreational<br />

class 3 differential rate in <strong>2015</strong>/16, exclusive <strong>of</strong> supplementary rates will be $4,137.<br />

• A rating concession <strong>of</strong> $379.00 for all rateable class 4 cultural and recreational properties. The<br />

total amount raised from the cultural and recreational class 4 differential rate in <strong>2015</strong>/16,<br />

exclusive <strong>of</strong> supplementary rates will be $6,822.<br />

• A rating concession <strong>of</strong> $497.00 for all rateable class 5 cultural and recreational properties. The<br />

total amount raised from the cultural and recreational class 5 differential rate in <strong>2015</strong>/16,<br />

exclusive <strong>of</strong> supplementary rates will be $9,443.<br />

Each differential rate (excepting class 4 and class 5 cultural and recreational properties) will be<br />

determined by multiplying the Capital Improved Value <strong>of</strong> each rateable land (categorised by the<br />

characteristics described below) by the relevant percentages indicated above.<br />

<strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong> considers that each differential rate will contribute to the equitable and<br />

efficient carrying out <strong>of</strong> <strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong> functions. Details <strong>of</strong> the objectives <strong>of</strong> each<br />

differential rate, the types <strong>of</strong> classes <strong>of</strong> land, which are subject to each differential rate and the uses<br />

<strong>of</strong> each differential rate, are set out below.<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2015</strong>/16 71