You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

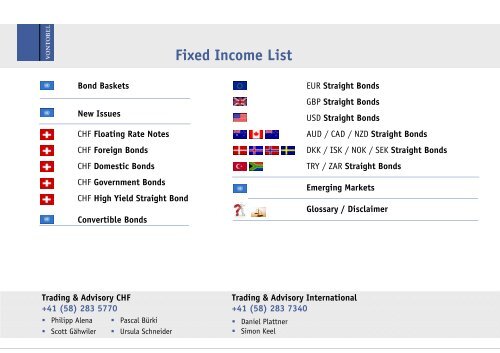

cáñÉÇ fåÅçãÉ=iáëí_çåÇ=_~ëâÉíëkÉï=fëëìÉë`ec=cäç~íáåÖ=o~íÉ=kçíÉë`ec=cçêÉáÖå _çåÇë`ec=açãÉëíáÅ _çåÇë`ec=dçîÉêåãÉåí _çåÇë`ec=eáÖÜ váÉäÇ píê~áÖÜí _çåÇ`çåîÉêíáÄäÉ _çåÇëbro píê~áÖÜí _çåÇëd_m=píê~áÖÜí _çåÇërpa píê~áÖÜí _çåÇë^ra=L=`^a=L=kwa píê~áÖÜí _çåÇëahh=L=fph=L=klh=L=pbh píê~áÖÜí _çåÇëqov=L=w^o=píê~áÖÜí _çåÇëbãÉêÖáåÖ j~êâÉíëdäçëë~êó L=aáëÅä~áãÉêqê~ÇáåÖ=C=^Çîáëçêó `ecHQN=ERUF=OUP=RTTM• mÜáäáéé=^äÉå~• pÅçíí=d®ÜïáäÉê• m~ëÅ~ä=_Ωêâá• rêëìä~=pÅÜåÉáÇÉêqê~ÇáåÖ=C=^Çîáëçêó fåíÉêå~íáçå~äHQN=ERUF=OUP=TPQM• a~åáÉä=mä~ííåÉê• páãçå=hÉÉä

1 Risk Management &Advisory Int.BasketsHOME+41 (58) 283 7340ISIN Coupon Name Maturity Minimum Piece Moody's S&P Price Acc. Int. Dirty Price YTM SWAP Mod DurCHFCH0113287178 0.000 VONCERT/BB DIVERSE CHF 22.06.2015 5'000 106.600 0.000 106.600 - - -CH0113288549 0.000 VONCERT/BB SKANDINAVIAN BONDS 23.01.2015 5'000 102.200 0.000 102.200 - - -CH0120880940 0.000 VONCERT/BB EMERGING CCY 10.04.2014 5'000 84.000 0.000 84.000 - - -CH0141499746 0.000 VONCERT/BB MULTI CURRENCY WITH 26.01.2015 ANNUAL PAYOUT 1'000 96.100 0.000 96.100 - - -CH0141501947 0.000 VONCERT/BB EMERGING MARKETS WITH 26.05.2014 ANNUAL PAYOUT 1'000 82.000 0.000 82.000 - - -CH0141504016 0.000 VONCERT/BB EMERGING MARKETS LOCAL 23.12.2015 CURRENCIES 1'000 92.700 0.000 92.700 - - -CH0141504354 0.000 VONCERT/BB EMERGING MARKETS LOCAL 23.12.2015 CURRENCIES II 1'000 90.300 0.000 90.300 - - -ch0141505286 0.000 VONCERT/BB CORPORATE BONDS 08.02.2017 1'000 101.700 0.000 101.700 - - -CH0141505815 0.000 VONCERT/BB SKANDINAVIAN BONDS II08.09.2017 1'000 96.900 0.000 96.900 - - -EURCH0101891767 0.000 VONCERT/BB WITH ANNUAL PAYOUT 31.01.2014 1'000 98.700 0.000 98.700 - - -CH0108027324 0.000 VONCERT/BB CORPORATE BBB & HIGH 02.06.2014 YIELD1'000 124.900 0.000 124.900 - - -CH0110879910 0.000 VONCERT/BB FLOATERS 24.07.2014 1'000 104.300 0.000 104.300 - - -CH0111816788 0.000 VONCERT/ACTIVE DYNAMIC HY BB OPEN END 1'000 132.600 0.000 132.600 - - -CH0113284142 0.000 VONCERT/BB INFLATION-LINKED 13.04.2016 1'000 111.900 0.000 111.900 - - -CH0113284704 0.000 VONCERT/BB DIVERSE € 30.03.2015 1'000 110.700 0.000 110.700 - - -CH0113286873 0.000 VONCERT/BB DIVERSE € 02.09.2015 1'000 109.400 0.000 109.400 - - -CH0133288986 0.000 VONCERT/BB DIVERSE € 02.03.2016 1'000 112.600 0.000 112.600 - - -CH0125719242 0.000 VONCERT/BB DIVERSE € CORPORATE SINGLE 01.03.2016 A1/A2 1'000 115.800 0.000 115.800 - - -CH0125722600 0.000 VONCERT/BB WITH ANNUAL PAYOUT 15.08.2014 1'000 100.200 0.000 100.200 - - -CH0125723434 0.000 VONCERT/BB COSI-COVERED GOVT BONDS 15.08.2014 DIV. CCY 1'000 95.600 0.000 95.600 - - -CH0125723715 0.000 VONCERT/BB WITH ANNUAL PAYOUT 10.11.2016 1'000 112.700 0.000 112.700 - - -CH0141497930 0.000 VONCERT/BB DIVERSE € 14.03.2016 1'000 115.600 0.000 115.600 - - -CH0141498169 0.000 VONCERT/BB DIVERSE € 13.01.2016 1'000 125.500 0.000 125.500 - - -CH0141498557 0.000 VONCERT/BB TOP YIELD EURO 31.10.2016 1'000 112.300 0.000 112.300 - - -CH0141499779 0.000 VONCERT/BB MULTI CURRENCY WITH 26.01.2015 ANNUAL PAYOUT 1'000 93.600 0.000 93.600 - - -CH0141499654 0.000 VONCERT/BB DIVERSE € 18.04.2018 1'000 105.300 0.000 105.300 - - -CH0141501954 0.000 VONCERT/BB EMERGING MARKETS WITH 26.05.2014 ANNUAL PAYOUT 1'000 79.600 0.000 79.600 - - -CH0141503414 0.000 VONCERT/BB DIVERSE € 20.03.2018 1'000 108.600 0.000 108.600 - - -ch0141504743 0.000 VONCERT/BB EMERGING MARKETS WITH 27.01.2017 ANNUAL PAYOUT 1'000 106.000 0.000 106.000 - - -ch0141505278 0.000 VONCERT/BB DIVERSE € 15.06.2017 1'000 104.300 0.000 104.300 - - -CH0141505245 0.000 VONCERT/ACTIVE DYNAMIC HY BB OPEN END 1'000 102.600 0.000 102.600 - - -ch0141507159 0.000 VONCERT/ BB DIVERSE € 13.03.2017 1'000 101.700 0.000 101.700 - - -USDCH0111816796 0.000 VONCERT/ACTIVE DYNAMIC HY BB OPEN END 1'000 127.800 0.000 127.800 - - -CH0120879561 0.000 VONCERT/EMERGING MARKETS BB 07.01.2016 1'000 116.900 0.000 116.900 - - -CH014150088 0.000 VONCERT/ACTIVE DYNAMIC BB OPEN END 1'000 116.400 0.000 116.400 - - -CH0141504909 0.000 VONCERT/BB ON RENMIMBI BONDS 22.01.2016 1'000 103.800 0.000 103.800 - - -CH0141505872 0.000 VONCERT/BB HIGH YIELD 28.04.2016 1'000 102.700 0.000 102.700 - - -CH0141506243 0.000 VONCERT/BB ON RENMIMBI BONDS 20.05.2016 1'000 101.900 0.000 101.900 - - -CH0141510104 0.000 VONCERT/BB ON RENMIMBI BONDS 17.07.2017 1'000 101.300 0.000 101.300 - - -20.01.2014

ISIN Coupon Name Maturity Minimum Piece Moody's S&P Price Acc. Int. Dirty Price YTM SWAP Mod DurGBPCH0105263211 0.000 VONCERT/BB DIVERSE £ 25.08.2014 1'000 119.100 0.000 119.100CH0113284464 0.000 VONCERT/BB DIVERSE £ 25.06.2014 1'000 111.800 0.000 111.800CH0141501772 0.000 VONCERT/BB DIVERSE £ 18.07.2016 1'000 103.700 0.000 103.700AUDCH0125723178 0.000 VONCERT/BB DIVERSE AUD 2015 26.01.2015 1'000 108.100 0.000 108.100 - - -CH0141498581 0.000 VONCERT/BB DIVERSE AUD 2016 31.10.2016 1'000 113.200 0.000 113.200 - - -CH0141509411 0.000 VONCERT/BB DIVERSE AUD 2017 18.07.2017 1'000 102.100 0.000 102.100 - - -CH0141507282 0.000 VONCERT/BB DIVERSE AUD 2018 13.07.2018 1'000 104.500 0.000 104.500 - - -NZDCH0120979397 0.000 VONCERT/BB DIVERSE NZD 2014 01.08.2014 1'000 114.700 0.000 114.700 - - -CH0141500436 0.000 VONCERT/BB DIVERSE NZD 2017 30.01.2017 1'000 105.900 0.000 105.900 - - -CADCH0107074939 0.000 VONCERT/BB DIVERSE CAD 2014 09.06.2014 1'000 110.100 0.000 110.100 - - -NOKCH0111093800 0.000 VONCERT/BB DIVERSE NOK 2014 29.08.2014 1'000 115.600 0.000 115.600 - - -ZARCH0120879538 0.000 VONCERT/BB DIVERSE ZAR 2014 07.03.2014 1'000 122.000 0.000 122.000 - - -CNYCH0141499076 0.000 VONCERT/BB DIVERSE CNY 2016 07.04.2016 1'000 104.400 0.000 104.400 - - -Termsheets for all Bond Baskets on www.derinet.com20.01.2014

Risk Management &Advisory CHF/Int.New Issues HOME +41 (58) 283 5770+41 (58) 283 7340ISIN Currency Coupon Name Maturity First Settle Date Moody's S&P Price Acc. Int. Dirty Price YTM SWAP Govie Mod DurCHF ForeignCH0229318107 CHF 1.000 BANCO SANTANDER CHILE 31.07.2017 31.01.2014 Aa3 100.100 0.000 100.2500 0.9704 62.4 93.1 3.43CH0232663549 CHF 1.125 ABN AMRO BANK NV 31.01.2019 31.01.2014 A2e 100.250 0.000 100.2500 1.0734 43.3 83.5 4.80CH0233720660 CHF 1.125 BANQUE FED CRED MUTUEL 12.02.2019 12.02.2014 Aa3e 100.100 0.000 100.2500 1.1043 45.0 86.1 4.84CH0233226262 CHF 1.125 ASB FINANCE LTD LONDON 05.02.2020 05.02.2014 Aa3e 100.350 0.000 100.2500 1.0645 20.6 63.9 5.74CH0233731188 CHF 1.125 OEKB OEST. KONTROLLBANK 24.07.2020 21.02.2014 101.750 0.641 100.2500 0.8438 -10.8 32.5 6.22CH0232635869 CHF 1.375 BNZ INTERNATIONAL FNDNG 03.02.2021 03.02.2014 Aa3 AA- 100.350 0.000 100.2500 1.3223 26.2 70.4 6.57CH0233911772 CHF 1.500 COMMONWEALTH BANK AUST 07.02.2022 07.02.2014 Aa2e 100.650 0.000 100.2500 1.4135 17.7 62.6 7.42CH0232842341 CHF 1.500 PROVINCE OF QUEBEC 05.02.2024 05.02.2014 Aa2e A+ 100.000 0.000 100.2500 1.5000 -0.6 47.8 9.12CH0225173332 CHF 2.000 CORP ANDINA DE FOMENTO 05.02.2024 05.02.2014 Aa3e AA- 100.050 0.000 100.2500 1.9944 48.0 97.3 8.84CH0229318123 CHF 2.000 CORP ANDINA DE FOMENTO 05.02.2024 05.02.2014 100.050 0.000 100.2500 1.9944 48.0 97.3 8.84CH0233911988 CHF 1.500 NATIONAL AUSTRALIA BANK 07.02.2024 07.02.2014 Aaae 100.050 0.000 100.2500 1.4946 -1.3 47.2 9.12CH0229318099 CHF 5.125 GAZPROMBK (GPB FINANCE) 13.05.2024 13.02.2014 100.350 0.000 100.2500 5.0773 429.1 402.8 7.60CH0233004172 CHF 1.625 EUROPEAN INVESTMENT BANK 04.02.2025 04.02.2014 Aaae 100.290 0.000 100.2500 1.5960 -0.8 41.9 9.87CHF DomesticCH0229881138 CHF 1.375 PSP SWISS PROPERTY AG 04.02.2020 04.02.2014 100.650 0.000 100.6500 1.2618 40.3 83.7 5.68CH0233341657 CHF 1.125 BANQ CANTONALE FRIBOURG 05.02.2021 05.02.2014 100.400 0.000 100.4000 1.0654 0.8 44.6 6.66CH0232698719 CHF 1.500 ZUERCHER KANTONALBANK 27.01.2023 27.01.2014 101.050 0.000 101.0500 1.3752 0.3 46.0 8.26CH0229881153 CHF 2.250 CITY OF WINTERTHUR 10.02.2039 10.02.2014 100.750 0.000 100.7500 2.2106 18.6 45.9 18.63CH0233680203 CHF 1.500 LGT BANK AG 10.05.2021 10.02.2014 A1e 100.300 0.000 100.3000 1.4558 34.6 78.9 6.80USDUS24422ESH35 USD 1.050 JOHN DEERE CAPITAL CORP 15.12.2016 17.01.2014 A2 A 100.115 0.018 100.1325 1.0093 16.0 104.8 2.83US06675GAE52 USD 1.700 BANQUE FED CRED MUTUEL 20.01.2017 22.01.2014 Aa3 A 99.942 0.005 99.9467 1.7200 81.6 174.6 2.89USF2893TAG16 USD 1.150 ELECTRICITE DE FRANCE 20.01.2017 22.01.2014 Aa3e A+ 99.796 0.003 99.7992 1.2198 32.3 124.5 2.92US78010UNX18 USD 1.200 ROYAL BANK OF CANADA 23.01.2017 23.01.2014 Aa3 AA- 100.181 0.000 100.1810 1.1383 24.0 116.3 2.93US961214CF89 USD 2.250 WESTPAC BANKING CORP 17.01.2019 17.01.2014 Aa2 AA- 99.784 0.038 99.8215 2.2963 55.7 206.3 4.66US89236TBB08 USD 2.100 TOYOTA MOTOR CREDIT CORP 17.01.2019 17.01.2014 Aa3 AA- 100.296 0.035 100.3310 2.0369 30.5 180.4 4.69US06675GAC96 USD 2.750 BANQUE FED CRED MUTUEL 22.01.2019 22.01.2014 Aa3 A 99.928 0.008 99.9356 2.7656 101.4 253.1 4.61USF2893TAJ54 USD 2.150 ELECTRICITE DE FRANCE 22.01.2019 22.01.2014 A+ 99.076 0.006 99.0820 2.3481 59.7 211.3 4.68US50065XAE40 USD 2.750 KOREA NATIONAL OIL CORP 23.01.2019 23.01.2014 A1 A+ 99.928 0.000 99.9280 2.7656 101.3 253.0 4.61XS1020806375 USD 1.750 NETWORK RAIL INFRA FIN 24.01.2019 24.01.2014 Aa1e 99.783 0.000 99.7830 1.7958 5.8 156.0 4.67US500769GA69 USD 1.875 KFW 01.04.2019 23.01.2014 Aaae AAA 99.972 0.000 99.9720 1.8802 8.0 161.8 4.83USF8590LAA47 USD 5.000 SOCIETE GENERALE -SUBORDINATED- 17.01.2024 17.01.2014 Baa3 BBB+ 99.850 0.083 99.9333 5.0192 204.8 400.3 7.70US857524AC63 USD 4.000 REPUBLIC OF POLAND 22.01.2024 22.01.2014 A2e 99.100 0.011 99.1111 4.1116 114.6 309.4 8.09US500630CC01 USD 3.750 KOREA DEVELOPMENT BANK 22.01.2024 22.01.2014 Aa3 98.936 0.010 98.9464 3.8804 91.9 286.3 8.19US06051GFB05 USD 4.125 BANK OF AMERICA CORP 22.01.2024 21.01.2014 Baa2 A- 100.452 0.023 100.4749 4.0690 112.1 305.1 8.07US50065XAF15 USD 4.000 KOREA NATIONAL OIL CORP 23.01.2024 23.01.2014 A1 A+ 100.252 0.000 100.2520 3.9690 102.0 295.1 8.12US05578UAB08 USD 5.150 BPCE -SUBORDINATED- 21.07.2024 21.01.2014 Baa3 BBB+ 99.437 0.029 99.4656 5.2169 217.6 408.5 7.75US06051GFC87 USD 5.000 BANK OF AMERICA CORP 21.01.2044 21.01.2014 Baa2 A- 101.224 0.028 101.2518 4.9210 117.6 282.3 15.46US77586TAE64 USD 6.125 ROMANIA 22.01.2044 22.01.2014 Baa3e 101.250 0.017 101.2670 6.0338 227.8 393.6 13.68USF2893TAK28 USD 4.875 ELECTRICITE DE FRANCE 22.01.2044 22.01.2014 Aa3e A+ 97.560 0.014 97.5735 5.0343 124.7 293.6 15.41US4581X0CE61 USD 4.375 INTER-AMERICAN DEVEL BK 24.01.2044 24.01.2014 Aaae 101.633 0.000 101.6330 4.2774 54.1 217.9 15.96USF2893TAL01 USD 6.000 ELECTRICITE DE FRANCE 22.01.2114 22.01.2014 Aa3e A+ 101.802 0.017 101.8187 5.8934 261.7 -110.0 16.91EURXS1017789089 EUR 1.000 INSTITUT CREDITO OFICIAL 20.09.2015 20.01.2014 Baa3 BBB- 99.920 0.008 99.9282 1.0482 57.7 118.6 1.63XS1016635580 EUR 1.450 SANTAN CONSUMER FINANCE 29.01.2016 29.01.2014 Baa2e BBB- 100.189 0.000 100.1890 1.3536 84.1 147.7 1.95XS1021817355 EUR 2.875 FGA CAPITAL IRELAND 26.01.2018 27.01.2014 Baa3e 100.300 0.000 100.3000 2.7946 186.6 270.2 3.64DE000AAR0173 EUR 1.125 AAREAL BANK -GERMAN COVERED- 21.01.2019 21.01.2014 100.020 0.006 100.0262 1.1209 -0.9 88.6 4.8320.01.2014

ISIN Currency Coupon Name Maturity First Settle Date Moody's S&P Price Acc. Int. Dirty Price YTM SWAP Govie Mod DurES0413056047 EUR 3.125 BANCO MARE NOSTRUM -SPANISH COVERED- 21.01.2019 21.01.2014 101.220 0.017 101.2371 2.8593 171.4 262.5 4.57XS1016720853 EUR 2.375 BBVA SENIOR FINANCE SA 22.01.2019 22.01.2014 Baa3 BBB- 100.370 0.007 100.3765 2.2958 114.8 206.1 4.66XS1015892182 EUR 1.375 CBA -AUSTRALIAN COVERED- 22.01.2019 22.01.2014 Aaae 100.363 0.004 100.3668 1.2995 16.7 106.5 4.80XS1017828911 EUR 1.375 BASF SE 22.01.2019 22.01.2014 A1e 100.129 0.004 100.1328 1.3481 27.3 111.3 4.80EU000A1G0BM9 EUR 1.250 EFSF 22.01.2019 22.01.2014 Aa1e 100.240 0.003 100.2434 1.2002 6.9 96.5 4.82XS1020295348 EUR 1.750 RABOBANK NEDERLAND 22.01.2019 22.01.2014 Aa2e 100.228 0.005 100.2328 1.7020 56.3 146.7 4.75XS1019818787 EUR 2.324 PKO FIN AB (PKO BANK PL) 23.01.2019 23.01.2014 100.700 0.000 100.7000 2.1747 103.1 193.9 4.68XS1015339218 EUR 2.000 ABN AMRO BANK NV 22.07.2019 22.01.2014 A2e 100.236 0.005 100.2415 1.9534 70.2 163.6 5.11DE000A1X3NV9 EUR 1.500 LAND BERLIN 21.01.2021 21.01.2014 Aa1e 99.490 0.008 99.4982 1.5776 2.6 96.6 6.59XS1017763100 EUR 2.625 REPUBLIC OF LATVIA 21.01.2021 21.01.2014 Baa2e BBB+ 100.150 0.014 100.1644 2.6012 103.3 198.9 6.32FR0011703776 EUR 3.125 BUREAU VERITAS SA 21.01.2021 21.01.2014 101.175 0.017 101.1921 2.9367 137.3 232.5 6.21XS1019709069 EUR 2.000 DEXIA CREDIT LOCAL 22.01.2021 22.01.2014 Aa3e 100.301 0.005 100.3065 1.9535 39.7 134.1 6.47XS1018032950 EUR 3.500 INTESA SANPAOLO SPA 17.01.2022 17.01.2014 Baa2 BBB 99.930 0.058 99.9875 3.5101 174.8 273.1 6.86DE000A1X3LT7 EUR 1.875 DT. PFANDBRIEFBANK -GERMAN COVERED- 21.01.2022 21.01.2014 Aa2e AA+ 99.832 0.010 99.8423 1.8978 16.5 111.8 7.36DE000A1R04X6 EUR 2.250 DAIMLER AG 24.01.2022 24.01.2014 A3e 100.080 0.000 100.0800 2.2390 49.9 145.7 7.09XS1019326641 EUR 3.250 SNAM SPA 22.01.2024 22.01.2014 Baa1 BBB+ 100.910 0.009 100.9189 3.1425 110.0 212.5 8.44XS1017833242 EUR 2.500 BASF SE 22.01.2024 22.01.2014 A1e 100.257 0.007 100.2638 2.4707 46.8 145.3 8.75XS1019821732 EUR 3.000 HOLCIM FINANCE LUX SA 22.01.2024 22.01.2014 Baa2 BBB 100.888 0.008 100.8962 2.8964 85.7 187.9 8.54XS1020300288 EUR 3.375 REPUBLIC OF LITHUANIA 22.01.2024 22.01.2014 Baa1e BBB 99.850 0.009 99.8592 3.3929 133.5 237.5 8.36AT000B049465 EUR 2.375 UNICREDIT BK AUSTRIA -AUSTRIAN COVERED- 22.01.2024 22.01.2014 Aa1 99.844 0.007 99.8505 2.3927 35.5 137.5 8.80XS1019493896 EUR 2.375 PROVINCE OF QUEBEC 22.01.2024 22.01.2014 Aa2e A+ 99.993 0.007 99.9995 2.3758 33.9 135.8 8.81FR0011689033 EUR 3.250 VALEO SA 22.01.2024 22.01.2014 Baa3 BBB 101.720 0.009 101.7289 3.0478 101.4 203.0 8.45XS1020769748 EUR 2.375 ABN AMRO BANK -DUTCH COVERED- 23.01.2024 23.01.2014 Aaae 99.941 0.000 99.9410 2.3817 34.4 136.4 8.81IT0004988553 EUR 3.000 UNICREDIT -ITALIAN COVERED- 31.01.2024 24.01.2014 A2e 100.067 0.000 100.0670 2.9921 94.2 197.2 8.30BE0000332412 EUR 2.600 BELGIUM KINGDOM 22.06.2024 21.01.2014 100.735 0.014 100.7492 2.5180 43.4 139.2 8.90FR0011689579 EUR 3.000 BPCE SA 19.07.2024 20.01.2014 A2 A 100.662 0.025 100.6867 2.9246 82.4 179.3 8.77GBPXS1017603751 GBP 1.125 FMS WERTMANAGEMENT 07.12.2016 20.01.2014 Aaa AAA 99.771 0.009 99.7802 1.2063 -10.8 124.8 2.81XS1019727046 GBP 1.875 EXPORT DEVELOPMNT CANADA 17.12.2018 23.01.2014 Aaae 100.021 0.000 100.0210 1.8701 -10.5 164.9 4.63XS1017618783 GBP 2.625 VOLKSWAGEN FIN SERV NV 22.07.2019 22.01.2014 100.370 0.007 100.3773 2.5504 43.8 223.3 5.00FR0011710284 GBP 6.000 ELECTRICITE DE FRANCE 23.01.2114 23.01.2014 Aa3e 106.594 0.000 106.5940 5.6274 293.3 -136.6 17.68AUDXS1020133283 AUD 3.750 MERCEDES-BENZ AUSTRALIA 24.01.2017 24.01.2014 100.051 0.000 100.0510 3.7317 63.5 375.6 2.69AU3CB0218071 AUD 3.750 L-BANK BADEN-WUERTTEMBERG 23.01.2018 23.01.2014 100.308 0.000 100.3080 3.6658 33.1 357.5 3.65XS1017966554 AUD 4.375 BMW FINANCE NV 23.07.2018 23.01.2014 A2e 100.570 0.000 100.5700 4.2276 73.2 406.5 3.93AU3CB0218063 AUD 4.000 KOMMUNALBANKEN AS 23.01.2019 23.01.2014 99.970 0.000 99.9700 4.0067 41.3 377.1 4.45AU3CB0217982 AUD 3.750 INTL BK RECON & DEVELOP 23.01.2019 23.01.2014 Aaae 99.958 0.000 99.9580 3.7594 16.7 352.4 4.48XS1013984981 AUD 4.875 RABOBANK NEDERLAND 20.01.2020 20.01.2014 Aa2e AA- 100.762 0.040 100.8021 4.7258 87.0 430.9 5.10XS1019354007 AUD 5.000 BNP PARIBAS 21.01.2020 21.01.2014 A2 A+ 100.534 0.027 100.5614 4.8949 103.5 447.7 5.08NZDXS1017788784 NZD 4.750 EUROPEAN INVESTMENT BANK 22.01.2019 22.01.2014 99.776 0.013 99.7890 4.8014 21.6 456.7 4.35NZNIBDT008C2 NZD 4.875 NORDIC INVESTMENT BANK 22.01.2019 22.01.2014 Aaa AAA 100.472 0.000 100.4720 4.7666 24.2 453.2 4.35SGDXS1020855588 SGD 4.400 STANDARD CHARTERED -SUBORDINATED-23.01.2026 23.01.2014 A3 A- 100.150 0.000 100.1500 4.3837 213.3 312.7 9.17ZARXS1018702941 ZAR 7.000 KFW 21.01.2019 21.01.2014 Aaae 98.127 0.038 98.1654 7.4626 -23.5 722.8 4.07TRYXS1021937765 TRY 9.000 INTL FINANCE CORP 30.01.2017 30.01.2014 Aaae 99.621 0.000 99.6210 9.1501 -123.9 917.2 2.34CNYXS1013890220 CNY 10.000 TRAD & DEV BANK MONGOLIA 21.01.2017 21.01.2014 B1 99.440 0.055 99.4948 10.2254 679.6 1025.1 2.4820.01.2014

ISIN Currency Coupon Name Maturity First Settle Date Moody's S&P Price Acc. Int. Dirty Price YTM SWAP Govie Mod DurHK0000181773 CNY 11.000 MODERN LAND CHINA CO 22.01.2017 22.01.2014 B2 101.200 0.031 101.2306 10.5121 716.1 1053.7 2.45XS1020462930 CNY 5.500 GREENLAND HONG KONG HOLD 23.01.2018 23.01.2014 100.000 0.000 100.0000 5.5000 214.6 540.9 3.51XS1019326302 CNY 3.500 VOLKSWAGEN INTL FIN NV 23.01.2019 23.01.2014 A3 A- 100.650 0.000 100.6500 3.3566 -24.4 312.1 4.52XS1019722914 CNY 3.625 EXPORT-IMPORT BK KOREA 27.01.2019 27.01.2014 Aa3 100.450 0.000 100.4500 3.5253 -8.2 328.8 4.36BRL (ALL CASHFLOWS IN EUR)XS1020328024 BRL 9.750 KFW 23.05.2017 23.01.2014 98.909 0.000 98.9090 10.1131 1009.4 2.57XS1014703851 BRL 10.500 EUROPEAN INVESTMENT BANK 21.12.2017 21.01.2014 Aaae 100.740 0.058 100.7975 10.2477 1016.8 3.06HIGH YIELDXS1016053537 EUR 4.000 VENETO BANCA SCPA 20.01.2017 20.01.2014 BB 100.489 0.033 100.5219 3.8237 311.7 384.9 2.77XS1017615920 EUR 3.500 BANCA POP DI VICENZA 20.01.2017 20.01.2014 BB 100.279 0.029 100.3078 3.4002 269.5 342.6 2.80XS1017790178 EUR 2.500 BPE FINANCIACIONES SA 01.02.2017 23.01.2014 Ba3 99.770 0.000 99.7700 2.5798 187.4 260.1 2.81XS1019171427 EUR 4.125 BENI STABILI SPA 22.01.2018 22.01.2014 101.550 0.011 101.5613 3.7007 278.5 361.0 3.63PTBENKOM0012 EUR 4.000 BANCO ESPIRITO SANTO SA 21.01.2019 21.01.2014 Ba3 BB- /*- 100.009 0.022 100.0309 3.9979 281.9 376.3 4.45XS1013954646 EUR 2.375 FRESENIUS FINANCE BV 01.02.2019 23.01.2014 Ba1 BB+ 99.850 0.000 99.8500 2.4069 125.2 216.8 4.57FR0011694496 EUR 3.750 WENDEL SA 21.01.2021 21.01.2014 BB+ 100.250 0.021 100.2705 3.7087 212.3 309.7 6.06XS1020952435 EUR 4.500 TELECOM ITALIA SPA 25.01.2021 23.01.2014 Ba1e BB+ 100.755 0.000 100.7550 4.3725 278.3 375.9 5.66XS1013955379 EUR 3.000 FRESENIUS FINANCE BV 01.02.2021 23.01.2014 Ba1 BB+ 100.200 0.000 100.2000 2.9679 139.9 235.0 6.07USN9417JAB72 USD 6.875 VTR FINANCE BV 15.01.2024 24.01.2014 B1 B+ 102.999 0.000 102.9990 6.4572 381.7 544.1 7.11USF22797RT78 USD 7.875 CREDIT AGRICOLE -SUBORDINATED- PerpNC10 23.01.2014 BB+ 102.900 0.000 102.9000 457.3FR0011697010 EUR 4.125 EDF -SUBORDINATED- PerpNC8 22.01.2014 (P)A3 BBB+ 99.875 0.011 99.8863 236.6USF2893TAM83 USD 5.625 EDF -SUBORDINATED- PerpNC10 22.01.2014 (P)A3 BBB+ 99.350 0.016 99.3656 272.7FR0011697028 EUR 5.000 EDF -SUBORDINATED- PerpNC12 22.01.2014 (P)A3 BBB+ 100.900 0.014 100.9137 260.8FR0011700293 GBP 5.875 EDF -SUBORDINATED- PerpNC15 22.01.2014 (P)A3 BBB+ 100.247 0.016 100.2632 267.1EMERGING MARKETSXS1016655265 USD 2.125 BANK OF CHINA/HONG KONG 23.01.2017 23.01.2014 A1 99.521 0.000 99.5210 2.2920 136.9 231.7 2.87XS1017435782 EUR 3.625 BNDES 21.01.2019 21.01.2014 Baa2 BBB 100.310 0.020 100.3299 3.5561 238.9 332.2 4.50XS1019652368 USD 3.500 WHARF FINANCE LTD 23.01.2019 23.01.2014 100.065 0.000 100.0650 3.4856 172.3 325.0 4.52XS0996662853 USD 5.125 CHINA OS GRAND OCEAN FIN 23.01.2019 23.01.2014 Baa2 BBB- 98.527 0.000 98.5270 5.4697 363.4 523.4 4.30US71656MAW91 USD 3.125 PETROLEOS MEXICANOS 23.01.2019 23.01.2014 Baa1 BBB+ 101.100 0.000 101.1000 2.8856 114.4 265.0 4.58XS1016655349 USD 3.125 BANK OF CHINA/HONG KONG 23.01.2019 23.01.2014 A1 98.623 0.000 98.6230 3.4294 164.7 319.4 4.55XS1017606853 USD 10.625 FANTASIA HOLDINGS GROUP 23.01.2019 23.01.2014 B2 B+ 100.250 0.000 100.2500 10.5581 869.4 1032.3 3.73USP1R05SAJ45 USD 8.125 BANCO REGIONAL SAECA 24.01.2019 24.01.2014 Ba2 BB- 103.400 0.000 103.4000 7.2893 559.4 705.4 3.73NO0010700982 USD 7.500 ORO NEGRO DRIL PTE LTD 24.01.2019 24.01.2014 102.500 0.000 102.5000 6.8920 516.2 665.6 3.80USY04342AA28 USD 4.875 BANK OF BARODA 23.07.2019 23.01.2014 Baa3e 99.998 0.000 99.9980 4.8693 292.2 455.2 4.62US91086QBD97 USD 3.500 UNITED MEXICAN STATES 21.01.2021 21.01.2014 Baa1e BBB+ 100.400 0.019 100.4194 3.4346 106.4 282.3 6.11XS1013209017 USD 8.125 SHIMAO PPTY HLDNG LTD 22.01.2021 22.01.2014 Ba3 BB- 100.850 0.023 100.8726 7.9617 580.2 734.9 5.20USP3318GAA69 USD 7.750 HOCHSCHILD MINING 23.01.2021 23.01.2014 Ba1 100.850 0.000 100.8500 7.5890 543.3 697.6 5.26USP06518AF40 USD 5.750 COMMONWEALTH OF BAHAMAS 16.01.2024 16.01.2014 Baa1e 99.900 0.112 100.0118 5.7630 277.9 474.7 7.43US71656MAX74 USD 4.875 PETROLEOS MEXICANOS 18.01.2024 23.01.2014 Baa1e 100.850 0.000 100.8500 4.7659 181.5 374.9 7.77US718286BY27 USD 4.200 REPUBLIC OF PHILIPPINES 21.01.2024 21.01.2014 Baa3 BBB- 102.250 0.023 102.2733 3.9235 99.7 290.6 8.07US10553YAF25 USD 6.450 BRASKEM FINANCE LTD 03.02.2024 03.02.2014 Baa3 BBB- 101.500 0.000 101.5000 6.2438 327.6 522.3 6.83US91086QBE70 USD 5.550 UNITED MEXICAN STATES 21.01.2045 21.01.2014 Baa1e BBB+ 101.800 0.031 101.8308 5.4287 168.1 326.1 14.78US71656MAY57 USD 6.375 PETROLEOS MEXICANOS 23.01.2045 23.01.2014 Baa1 BBB+ 102.250 0.000 102.2500 6.2098 246.7 404.2 13.5520.01.2014

CHF Floating Rate NotesHOMERisk Management &Advisory CHF+41 (58) 283 5770ISIN Size Act. Coupon Name Maturity First Settle Date Moody's S&P Price Acc. Int. Dirty Price Assumed Rate Disc. MarginReset Frequ.Next ResetCH0197841536 500'000 0.467 RAIFFEISEN LB NIEDEROEST 05.12.2014 05.12.2012 A2 100.1 0.064 100.164 45.000 23.5 4.0 05.03.2014CH0149182476 1'000'000 0.819 ANZ NEW ZEALAND INTL/LDN 27.02.2015 27.02.2012 Aaa 100.82 0.130 100.950 80.000 32.4 4.0 27.02.2014CH0183698411 500'000 0.201 ZUERCHER KANTONALBANK 07.05.2015 07.05.2012 NR 100.11 0.043 100.153 18.000 9.7 4.0 07.02.2014CH0199457927 250'000 1.019 AAREAL BANK AG 23.11.2015 23.11.2012 99.31 0.167 99.477 100.000 139.3 4.0 24.02.2014CH0194112113 500'000 1.023 DVB BANK SE 08.01.2016 08.10.2012 NR A+ 100.12 0.043 100.163 100.000 95.0 4.0 08.04.2014CH0212037862 500'000 0.551 QNB FINANCE LTD 13.05.2016 13.05.2013 Aa3 A+ 100.2 0.109 100.309 53.000 45.8 4.0 13.02.2014CH0208991957 500'000 1.021 BANCO SANTANDER CHILE 28.03.2017 28.03.2013 Aa3 100.64 0.068 100.708 100.000 79.9 4.0 28.03.201420.01.2014

CHF Foreign BondsHOMERisk Management &Advisory CHF+41 (58) 283 5770ISIN Size Coupon Name Maturity First Settle Date Moody's S&P Price Acc. Int. Dirty Price YTM SWAP Govie Mod DurCH0115237015 2'000'000 1.750 SWISS RE TREASURY (US) 21.07.2014 21.07.2010 Aa3 AA- 100.870 0.885 101.755 -0.009 -5.4CH0105004078 8'000'000 2.250 NATIONAL AUSTRALIA BANK 02.12.2014 02.12.2009 Aa2 AA- 101.880 0.319 102.199 0.058 -7.4 26.2 0.86CH0042527652 2'000'000 3.750 GROUPE AUCHAN SA 23.06.2015 23.06.2008 A 105.030 2.188 107.218 0.191 8.6 33.5 1.38CH0042799913 1'000'000 3.375 NORGES STATSBANER AS 03.08.2015 30.06.2008 Aa2 AA- 105.100 1.594 106.694 0.035 -7.2 17.6 1.50CH0123326081 2'000'000 3.375 UNION BANK OF INDIA 07.08.2015 07.02.2011 Baa3 BBB- 102.650 1.556 104.206 1.613 154.4 175.4 1.48CH0115822642 1'000'000 1.875 WESTPAC SECURITIES NZ LT 25.08.2015 25.08.2010 Aa3 AA- 102.750 0.771 103.521 0.141 4.0 27.9 1.57CH0187216012 2'000'000 3.250 BANQUE PSA FINANCE 25.09.2015 25.06.2012 Ba1 BB+ 102.700 1.065 103.765 1.597 153.3 173.3 1.62CH0044359070 1'000'000 3.375 ASSIST PUBL HOPIT PARIS 25.09.2015 25.08.2008 AA 105.650 1.106 106.756 -0.004 -11.1 13.2CH0022976853 2'000'000 2.375 ROYAL BK OF SCOTLAND PLC 02.11.2015 02.11.2005 Ba1 BBB- 101.500 0.534 102.034 1.510 142.1 164.2 1.73CH0198380237 2'000'000 2.750 GIC FUNDING LIMITED 16.11.2015 16.11.2012 Baa2 102.600 0.512 103.112 1.289 120.4 142.0 1.76CH0141533403 2'000'000 5.000 VTB BANK (VTB CAPITAL SA 17.11.2015 17.11.2011 Baa2 BBB 105.850 0.917 106.767 1.699 166.4 182.9 1.74CH0120169799 2'000'000 3.000 CBQ FINANCE LTD 07.12.2015 07.12.2010 A1 A- 104.050 0.383 104.433 0.811 71.7 93.9 1.83CH0124757904 2'000'000 3.000 ADCB FINANCE CAYMAN LTD 08.12.2015 08.03.2011 A1u A 104.100 0.375 104.475 0.788 69.3 91.6 1.83CH0108870020 2'000'000 2.625 GENERAL ELEC CAP CORP 20.01.2016 20.01.2010 A1 104.650 0.022 104.672 0.280 15.9 40.5 1.96CH0123133297 2'000'000 3.000 FIRST GULF BANK 16.02.2016 16.02.2011 104.650 2.808 107.458 0.722 60.7 84.3 1.97CH0126639381 2'000'000 2.500 BARCLAYS BANK PLC 29.03.2016 29.03.2011 A2 A 104.850 2.042 106.892 0.269 12.7 38.4 2.11CH0117367430 1'000'000 3.625 GLENCORE FINANCE EUROPE 06.04.2016 06.10.2010 Baa2 BBB 105.850 2.890 108.740 0.928 81.4 104.1 2.08CH0112134751 2'000'000 2.250 NORDEA BANK AB 06.05.2016 06.05.2010 Aa3 104.600 1.606 106.206 0.230 7.5 33.5 2.22CH0049495598 2'000'000 2.750 BK NEDERLANDSE GEMEENTEN 11.05.2016 11.02.2009 Aaa AA+ 105.950 1.925 107.875 0.156 -0.3 26.0 2.22CH0101589361 2'000'000 3.000 RABOBANK NEDERLAND 10.06.2016 10.06.2009 Aa2 AA- 106.500 1.858 108.358 0.257 9.4 35.3 2.29CH0185349351 2'000'000 2.250 LEASEPLAN CORPORATION NV 18.07.2016 18.07.2012 Baa2 BBB+ 103.450 1.156 104.606 0.841 67.6 92.7 2.40CH0115149418 2'000'000 2.500 SPI AUSTRALIA ASSETS PTY 09.08.2016 09.08.2010 Baa1 BBB+ 104.250 1.139 105.389 0.805 63.5 88.5 2.45CH0026734449 2'000'000 2.875 TOYOTA MOTOR CREDIT CORP 20.09.2016 20.09.2006 Aa3 AA- 106.900 0.982 107.882 0.266 6.8 33.6 2.57CH0194215650 2'000'000 2.500 BLACK SEA TRADE AND DEVE 04.10.2016 04.10.2012 A3 /*+ A- 103.150 0.757 103.907 1.303 111.9 136.9 2.59CH0102162952 1'500'000 2.875 EKSPORTFINANS ASA 16.11.2016 16.06.2009 Ba3 BB+ 102.150 0.535 102.685 2.079 188.2 212.9 2.68CH0197841544 2'000'000 5.250 FIAT FINANCE & TRADE 23.11.2016 23.11.2012 B1 /*- BB- 105.850 0.875 106.725 3.059 294.9 310.7 2.61CH0187696114 2'000'000 2.000 LG ELECTRONICS INC 02.12.2016 02.07.2012 Baa2 BBB- 103.000 0.283 103.283 0.931 71.4 97.5 2.78CH0136594360 2'000'000 1.000 PHILIP MORRIS INTL INC 06.12.2016 06.12.2011 A2 A 102.000 0.131 102.131 0.299 6.7 34.2 2.83CH0143421169 2'000'000 2.125 KOREA LAND & HOUSING COR 12.12.2016 12.12.2011 A1 103.650 0.242 103.892 0.839 61.9 88.0 2.80CH0028944681 2'000'000 2.875 GENERAL ELEC CAP CORP 27.02.2017 27.02.2007 A1 AA+ 107.600 2.603 110.203 0.399 14.1 41.0 2.93CH0149710771 2'000'000 1.875 KOREA NATIONAL OIL CORP 08.03.2017 08.03.2012 A1 A+ 103.150 1.641 104.791 0.849 59.1 85.6 2.99CH0186130446 2'000'000 1.750 SK TELECOM CO LTD 12.06.2017 12.06.2012 A3 A- 102.850 1.074 103.924 0.891 58.7 86.2 3.26CH0190369048 2'000'000 3.000 MACQUARIE BANK LTD 09.08.2017 09.08.2012 A2 A 107.150 1.367 108.517 0.939 62.7 89.3 3.35CH0111174576 2'000'000 2.250 ELECTRICITE DE FRANCE 29.09.2017 29.03.2010 A+ 106.600 0.713 107.313 0.439 7.8 37.9 3.54CH0118596888 2'000'000 1.500 BK NEDERLANDSE GEMEENTEN 03.11.2017 03.11.2010 Aaa AA+ 104.400 0.333 104.733 0.326 -5.9 25.5 3.68CH0181379774 2'000'000 2.125 SLOVAK REPUBLIC 25.04.2018 25.04.2012 A2 A 105.700 1.582 107.282 0.758 29.3 62.5 4.03CH0226747746 2'000'000 2.900 VTB BANK (VTB CAPITAL SA 25.05.2018 25.11.2013 Baa2 BBB 101.300 0.467 101.767 2.577 209.7 243.2 3.97CH0101768064 3'500'000 2.750 SOC NATL CHEMINS FER FRA 11.06.2018 11.06.2009 Aa2 AA- 109.900 1.696 111.596 0.463 -3.5 31.1 4.12CH0025739316 1'000'000 3.125 TOTAL CAPITAL SA 28.06.2018 28.06.2006 Aa1 AA- 111.200 1.780 112.980 0.558 5.7 40.0 4.13CH0223523298 2'000'000 1.375 KOREA FINANCE CORP 02.07.2018 02.10.2013 Aa3 A+ 101.450 0.424 101.874 1.039 52.5 87.9 4.26CH0207960649 2'000'000 0.875 NORDEA BANK AB 25.09.2018 25.03.2013 Aa3 AA- 101.150 0.287 101.437 0.624 5.9 43.0 4.56CH0222418268 2'000'000 2.500 BRE FINANCE FRANCE SA 08.10.2018 08.10.2013 BBB+ 101.800 0.729 102.529 2.093 153.6 189.4 4.38CH0112086951 2'000'000 2.125 BK NEDERLANDSE GEMEENTEN 06.11.2018 06.05.2010 Aaa AA+ 107.250 0.455 107.705 0.584 0.2 37.3 4.56CH0200404173 1'000'000 1.500 GOLDMAN SACHS GROUP INC 29.11.2018 29.11.2012 Baa1 A- 101.750 0.225 101.975 1.127 52.9 90.7 4.65CH0185843023 2'000'000 2.625 GLENCORE FINANCE EUROPE 03.12.2018 03.07.2012 Baa2 BBB 105.350 0.365 105.715 1.476 90.2 125.4 4.55CH0215076313 2'000'000 1.625 KOREA WESTERN POWER CO 26.03.2019 26.09.2013 A1 A+ 101.550 0.528 102.078 1.313 64.5 104.6 4.88CH0103078231 5'000'000 3.000 RESEAU FERRE DE FRANCE 24.04.2019 24.07.2009 Aa1 AA 111.400 2.242 113.642 0.776 10.7 49.7 4.82CH0030644030 2'000'000 3.250 REPUBLIC OF POLAND 15.05.2019 15.05.2007 A2 A- 110.800 2.239 113.039 1.142 48.2 85.4 4.83CH0027333241 5'000'000 2.625 REGIE AUTONOME DES TRANS 06.11.2019 06.11.2006 Aa1 109.450 0.561 110.011 0.939 15.5 55.7 5.38CH0225173290 2'000'000 1.500 KOREA RAILROAD CORP 02.12.2019 02.12.2013 A1 A 100.450 0.213 100.663 1.419 59.6 102.3 5.56CH0222359421 2'000'000 1.250 SVENSKA HANDELSBANKEN AB 20.12.2019 25.09.2013 Aa3 AA- 102.150 0.115 102.265 0.875 4.4 46.9 5.68CH0123575091 2'000'000 2.125 NORGES STATSBANER AS 14.02.2020 14.02.2011 Aa2 AA- 108.300 2.001 110.301 0.720 -13.8 28.4 5.62CH0204477241 2'000'000 2.250 BORAL LIMITED 20.02.2020 20.02.2013 Baa3 BBB 100.650 2.081 102.731 2.134 126.6 169.5 5.51CH0107134717 5'000'000 2.250 KFW 12.08.2020 12.02.2010 Aaa AAA 109.650 1.006 110.656 0.736 -22.6 20.3 6.0920.01.2014

ISIN Size Coupon Name Maturity First Settle Date Moody's S&P Price Acc. Int. Dirty Price YTM SWAP Govie Mod DurCH0195529380 2'000'000 2.375 LEASEPLAN CORPORATION NV 15.10.2020 15.10.2012 Baa2 BBB+ 104.850 0.647 105.497 1.608 63.0 104.1 6.17CH0222418300 2'000'000 2.595 TELEFONICA EMISIONES SAU 23.10.2020 23.10.2013 Baa2 BBB 104.150 0.649 104.799 1.933 95.3 136.1 6.13CH0013843443 1'000'000 2.875 RESEAU FERRE DE FRANCE 26.02.2021 26.02.2009 Aa1 AA 111.700 2.611 114.311 1.147 10.5 50.9 6.33CH0136594386 2'000'000 2.000 PHILIP MORRIS INTL INC 06.12.2021 06.12.2011 A2 A 104.300 0.261 104.561 1.418 22.3 65.0 7.25CH0028608195 2'000'000 2.625 NEDER WATERSCHAPSBANK 07.02.2022 07.02.2007 Aaa AA+ 110.950 2.523 113.473 1.189 -2.5 39.3 7.14CH0207550010 1'000'000 1.125 BK NEDERLANDSE GEMEENTEN 19.04.2023 19.03.2013 Aaa AA+ 97.800 0.950 98.750 1.380 -4.0 43.1 8.63CH0127860192 1'500'000 2.375 CAISSE D'AMORT DETTE SOC 19.04.2023 19.04.2011 Aa1 NR 107.100 1.808 108.908 1.544 15.4 59.5 8.17CH0214333731 2'000'000 1.875 ADCB FINANCE CAYMAN LTD 13.06.2023 13.06.2013 NR A- 92.400 1.146 93.546 2.806 128.6 184.1 8.32CH0212937251 2'000'000 1.375 DEUTSCHE BAHN FINANCE BV 24.07.2023 24.07.2013 Aa1 AA 100.050 0.684 100.734 1.369 -7.8 39.2 8.79CH0233004172 1'000'000 1.625 EUROPEAN INVESTMENT BANK 04.02.2025 04.02.2014 Aaae 100.254 0.000 100.254 1.600 -1.4 41.0 9.8720.01.2014

CHF Domestic BondsHOMERisk Management &Advisory CHF+41 (58) 283 5770ISIN Size Coupon Name Maturity First Settle Date Moody's S&P Price Acc. Int. Dirty Price YTM SWAP Govie Mod DurCH0020370901 1'500'000 2.500 CANTON OF BASLE-STADT 28.01.2015 28.01.2005 102.470 2.465 104.935 0.062 -9.0 25.0 0.99CH0034804762 5'000'000 3.250 PFANDBRIEF SCHW KANTBK 02.11.2015 02.11.2007 Aaa 105.510 0.731 106.241 0.140 3.5 27.3 1.74CH0142132015 5'000'000 4.875 ACTELION LTD 07.12.2015 07.12.2011 105.600 0.623 106.223 1.804 176.3 193.3 1.79CH0112193518 1'500'000 3.125 IMPLENIA AG 12.05.2016 12.05.2010 106.600 2.179 108.779 0.247 9.5 35.0 2.21CH0114150888 500'000 2.000 COOP-GRUPPE 30.06.2016 30.06.2010 103.700 1.128 104.828 0.468 30.3 55.8 2.37CH0135120407 500'000 0.875 CANTON OF BASLE-STADT 08.09.2016 08.09.2011 AA+ 102.200 0.328 102.528 0.036 -16.4 10.8 2.60CH0139264961 750'000 1.250 ABB LTD 11.10.2016 11.10.2011 A2 A 102.250 0.354 102.604 0.415 20.8 47.8 2.67CH0126183034 500'000 1.750 ZUERCHER KANTONALBANK 29.03.2017 29.03.2011 104.750 1.429 106.179 0.250 -3.0 25.3 3.08CH0019847968 2'500'000 2.750 CANTON OF ZURICH 24.11.2017 24.11.2004 AAA 109.700 0.451 110.151 0.209 -19.1 13.5 3.68CH0128705214 1'500'000 2.375 RAIFFEISEN SCHWEIZ 10.05.2018 10.05.2011 Aa3 107.250 1.669 108.919 0.658 18.7 52.3 4.05CH0104493058 3'000'000 2.375 CITY OF ZURICH 10.09.2018 10.09.2009 108.300 0.877 109.177 0.554 1.0 37.1 4.39CH0221386136 500'000 1.500 GEORG FISCHER FINANZ AG 12.09.2018 12.09.2013 103.000 0.546 103.546 0.837 29.1 65.3 4.46CH0143218441 2'500'000 3.125 LONZA SWISS FINANCE AG 07.12.2018 07.12.2011 109.450 0.399 109.849 1.121 55.7 90.3 4.54CH0017410314 1'000'000 3.250 EUROFIMA 28.12.2018 30.12.2003 Aaa AA+ 112.800 0.226 113.026 0.607 0.6 38.1 4.62CH0122512145 5'000'000 2.125 RAIFFEISEN SCHWEIZ 04.02.2019 04.02.2011 Aa3 106.200 2.060 108.260 0.860 23.8 62.0 4.70CH0209472064 1'000'000 1.125 HELVETIA HOLDING AG 08.04.2019 08.04.2013 101.450 0.891 102.341 0.839 16.5 57.4 5.00CH0212184060 1'000'000 1.125 SWISS LIFE HOLDING AG 21.06.2019 21.06.2013 BBB 99.800 0.663 100.463 1.163 44.0 86.3 5.19CH0188098740 2'500'000 1.500 ZURICH INSURANCE CO 25.06.2019 25.06.2012 A1 A+ 103.350 0.867 104.217 0.865 14.9 56.2 5.16CH0023438010 2'500'000 2.500 PFANDBRIEF SCHWEIZ HYPO 13.12.2019 15.12.2005 Aaa 109.940 0.278 110.218 0.767 -4.2 37.1 5.51CH0110814065 2'500'000 2.500 BANQUE CANTONALE VAUDOIS 25.03.2020 25.03.2010 NR 109.850 2.069 111.919 0.855 -1.1 40.1 5.66CH0189276055 2'500'000 2.625 ADECCO SA 18.12.2020 18.07.2012 BBB 107.900 0.255 108.155 1.415 41.9 81.9 6.32CH0018712346 2'500'000 3.375 EUROFIMA 29.12.2020 29.06.2004 Aaa AA+ 115.600 0.225 115.825 1.032 2.9 43.0 6.27CH0210240302 2'500'000 0.875 PFANDBRIEF SCHW KANTBK 16.04.2021 16.04.2013 Aaa 98.770 0.673 99.443 1.052 -4.3 39.4 6.92CH0130036566 2'500'000 3.000 SGS SA 27.05.2021 27.05.2011 112.300 1.967 114.267 1.237 16.1 56.0 6.55CH0192241252 4'500'000 1.000 PFANDBRIEF SCHWEIZ HYPO 13.08.2021 15.08.2012 Aaa 98.910 0.444 99.354 1.151 -0.3 43.9 7.20CH0136940282 2'750'000 2.250 ALPIQ HOLDING AG 20.09.2021 20.09.2011 99.600 0.769 100.369 2.307 113.1 157.8 6.91CH0028968201 2'500'000 2.875 PFANDBRIEF SCHWEIZ HYPO 14.02.2022 14.02.2007 Aaa 112.710 2.707 115.417 1.210 0.4 41.7 7.10CH0184183322 750'000 3.000 ALPIQ HOLDING AG 16.05.2022 16.05.2012 103.150 2.058 105.208 2.573 132.5 174.0 7.17CH0228531452 1'500'000 2.000 HOLCIM LTD 09.06.2022 09.12.2013 Baa2 BBB 99.950 0.244 100.194 2.006 71.7 116.3 7.55CH0127181177 5'000'000 1.250 SWITZERLAND 11.06.2024 11.06.2012 101.270 0.771 102.041 1.120 -42.0 -0.6 9.63CH0188335365 2'500'000 1.750 SWISSCOM AG 10.07.2024 10.07.2012 A2 A 100.250 0.938 101.188 1.723 17.3 59.1 9.40CH0222261494 1'500'000 1.750 THURGAUER KANTONALBANK 30.09.2024 30.09.2013 101.500 0.549 102.049 1.596 2.7 44.5 9.64CH0200044805 5'000'000 1.875 KRAFTWERKE OBERHASLI 21.02.2025 21.02.2013 100.000 1.729 101.729 1.875 26.3 69.2 9.75CH0184250063 15'000'000 1.500 SWITZERLAND 24.07.2025 22.01.2014 102.820 0.746 103.566 1.235 -41.0 1.7 10.46CH0025185676 1'500'000 3.000 EUROFIMA 15.05.2026 15.05.2006 Aaa AA+ 113.050 2.067 115.117 1.808 13.6 52.3 10.23CH0143302005 500'000 1.625 BANQUE CANTONALE VAUDOIS 30.11.2026 30.11.2011 97.000 0.239 97.239 1.890 12.5 56.0 11.44CH0128891105 1'500'000 2.750 PFANDBRIEF SCHWEIZ HYPO 15.12.2026 29.04.2011 Aaa 111.510 0.290 111.800 1.745 1.9 41.2 10.93CH0143808340 2'500'000 1.250 CANTON OF BERN 30.03.2027 30.03.2012 94.600 1.017 95.617 1.711 -7.7 35.4 11.87CH0142132031 2'500'000 1.500 CANTON OF GENEVA 27.01.2028 27.01.2012 AA- 94.000 1.483 95.483 1.995 14.7 58.4 12.25CH0149317056 1'500'000 1.500 CANTON OF GENEVA 05.03.2032 05.03.2012 AA- 90.550 1.325 91.875 2.134 14.4 55.5 15.31CH0184636915 1'500'000 1.600 AARGAUISCHE KANTONALBANK 18.05.2037 18.05.2012 91.350 1.089 92.439 2.071 1.0 44.2 18.82CH0199347680 1'000'000 1.500 ZUGER KANTONALBANK 20.11.2037 20.11.2012 89.100 0.263 89.363 2.085 2.0 41.8 19.48CH0217850699 1'500'000 2.000 CANTON OF ZURICH 29.07.2038 29.07.2013 AAA 101.250 0.967 102.217 1.935 -10.2 22.0 19.10CH0214925882 1'500'000 1.750 CANTON OF BASLE-LAND 26.06.2043 26.06.2013 AA+ 94.950 1.006 95.956 1.978 -2.9 27.4 22.37CH0208271541 5'000'000 3.000 KRAFTWERKE LINTH LIMMERN 02.04.2048 02.04.2013 100.500 2.425 102.925 2.976 38.0 99.6 20.7420.01.2014

ISIN Size Coupon Name Maturity First Settle Date Moody's S&P Price Acc. Int. Dirty Price YTM SWAP Govie Mod DurCH0194958960 5'000'000 3.000 KRAFTWERKE LINTH LIMMERN 27.09.2052 27.09.2012 101.000 0.967 101.967 2.956 42.6 107.0 22.5920.01.2014

Swiss Government BondsHOMERisk Management &Advisory CHF+41 (58) 283 5770ISIN Coupon Name Maturity First Settle Date Moody's S&P Mid Price Acc. Int. Dirty Price YTM SWAP Govie Mod DurCH0023139816 2.000 SWITZERLAND 09.11.2014 09.11.2005 Aaau NR 101.760 0.411 102.171 -0.211 -34.1 - N/ACH0012385586 3.750 SWITZERLAND 10.06.2015 11.06.2001 Aaau NR 105.410 2.323 107.733 -0.161 -28.4 - N/ACH0015633453 2.500 SWITZERLAND 12.03.2016 12.03.2003 Aaau NR 105.605 2.160 107.765 -0.119 -27.2 - N/ACH0022859612 2.000 SWITZERLAND 12.10.2016 12.10.2005 Aaau NR 105.620 0.561 106.181 -0.064 -28.5 - N/ACH0006448424 4.250 SWITZERLAND 05.06.2017 05.06.1997 Aaa NR 114.210 2.692 116.902 0.027 -30.3 - 3.15CH0015221663 3.000 SWITZERLAND 08.01.2018 08.01.2003 Aaau NR 111.495 0.125 111.620 0.090 -34.6 - 3.79CH0018454253 3.000 SWITZERLAND 12.05.2019 12.05.2004 Aaau NR 114.260 2.092 116.352 0.286 -42.9 - 4.90CH0021908907 2.250 SWITZERLAND 06.07.2020 06.07.2005 Aaau NR 111.000 1.231 112.231 0.512 -44.1 - 6.01CH0111999816 2.000 SWITZERLAND 28.04.2021 28.04.2010 Aaau NR 109.390 1.472 110.862 0.671 -43.5 - 6.72CH0127181011 2.000 SWITZERLAND 25.05.2022 25.05.2011 Aaa NR 109.285 1.322 110.607 0.842 -44.2 - 7.64CH0008435569 4.000 SWITZERLAND 11.02.2023 11.02.1998 Aaau NR 126.530 3.800 130.330 0.930 -45.6 - 7.63CH0127181177 1.250 SWITZERLAND 11.06.2024 11.06.2012 Aaa NR 101.115 0.771 101.886 1.135 -41.2 - 9.62CH0184249990 1.500 SWITZERLAND 24.07.2025 24.07.2013 Aaa NR 102.690 0.746 103.436 1.247 -40.6 - 10.46CH0031835561 3.250 SWITZERLAND 27.06.2027 27.06.2007 Aaau NR 122.715 1.860 124.575 1.384 -40.4 - 11.04CH0008680370 4.000 SWITZERLAND 08.04.2028 08.04.1998 Aaau NR 132.840 3.167 136.007 1.429 -40.3 - 11.15CH0127181029 2.250 SWITZERLAND 22.06.2031 22.06.2011 Aaa NR 110.590 1.319 111.909 1.551 -41.5 - 14.37CH0015803239 3.500 SWITZERLAND 08.04.2033 08.04.2003 Aaa NR 131.265 2.771 134.036 1.597 -40.9 - 14.47CH0024524966 2.500 SWITZERLAND 08.03.2036 08.03.2006 Aaau NR 116.075 2.188 118.263 1.629 -41.0 - 17.06CH0127181193 1.250 SWITZERLAND 27.06.2037 27.06.2012 Aaa NR 92.420 0.715 93.135 1.642 -39.5 - 19.82CH0127181169 1.500 SWITZERLAND 30.04.2042 30.04.2012 Aaa NR 96.785 1.096 97.881 1.643 -32.9 - 22.52CH0009755197 4.000 SWITZERLAND 06.01.2049 06.01.1999 Aaau NR 159.860 0.189 160.049 1.710 -33.0 - 22.3220.01.2014

High Yield Straight Bonds CHFHOMERisk Management &Advisory CHF+41 (58) 283 5770ISIN Coupon Name Maturity First Settle Date Moody's S&P Price Acc. Int. Dirty Price YTM SWAP +/- Change MdurCH0180006097 9.375 ROYAL BK OF SCOTLAND PLC 16.03.2022 16.03.2012 BBB- 118.475 7.995 126.470 6.390 575.2 -0.5 5.49CH0224486578 5.500 AFRICAN BANK LIMITED 11.10.2017 11.10.2013 Baa3 104.700 1.558 106.258 4.104 385.1 -11.7 3.29CH0024764257 2.625 MBIA GLOBAL FUNDING LLC 11.04.2016 11.04.2006 WR B 97.250 2.056 99.306 3.941 372.0 -26.8 2.06CH0184987789 5.000 MEYER BURGER TECHNOLOGY 24.05.2017 24.05.2012 103.525 3.319 106.844 3.847 363.0 -7.8 2.95CH0204819301 4.750 EFG FUNDING GUERNSEY LTD 31.01.2023 31.01.2013 100.375 4.658 105.033 4.698 331.1 -3.4 6.89CH0211816381 4.750 GUTBURG IMM SA LX 08.07.2018 08.07.2013 104.125 2.573 106.698 3.723 329.0 9.4 3.89CH0190227691 4.750 AFRICAN BANK LIMITED 24.07.2015 24.07.2012 Baa3 102.200 2.362 104.562 3.214 317.6 -19.7 1.41CH0197841544 5.250 FIAT FINANCE & TRADE 23.11.2016 23.11.2012 B1 /*- BB- 105.725 0.875 106.600 3.104 299.6 -3.8 2.61CH0028603618 2.750 MBIA GLOBAL FUNDING LLC 07.02.2017 07.02.2007 B 98.500 2.643 101.143 3.276 298.4 2.4 2.79CH0110623722 2.125 TOKYO ELECTRIC POWER CO 24.03.2017 24.03.2010 Ba2 BB+ 96.600 1.765 98.365 3.270 292.5 0.5 2.95CH0199541308 4.000 AFRICAN BANK LIMITED 09.11.2016 09.11.2012 Baa3 102.550 0.822 103.372 3.031 286.4 -43.3 2.60CH0207961084 4.125 BAUWERK PARKETT AG 21.05.2018 21.05.2013 104.000 2.773 106.773 3.119 269.6 6.5 3.84CH0148606178 5.000 FIAT FINANCE & TRADE 07.09.2015 07.03.2012 B1 /*- BB- 103.875 1.889 105.764 2.523 250.7 -20.9 1.54CH0210009897 4.000 VALIANT BANK 24.04.2023 24.04.2013 100.875 2.989 103.864 3.884 247.8 -0.1 7.41CH0202406440 2.750 ICICI BANK LTD/DUBAI 07.01.2020 07.01.2013 Baa2 BBB- 97.450 0.122 97.572 3.227 233.7 12.2 5.39CH0123360254 2.250 EKSPORTFINANS ASA 11.02.2021 11.02.2011 NR BB+ 92.175 2.138 94.313 3.522 231.8 -9.0 6.21CH0212937210 4.000 RAIFFEISEN BANK INTL 24.05.2023 24.05.2013 Baa3 BBB 102.250 2.656 104.906 3.708 231.4 -10.4 7.51CH0196770439 4.375 AUTONEUM HOLDING AG 14.12.2017 14.12.2012 106.425 0.474 106.899 2.616 230.2 -1.3 3.56CH0197841551 4.000 EDP FINANCE BV 29.11.2018 29.11.2012 Ba1 BB+ /*- 105.350 0.578 105.928 2.803 227.8 -7.2 4.37CH0140684512 7.250 HEIDELBERGCEMENT FIN LUX 14.11.2017 14.11.2011 (P)Ba2 NR 117.375 1.390 118.765 2.416 226.6 0.4 3.37CH0106322123 2.500 EKSPORTFINANS ASA 29.04.2019 29.10.2009 Ba3 BB+ 97.600 1.833 99.433 2.998 226.4 -22.4 4.76CH0110411532 2.750 GENERALITAT DE CATALUNYA 24.03.2016 24.03.2010 Ba3 BB 100.750 2.284 103.034 2.389 226.4 -43.8 2.04CH0039613317 4.000 HUNGARY 20.05.2016 20.05.2008 Ba1 BB 103.675 2.700 106.375 2.353 225.6 -5.2 2.16CH0196238601 4.000 VON ROLL AG 24.10.2016 24.10.2012 104.525 0.989 105.514 2.282 213.7 -0.2 2.58CH0195512519 4.250 UNICRED BANK IRELAND PLC 19.10.2022 19.10.2012 Baa2 106.425 1.110 107.535 3.387 213.2 -8.4 7.21CH0182096997 3.125 IDBI BANK LTD/DIFC DUBAI 12.10.2015 12.04.2012 Baa3 BB+ 101.650 0.877 102.527 2.134 205.7 -10.7 1.65CH0205170555 3.000 NIBC BANK NV 19.12.2016 19.02.2013 Baa3u 102.150 0.283 102.433 2.227 201.9 -1.1 2.76CH0102162952 2.875 EKSPORTFINANS ASA 16.11.2016 16.06.2009 Ba3 BB+ 101.875 0.535 102.410 2.179 198.3 -19.8 2.67CH0193724280 3.150 VTB BANK (VTB CAPITAL SA 16.12.2016 26.09.2012 Baa2 102.800 0.324 103.124 2.142 194.3 -8.1 2.75CH0214926096 3.500 AEVIS HOLDING SA 02.07.2018 02.07.2013 104.650 1.954 106.604 2.382 192.3 -14.9 4.03CH0187896698 4.250 AEVIS HOLDING SA 03.08.2016 03.08.2012 105.450 2.007 107.457 2.013 190.3 -27.5 2.36CH0039050205 3.125 EKSPORTFINANS ASA 29.04.2016 29.04.2008 Ba3 BB+ 102.475 2.292 104.767 1.995 187.8 -19.3 2.14CH0105004060 2.125 GENERALITAT DE CATALUNYA 01.10.2014 01.10.2009 Ba3 BB 100.100 0.661 100.761 1.965 186.8 0.6 0.68CH0027030854 3.125 BAYERISCHE LANDESBANK 12.10.2016 12.10.2006 Ba2 NR 102.850 0.877 103.727 2.035 186.4 -1.7 2.58CH0127699434 3.500 EXPORT-IMPORT BK INDIA 13.04.2016 13.04.2011 Baa3 BBB- 103.400 2.722 106.122 1.920 181.9 1.1 2.08CH0142132015 4.875 ACTELION LTD 07.12.2015 07.12.2011 105.550 0.623 106.173 1.830 178.8 38.7 1.79CH0026116084 3.250 DEPFA ACS BANK 31.07.2031 31.07.2006 A3 BBB 92.675 1.562 94.237 3.830 176.5 -6.2 12.75CH0130864389 4.000 ZUEBLIN IMMOBILIEN HOLDI 20.07.2015 20.07.2011 103.175 2.033 105.208 1.817 175.7 84.9 1.43CH0123326081 3.375 UNION BANK OF INDIA 07.08.2015 07.02.2011 Baa3 BBB- 102.325 1.556 103.881 1.824 175.2 3.2 1.48CH0123431709 3.750 VNESHECONOMBANK(VEB) 17.02.2016 17.02.2011 NR BBB 103.850 3.500 107.350 1.833 174.9 -15.0 1.93CH0148606145 3.500 RURAL ELECTRIFICATION 07.03.2017 07.03.2012 Baa3 104.675 3.072 107.747 1.941 172.7 -20.2 2.87CH0141533403 5.000 VTB BANK (VTB CAPITAL SA 17.11.2015 17.11.2011 Baa2 BBB 105.775 0.917 106.692 1.739 170.5 -6.8 1.74CH0024021302 2.375 DEPFA ACS BANK 15.02.2019 15.02.2006 A3 BBB 100.100 2.230 102.330 2.353 170.3 0.2 4.62CH0031408112 3.250 INSTITUT CREDITO OFICIAL 28.06.2024 28.06.2007 Baa3 BBB- 100.275 1.851 102.126 3.217 166.3 -20.7 8.58CH0026463577 3.125 HYPO PFANDBRIEFBK INTL 31.08.2020 31.08.2006 A- 103.275 1.241 104.516 2.578 163.4 -3.0 5.8620.01.2014

CH0190653870 3.125 OJSC RUSS AGRIC BK(RSHB) 17.08.2015 17.08.2012 Baa3 102.175 1.354 103.529 1.702 162.6 8.0 1.51CH0187216012 3.250 BANQUE PSA FINANCE 25.09.2015 25.06.2012 Ba1 BB+ 102.550 1.065 103.615 1.687 162.0 -17.7 1.61CH0198415074 4.000 ENEL FINANCE INTL NV 26.10.2027 26.10.2012 Baa2 BBB 106.975 0.967 107.942 3.358 161.8 -7.6 10.51CH0199729366 4.125 ZUR ROSE AG 07.12.2017 07.12.2012 107.575 0.527 108.102 2.068 175.0 -2.8 3.58CH0024683192 2.750 CITIGROUP INC 06.04.2021 06.04.2006 Baa3 BBB+ 100.425 2.192 102.617 2.683 159.2 5.4 6.32CH0222418268 2.500 BRE FINANCE FRANCE SA 08.10.2018 08.10.2013 BBB+ 101.650 0.729 102.379 2.127 157.1 -10.1 4.38CH0197482711 3.375 UNICRED BANK IRELAND PLC 25.10.2017 25.10.2012 Baa2 105.550 0.825 106.375 1.831 150.6 -18.3 3.51CH0022738105 2.125 DEPFA ACS BANK 13.10.2017 13.10.2005 A3 BBB 100.900 0.590 101.490 1.871 150.6 -3.2 3.53CH0222900539 3.500 CIE FINANCIERE TRADITION 26.09.2016 26.09.2013 104.800 1.138 105.938 1.649 149.9 -6.0 2.54CH0102294805 5.000 BOBST GROUP SA 22.06.2015 22.06.2009 104.810 2.931 107.741 1.529 147.9 7.8 1.35CH0188931916 3.375 GAZPROMBK (GPB FINANCE) 05.08.2015 30.07.2012 Baa3 BBB- 102.750 1.575 104.325 1.542 146.9 1.2 1.48CH0022976853 2.375 ROYAL BK OF SCOTLAND PLC 02.11.2015 02.11.2005 Ba1 BBB- 101.425 0.534 101.959 1.553 146.2 2.4 1.73CH0022333980 2.500 HYPOTHEKENBANK FRA LUX 29.08.2025 30.08.2005 NR 93.700 1.000 94.700 3.156 141.5 -8.8 9.75CH0031026625 3.375 BANK OF AMERICA CORP 14.06.2022 14.06.2007 Baa3 BBB+ 105.675 2.053 107.728 2.612 137.5 4.9 7.15CH0186162639 4.250 OC OERLIKON CORP AG 13.07.2016 13.07.2012 106.700 2.243 108.943 1.467 135.5 3.5 2.32CH0188295312 3.500 CLARIANT AG 26.09.2022 26.09.2012 Ba1 BBB- 106.725 1.138 107.863 2.622 135.4 -0.5 7.40CH0210371198 2.750 TEMENOS GROUP AG 25.07.2017 25.04.2013 103.750 1.360 105.110 1.639 133.9 -1.4 3.30CH0226274261 2.850 GAZPROM (GAZ CAPITAL SA) 25.10.2019 25.10.2013 Baa1 BBB 104.050 0.697 104.747 2.095 133.2 10.0 5.25CH0124470995 3.375 STATE BANK OF INDIA 22.02.2016 22.02.2011 Baa3 BBB- 104.025 3.103 107.128 1.398 130.2 -11.4 1.96CH0181721629 3.250 CLARIANT AG 24.04.2019 24.04.2012 Ba1 BBB- 106.550 2.428 108.978 1.926 129.4 -0.3 4.73CH0043057295 3.500 COMUNIDAD DE MADRID 15.07.2015 15.07.2008 BBB- 103.100 1.828 104.928 1.363 128.8 -30.9 1.43CH0020393150 2.750 HYPOTHEKENBANK FRA LUX 07.02.2020 07.02.2005 NR 103.650 2.643 106.293 2.100 127.0 -4.0 5.40CH0181943983 3.250 BANCO SANTANDER BRAZ CI 12.04.2016 12.04.2012 Baa2 BBB 104.100 2.537 106.637 1.360 125.2 -26.0 2.10CH0037972392 4.875 CREDIT SUISSE NEW YORK 14.03.2018 14.03.2008 Baa2 BBB 113.025 4.184 117.209 1.599 125.0 0.5 3.67CH0103165020 3.000 ALPIQ HOLDING AG 25.11.2019 25.11.2009 105.425 0.483 105.908 2.005 123.4 -8.8 5.33CH0046229917 3.875 ALPIQ HOLDING AG 30.10.2018 30.10.2008 109.725 0.893 110.618 1.732 122.7 -4.6 4.35CH0198380237 2.750 GIC FUNDING LIMITED 16.11.2015 16.11.2012 Baa2 102.575 0.512 103.087 1.303 121.7 -10.5 1.76CH0148606160 3.100 SBERBANK (SB CAP SA) 14.09.2015 14.03.2012 Baa1 103.050 1.111 104.161 1.210 113.6 1.2 1.59CH0027810370 2.750 BAYERISCHE LANDESBANK 12.12.2014 12.12.2006 Ba2 NR 101.315 0.313 101.628 1.246 112.6 -7.9 0.88CH0112260358 3.375 AFG ARBONIA-FORSTER-HOLD 12.05.2016 12.05.2010 104.825 2.353 107.178 1.235 111.9 -2.5 2.18CH0149039023 2.500 VALORA HOLDING AG 02.03.2018 02.03.2012 103.825 2.229 106.054 1.532 111.2 2.0 3.82CH0105335498 2.250 INSTITUT CREDITO OFICIAL 07.11.2017 07.10.2009 Baa3 BBB- 102.875 0.475 103.350 1.464 109.8 -19.0 3.61CH0023970400 2.500 ITALY GOV'T INT BOND 30.01.2018 30.01.2006 NR 104.125 2.451 106.576 1.436 103.4 -23.2 3.73CH0122488452 3.000 KUDELSKI SA 16.12.2016 16.06.2011 105.050 0.308 105.358 1.215 101.5 -3.4 2.78CH0131858877 3.538 PKO FIN AB (PKO BANK PL) 07.07.2016 07.07.2011 A2 105.800 1.926 107.726 1.128 99.5 -3.3 2.33CH0102499461 3.000 COMUNIDAD DE MADRID 29.07.2014 29.06.2009 101.010 1.450 102.460 1.020 94.4 -28.5 0.51CH0022850033 2.000 INSTITUT CREDITO OFICIAL 15.12.2016 25.10.2005 Baa3 BBB- 102.450 0.211 102.661 1.134 91.5 -6.3 2.80CH0130720599 4.000 NOBEL BIOCARE HOLDING AG 10.10.2016 10.10.2011 107.800 1.144 108.944 1.067 90.9 -1.1 2.58CH0148560995 3.000 IBERDROLA INTL BV 13.02.2017 13.02.2012 Baa1 BBB 105.675 2.833 108.508 1.101 87.5 -4.7 2.86CH0039234361 3.000 INSTITUT CREDITO OFICIAL 06.05.2015 06.05.2008 Baa3 BBB- 102.710 2.142 104.852 0.870 77.4 -0.7 1.25CH0119190228 3.500 SBERBANK (SB CAP SA) 12.11.2014 12.11.2010 Baa1 102.155 0.690 102.845 0.793 68.8 -11.0 0.80CH0020386485 2.500 ITALY GOV'T INT BOND 02.03.2015 02.02.2005 NR 101.940 2.229 104.169 0.735 61.0 -2.2 1.0820.01.2014

Convertible BondsHOMERisk Management &Advisory CHF+41 (58) 283 5770ISIN Nominal Currency Coupon Name Maturity Price Mid YTM Premium Parity Underlying Conv. Ratio DeltaCHFCH0025148179 5'000 CHF 2.000 GRAUBUNDNER KANTONALBANK08.05.2014 101.455 -2.875 -1.737 103.248 GRKP 4.1666 68.0282CH0031826305 5'000 CHF 1.750 PARGESA NETHERLANDS NV 15.06.2014 100.450 0.600 155.733 39.279 PARG 26.6662 0.0004CH0112991333 5'000 CHF 2.125 MOBIMO HOLDING AG 30.06.2014 100.865 0.139 11.294 90.629 MOBN 24.0396 2.7206CH0105537671 5'000 CHF 2.125 ALLREAL HOLDING AG 09.10.2014 101.340 0.236 11.417 90.956 ALLN 36.7945 2.6593CH0108774156 5'000 CHF 1.875 SWISS PRIME SITE AG 20.01.2015 104.550 -2.594 5.247 99.338 SPSN 70.4523 30.9505CH0129314214 5'000 CHF 3.000 HOCHDORF HOLDING AG 30.05.2016 103.875 1.315 23.376 84.194 HOCN 40.3226 18.7753CH0131196237 5'000 CHF 1.875 SWISS PRIME SITE AG 21.06.2016 102.875 0.668 20.955 85.052 SPSN 60.3209 9.2482CH0107130822 5'000 CHF 1.500 BALOISE HOLDING AG 17.11.2016 109.575 -1.784 18.635 92.364 BALN 41.2337 25.7539CH0205276790 5'000 CHF 0.375 SCHINDLER HOLDING SA 05.06.2017 103.375 -0.614 26.059 82.005 ALSN 83.0013 45.2829CH0227342232 5'000 CHF 0.000 SWISS LIFE HOLDING AG 02.12.2020 108.775 -1.219 34.029 81.158 SLHN 20.4943 34.5686EURDE000A1AG4K7 50'000 EUR 7.500 INFINEON TECH HOLDINGS 26.05.2014 339.070 -203.810 -2.174 346.605 IFX 22500.9503 100.0000DE000A1AGZ06 100'000 EUR 5.750 Q-CELLS INTERNATIONAL FI 26.05.2014 31.000 670.638 35367.645 0.087 QCE 5141.3882 0.0000DE000A1AHTR5 50'000 EUR 6.000 KLOECKNER & CO FINL SERV 09.06.2014 101.387 2.351 48.403 68.319 KCO 3036.3890 2.4153DE000A1AN5K5 50'000 EUR 3.750 CELESIO FINANCE BV 29.10.2014 111.630 -11.247 10.354 101.156 CLS1 2223.2103 40.6735XS0479535022 50'000 EUR 2.500 AB INDUSTRIVARDEN 27.02.2015 129.520 -20.048 -0.007 129.528 INDUC 4590.0889 84.9584XS0827817221 100'000 EUR 0.250 BNP PARIBAS 21.09.2015 107.766 -4.120 9.436 98.473 PARG 1657.7123 32.3507BE6242865424 100'000 EUR 0.125 GRP BRUXELLES LAMBERT SA 21.09.2015 125.037 -12.264 2.924 121.485 SEV 8733.6245 71.6415BE6000386639 50'000 EUR 4.500 UCB SA 22.10.2015 131.876 -11.364 -1.014 133.227 UCB 1290.4558 100.0000DE000A1HCC83 100'000 EUR 5.500 VOLKSWAGEN INTL FIN NV 09.11.2015 123.085 -6.288 9.728 112.173 VOW3 552.5778 88.7365XS0550864192 50'000 EUR 2.875 WERELDHAVE NV 18.11.2015 102.408 1.407 45.732 70.271 WHA 616.5228 2.8833XS0632138961 100'000 EUR 4.000 AABAR INVESTMENTS PJSC 27.05.2016 120.729 -4.284 14.522 105.420 DAI 1602.6129 52.1758DE000A0Z2BL6 50'000 EUR 3.500 SGL CARBON SE 30.06.2016 113.611 -2.238 11.912 101.518 SGL 1724.1591 68.4997DE000A1AM3Y2 50'000 EUR 1.125 SALZGITTER FINANCE BV 06.10.2016 99.970 1.219 158.625 38.654 SZG 598.8289 4.6624XS0882243453 100'000 EUR 1.250 GBL VERWALTUNG SA 07.02.2017 109.636 -1.771 15.333 95.060 GSZ 5458.5153 28.3803XS0579438663 50'000 EUR 1.875 AB INDUSTRIVARDEN 27.02.2017 108.698 -0.898 38.863 78.277 INDUC 2776.6517 14.8340XS0849477178 100'000 EUR 5.000 NOKIA OYJ 26.10.2017 237.081 -18.488 5.839 224.001 NOK1V 38290.7030 94.4833DE000A1AYDS2 50'000 EUR 2.000 SALZGITTER FINANCE BV 08.11.2017 115.775 -1.971 17.775 98.301 NDA 1078.2218 41.8019DE000A1ML4A7 100'000 EUR 2.750 SGL CARBON SE 25.01.2018 104.194 1.750 53.725 67.779 SGL 2297.9824 49.8377XS0933556952 100'000 EUR 1.750 INTL CONSOLIDATED AIRLIN 31.05.2018 139.080 -5.936 14.082 121.912 IAG 23527.7500 77.4936BE6258355120 100'000 EUR 0.375 SAGERPAR 09.10.2018 103.015 0.804 30.916 78.688 GBLB 1167.1335 8.5312DE000A1ML0D9 200'000 EUR 0.250 ADIDAS AG 14.06.2019 127.560 -4.219 17.128 108.907 ADS 2406.7817 56.3306DE000A1R0VM5 100'000 EUR 0.600 DEUTSCHE POST AG 06.12.2019 134.890 -4.447 4.926 128.557 DPW 4821.1823 70.4440USDUS039483AW22 1'000 USD 0.875 ARCHER DANIELS 15.02.2014 100.925 -16.747 4.413 96.660 ADM 23.5698 31.1275XS0299687482 100'000 USD 2.750 SHIRE PLC 09.05.2014 134.200 -84.147 -12.034 152.559 SHP 30.7598 100.0000US03938LAK08 1'000 USD 5.000 ARCELORMITTAL 15.05.2014 101.425 4.953 65.002 61.469 MT 35.3880 1.1206US651639AH91 1'000 USD 1.250 NEWMONT MINING CORP 15.07.2014 100.075 3.140 78.121 56.184 NEM 22.8854 2.0586XS0475310396 100'000 USD 5.000 GLENCORE FINANCE EUROPE 31.12.2014 114.750 -9.664 9.636 104.665 GLEN 18735.8467 59.7593XS0563898062 100'000 USD 2.625 LUKOIL INTL FINANCE BV 16.06.2015 106.600 -2.008 25.585 84.883 LKOD 1441.1299 15.5481CH0105325853 100'000 USD 4.000 PETROPLUS FINANCE LTD 16.10.2015 14.000 165.009 270.230 3.781 PPHN 3441.4859 0.0000XS0434722087 100'000 USD 5.500 VEDANTA RESOURCES JERSEY 13.07.2016 101.345 4.915 130.856 43.900 VED 2873.5632 13.8202US651639AJ57 1'000 USD 1.625 NEWMONT MINING CORP 15.07.2017 106.775 -0.928 90.046 56.184 NEM 22.8854 27.6930US458140AD22 1'000 USD 2.950 INTEL CORP 15.12.2035 113.875 2.280 27.310 89.447 INTC 34.6022 62.0428£XS0435502769 50'000 GBP 4.250 SAINSBURY (J) PLC 16.07.2014 104.600 -5.082 15.588 90.494 SBRY 12345.6790 11.3849XS0827594762 100'000 GBP 1.500 BRITISH LAND CO(JERSEY) 10.09.2017 114.050 -2.196 19.855 95.156 BLND 14428.5570 25.723820.01.2014

125 Risk Management &Advisory Int.Straight Bonds EURHOME+41 (58) 283 7340ISIN Coupon Name Maturity Minimum Piece Moody's S&P Price Acc. Int. Dirty Price YTM/Worst SWAP Mod DurDE0001137370 0.250 GERMANY 14.03.2014 0.01 Aaau 100.025 0.216 100.241 0.073 -33.8 0.14DE0001141588 1.750 GERMANY 09.10.2015 0.01 Aaau NR 102.750 0.508 103.258 0.140 -33.1 1.69DE0001141612 1.250 GERMANY 14.10.2016 0.01 Aaau 102.708 0.346 103.054 0.251 -37.1 2.68DE0001141620 0.750 GERMANY 24.02.2017 0.01 Aaau 101.332 0.684 102.016 0.316 -35.9 3.03DE0001135473 1.750 GERMANY 04.07.2022 0.01 Aaau 101.757 0.973 102.730 1.526 -27.1 7.74FR0120634490 0.750 FRANCE (GOVT OF) 25.09.2014 1 Aa1u 100.389 0.247 100.636 0.170 -24.5 0.67FR0120473253 1.750 FRANCE (GOVT OF) 25.02.2017 1 Aa1u 103.765 1.592 105.357 0.518 -15.8 2.97FR0011196856 3.000 FRANCE (GOVT OF) 25.04.2022 1 Aa1u 108.260 2.244 110.504 1.908 16.1 7.19FR0011461037 3.250 FRANCE (GOVT OF) 25.05.2045 1 Aa1u 98.610 2.164 100.774 3.321 63.4 18.97NL0010055703 0.750 NETHERLANDS GOVERNMENT 15.04.2015 1 Aaau 100.697 0.582 101.279 0.181 -24.2 1.22NL0009819671 2.500 NETHERLANDS GOVERNMENT 15.01.2017 1 105.991 0.055 106.046 0.469 -18.9 2.89NL0010514246 1.250 NETHERLANDS GOVERNMENT 15.01.2019 1 NR 101.122 0.027 101.149 1.018 -10.5 4.81NL0010060257 2.250 NETHERLANDS GOVERNMENT 15.07.2022 1 103.156 1.184 104.340 1.844 4.5 7.60NL0010071189 2.500 NETHERLANDS GOVERNMENT 15.01.2033 1 Aaau 96.970 0.055 97.025 2.706 9.3 14.86AT0000A0CL73 3.400 REPUBLIC OF AUSTRIA 20.10.2014 1000 Aaa AA+ 102.438 0.885 103.323 0.109 -28.5 0.74AT0000A011T9 4.000 REPUBLIC OF AUSTRIA 15.09.2016 1000 Aaa AA+ 109.559 1.425 110.984 0.361 -25.6 2.53AT0000A0VRF9 1.950 REPUBLIC OF AUSTRIA 18.06.2019 1000 Aaa AA+ 104.288 1.170 105.458 1.127 -8.2 5.07AT0000A001X2 3.500 REPUBLIC OF AUSTRIA 15.09.2021 1000 Aaa AA+ 112.879 1.247 114.126 1.689 5.8 6.71AT0000A0VRQ6 3.150 REPUBLIC OF AUSTRIA 20.06.2044 1000 Aaa AA+ 105.890 1.873 107.763 2.857 20.9 19.42IE0006857530 4.600 IRELAND 18.04.2016 0.01 Baa3 BBB+ 108.755 3.529 112.284 0.643 11.8 2.10IE00B60Z6194 5.000 IRELAND 18.10.2020 0.01 Baa3 BBB+ 115.960 1.329 117.289 2.404 101.0 5.75IE00B4TV0D44 5.400 IRELAND 13.03.2025 0.01 Baa3 BBB+ 117.780 4.675 122.455 3.449 145.0 8.26FI0001006462 3.125 FINLAND 15.09.2014 1000 Aaa AAA 101.931 1.113 103.044 0.125 -29.2 0.64FI4000029715 1.875 FINLAND 15.04.2017 1000 Aaa AAA 104.359 1.454 105.813 0.510 -20.7 3.11FI4000068663 1.125 FINLAND 15.09.2018 1000 Aaa AAA 100.981 0.435 101.416 0.908 -13.7 4.49FI0001006306 4.375 FINLAND 04.07.2019 1000 Aaa AAA 117.202 2.433 119.635 1.103 -10.8 4.86FI4000010848 3.375 FINLAND 15.04.2020 1000 Aaa AAA 112.223 2.617 114.840 1.317 -5.9 5.55fi4000047089 1.625 FINLAND 15.09.2022 1000 Aaa AAA 98.238 0.579 98.817 1.847 0.6 7.94XS0747754892 0.625 KINGDOM OF SWEDEN 20.02.2015 50000 Aaa AAA 100.539 0.577 101.116 0.123 -25.7 1.07XS0757376610 2.250 LUXEMBOURG GOVERNMENT 21.03.2022 1000 Aaa AAA 103.460 1.899 105.359 1.790 5.1 7.29ES00000122F2 3.000 SPAIN 30.04.2015 1000 Baa3 BBB- 102.780 2.203 104.983 0.789 37.8 1.23ES00000123B9 5.500 SPAIN 30.04.2021 1000 Baa3 BBB- 115.687 4.038 119.725 3.058 161.6 5.89ES00000123X3 4.400 SPAIN 31.10.2023 1000 Baa3 BBB- 106.092 1.013 107.105 3.646 170.3 7.84ES00000122E5 4.650 SPAIN 30.07.2025 1000 Baa3 BBB- 107.682 2.255 109.937 3.811 168.1 8.76XS0410961014 5.875 REPUBLIC OF POLAND 03.02.2014 1000 A2 A- 100.200 5.698 105.898 -1.251 2.8ES0302761012 4.500 FUND ORDERED BANK RESTR. (GUAR. 03.02.2014 SPAIN)100000 Baa3 BBB- 100.410 4.364 104.774 -9.791 18.5FR0010693309 6.375 DANONE 04.02.2014 50000 A3 A- 100.205 6.165 106.370 -0.314 54.0FR0010720045 7.500 ACCOR SA 04.02.2014 50000 BBB- 100.234 7.253 107.487 -0.147 94.0DE000CB899M6 5.000 COMMERZBANK AG 06.02.2014 1000 Baa1 A- 100.195 4.808 105.003 -0.381 -428.9DE000A0XXM38 3.125 KFW 25.02.2014 1000 Aaa AAA 100.270 2.842 103.112 0.085 -29.3 0.09XS0414313691 3.500 TOTAL CAPITAL SA 27.02.2014 1000 Aa1 AA- 100.324 3.164 103.488 0.067 -16.4 0.09XS0416768686 3.500 SNS BANK (GAR. NETHERLAND) 10.03.2014 50000 Aaa AA+ 100.461 3.059 103.520 -0.030 -24.8XS0416482106 5.125 TELIASONERA AB 13.03.2014 50000 A3 A- 100.675 4.437 105.112 0.252 -1.8 0.14XS0417728325 3.125 KINGDOM OF DENMARK 17.03.2014 50000 Aaa AAA 100.443 2.671 103.114 0.167 -29.4 0.15XS0417825444 5.750 KONINKLIJKE DSM NV 17.03.2014 50000 A3 A 100.799 4.915 105.714 0.401 -6.3 0.15DE000NWB0444 3.375 NRW.BANK (LOCAL GOVT. GUAR.) 18.03.2014 1000 Aa1 AA- 100.491 2.876 103.367 0.156 -32.4 0.1520.01.2014

ISIN Coupon Name Maturity Minimum Piece Moody's S&P Price Acc. Int. Dirty Price YTM/Worst SWAP Mod DurXS0418268198 4.625 HENKEL AG & CO KGAA 19.03.2014 1000 A2 A 100.658 3.928 104.586 0.378 -14.1 0.15XS0418730601 4.625 FORTUM OYJ 20.03.2014 50000 A2 A- 100.666 3.915 104.581 0.400 -0.7 0.16DE000EH1A3F3 3.750 HYPOTHEKENBANK FRANKFURT 24.03.2014 1000 Aa3 NR 100.595 3.134 103.729 0.230 -7.4 0.17XS0419185789 6.750 DEUTSCHE LUFTHANSA AG 24.03.2014 1000 Ba1 BBB- 101.009 5.640 106.649 0.746 7.9 0.17XS0418783477 4.875 SVENSKA HANDELSBANKEN AB 25.03.2014 50000 Aa3 AA- 100.779 4.060 104.839 0.336 -8.3 0.17XS0418799630 4.500 SCHLUMBERGER FINANCE BV 25.03.2014 50000 A1 AA- 100.702 3.748 104.450 0.406 0.7 0.17XS0419605406 9.000 HOLCIM FINANCE LUX SA 26.03.2014 50000 Baa2 BBB 101.445 7.471 108.916 0.682 11.5 0.17XS0419352199 6.500 REPSOL INTL FINANCE 27.03.2014 50000 Baa3 BBB- 101.021 5.378 106.399 0.712 20.7 0.18XS0589735561 4.375 ICO (GUAR. KINGDOM OF SPAIN) 31.03.2014 1000 Baa3 BBB- 100.725 3.572 104.297 0.460 25.0 0.19XS0420248568 4.000 SKANDINAVISKA ENSKILDA 31.03.2014 50000 Aaa 100.705 3.266 103.971 0.204 -18.1 0.19XS0421410621 6.125 JPMORGAN CHASE & CO 01.04.2014 50000 A3 A 101.082 4.984 106.066 0.374 10.6 0.19SI0002102935 4.375 REPUBLIKA SLOVENIJA 02.04.2014 1000 Ba1 A- 101.850 3.548 105.398 -5.007 25.8 #NUM!FR0010744987 8.625 KERING 03.04.2014 1000 BBB 101.576 6.971 108.547 0.479 18.6 0.19XS0421464719 7.125 HEINEKEN NV 07.04.2014 1000 101.382 5.680 107.062 0.375 -37.4 0.20XS0422624980 6.250 OMV AG 07.04.2014 1000 A3 101.178 4.983 106.161 0.489 -4.5 0.20FR0010745984 4.875 SUEZ ENVIRONNEMENT 08.04.2014 50000 A3 100.945 3.873 104.818 0.323 -1.5 0.21XS0423036663 7.750 LANXESS FINANCE BV 09.04.2014 1000 Baa2 BBB 101.503 6.136 107.639 0.586 11.5 0.21XS0423639953 7.750 BACARDI LTD 09.04.2014 50000 WR NR 101.633 6.136 107.769 0.014 359.9 0.21XS0500128755 2.500 SAP AG 10.04.2014 1000 100.451 1.973 102.424 0.382 5.5 0.21XS0614919701 3.125 VOLKSWAGEN BANK GMBH 11.04.2014 1000 A3 A- 100.591 2.457 103.048 0.386 -6.7 0.22DE000A1H36U5 2.125 KFW 11.04.2014 1000 Aaa AAA 100.437 1.671 102.108 0.106 -30.0 0.22FR0010750497 5.250 VEOLIA ENVIRONNEMENT 24.04.2014 1000 Baa1 BBB 101.237 3.941 105.178 0.339 -6.2 0.25XS0424686573 8.625 MICHELIN LUXEMBOURG SCS 24.04.2014 1000 Baa1 BBB+ 102.057 6.475 108.532 0.449 -9.8 0.25XS0425722922 7.625 ADECCO INT FINANCIAL SVS 28.04.2014 50000 Baa3 BBB 101.832 5.640 107.472 0.635 36.6 0.26FR0010754663 4.375 LVMH MOET-HENNESSY 12.05.2014 50000 A+ 101.199 3.068 104.267 0.398 -5.0 0.30XS0428956287 5.625 UBS AG LONDON 19.05.2014 1000 A2 A 101.686 3.837 105.523 0.372 -13.8 0.32XS0429265159 7.000 SWISS RE TREASURY (US) 19.05.2014 50000 Aa3 AA- 102.139 4.775 106.914 0.338 -1.9 0.32XS0430698455 6.000 CARLSBERG BREWERIES A/S 28.05.2014 50000 Baa2 101.900 3.945 105.845 0.499 9.3 0.35DE000DXA1NP5 2.750 DEXIA KOMMUNALBANK (PUBLIC COVERED 30.05.2014 BOND) 1000 A+ 100.837 1.793 102.630 0.368 61.8 0.35XS0431772572 4.375 DEUTSCHE TELEKOM INT FIN 02.06.2014 1000 Baa1 BBB+ 101.400 2.817 104.217 0.449 2.1 0.36XS0633342604 2.750 CATERPILLAR INTL FIN LTD 06.06.2014 100000 A2 A 100.892 1.740 102.632 0.327 5.2 0.37DE000A0Z12Y2 9.250 THYSSENKRUPP AG 18.06.2014 1000 Ba1 BB 103.394 5.550 108.944 0.756 99.6 0.40XS0862695110 3.250 SANTAN CONSUMER FINANCE 20.06.2014 100000 Baa2 BBB- 101.030 1.932 102.962 0.707 47.2 0.41XS0435153068 9.375 REPUBLIC OF LITHUANIA 22.06.2014 1000 Baa1 BBB 103.684 5.522 109.206 0.434 17.4 0.41AT0000A0DRQ4 4.250 KIG (GUAR. STEIERMARK) 25.06.2014 500 AA+ 101.670 2.468 104.138 0.283 -9.8 0.42XS0436662828 4.000 SYNGENTA FINANCE NV 30.06.2014 50000 A2 A+ 101.534 2.268 103.802 0.465 4.7 0.43DE000BLB6c74 1.875 BAYERISCHE LANDESBANK 30.06.2014 1000 Aaa 100.717 1.063 101.780 0.227 -9.0 0.44XS0646719954 4.500 INSTITUT CREDITO OFICIAL 08.07.2014 1000 Baa3 BBB- 101.740 2.453 104.193 0.675 66.9 0.46XS0647263317 6.125 FIAT FINANCE & TRADE 08.07.2014 100000 B1 /*- BB- 102.036 3.339 105.375 1.597 127.1 0.45DE000A0Z2CS9 5.750 METRO AG 14.07.2014 1000 Baa3 BBB- 102.446 3.040 105.486 0.569 20.8 0.47XS0439260398 4.750 ADIDAS INTL FINANCE BV 14.07.2014 1000 101.957 2.512 104.469 0.603 28.6 0.47DE000A1K0KM5 2.250 FMS WERTMANAGEMENT 14.07.2014 100000 Aaa AAA 100.960 1.190 102.150 0.224 -21.2 0.47FR0010780452 8.375 PEUGEOT SA 15.07.2014 1000 B1 BB- 103.294 4.405 107.699 1.375 106.8 0.47XS0440007176 5.375 DEXIA CREDIT LOCAL 21.07.2014 1000 Baa2 BBB 102.125 2.739 104.864 1.027 522.0 0.49FR0010778928 3.750 GENELEC (MORTGAGE SECURED) 22.07.2014 1000 Aaa AAA 101.717 1.901 103.618 0.286 -9.4 0.50XS0409153110 8.250 COMPAGNIE DE ST GOBAIN 28.07.2014 50000 Baa2 BBB 103.956 4.046 108.002 0.511 20.8 0.51XS0441511200 6.750 HUNGARY 28.07.2014 1000 Ba1 BB 103.500 3.310 106.810 -0.057 46.9XS0482656005 3.375 VOLKSWAGEN FIN SERV AG 28.07.2014 1000 A3 A- 101.485 1.655 103.140 0.471 0.0 0.51XS0441800579 4.750 GE CAPITAL EURO FUNDING 30.07.2014 1000 A1 AA+ 102.275 2.303 104.578 0.354 -5.0 0.52DE000A1DAML2 1.750 KFW 04.08.2014 1000 Aaa AAA 100.850 0.825 101.675 0.145 -27.1 0.53DE000NWB27L0 2.375 NRW.BANK 04.08.2014 100000 Aa1 AA- 101.150 1.119 102.269 0.203 -18.2 0.53XS0446860826 3.750 SOCIETE GENERALE 21.08.2014 50000 A2 A 101.926 1.592 103.518 0.402 6.3 0.58DE000A1A55G9 4.625 DAIMLER AG 02.09.2014 1000 A3 A- 102.562 1.812 104.374 0.396 -1.2 0.61XS0821078861 4.375 SANTANDER INTL DEBT SA 04.09.2014 100000 Baa2 BBB 102.127 1.690 103.817 0.877 50.2 0.61DE000A1G85A6 0.375 SIEMENS FINANCIERINGSMAT 10.09.2014 1000 Aa3 A+ 100.111 0.139 100.250 0.198 -12.6 0.6320.01.2014

ISIN Coupon Name Maturity Minimum Piece Moody's S&P Price Acc. Int. Dirty Price YTM/Worst SWAP Mod DurFR0010801761 4.000 ALSTOM 23.09.2014 50000 Baa3 BBB 102.218 1.337 103.555 0.650 35.4 0.66DE000A1A6FV5 5.000 K+S AG 24.09.2014 1000 Ba1 BBB 103.006 1.658 104.664 0.487 33.9 0.67XS0420117383 4.625 BAYER CAPITAL CORP BV 26.09.2014 1000 A3 A- 102.898 1.508 104.406 0.318 1.8 0.67XS0455624170 3.000 UBS AG LONDON (SWISS COVERED BOND) 06.10.2014 1000 Aaa 101.914 0.896 102.810 0.269 -11.3 0.70XS0547937408 3.100 BP CAPITAL MARKETS PLC 07.10.2014 50000 A2 A 101.906 0.917 102.823 0.388 1.5 0.70XS0456451938 3.125 SANOFI 10.10.2014 1000 A1 AA 101.953 0.899 102.852 0.379 -2.1 0.71FR0010809236 6.000 RENAULT S.A. 13.10.2014 1000 Ba1 BB+ 103.549 1.677 105.226 1.032 69.5 0.71XS0456708212 7.000 EVONIK INDUSTRIES AG 14.10.2014 1000 Baa2 BBB+ 104.566 1.937 106.503 0.659 26.5 0.72XS0550825292 1.625 LANDBK HESSEN-THUERINGEN 20.10.2014 1000 101.071 0.423 101.494 0.178 -14.1 0.74XS0454794123 7.250 HELLA KGAA HUECK & CO 20.10.2014 1000 Baa2 104.683 1.887 106.570 0.878 56.7 0.74XS0553035840 2.875 GE CAPITAL EURO FUNDING 28.10.2014 1000 A1 AA+ 101.902 0.685 102.587 0.375 3.5 0.76XS0458230082 7.500 HEIDELBERGCEMENT FIN LUX 31.10.2014 1000 Ba2 NR 105.250 1.729 106.979 0.647 71.4 0.75DE000BLB8DA8 2.625 BAYR. LANDESBANK (PUCLIC COVERED 26.11.2014 BOND)1000 Aaa 102.095 0.417 102.512 0.133 -14.3 0.84XS0336018832 4.750 PFIZER INC 15.12.2014 50000 A1 AA 103.971 0.508 104.479 0.297 -8.0 0.89XS0729046051 2.125 BMW FINANCE NV 13.01.2015 1000 A2 A+ 101.637 0.058 101.695 0.434 4.4 0.97XS0478265274 3.125 BARCLAYS (COVERED BOND) 14.01.2015 50000 Aaa AAA 102.708 0.077 102.785 0.338 -6.8 0.97XS0455762640 2.875 BK NEDERLANDSE GEMEENTEN 15.01.2015 1000 Aaa AA+ 102.580 0.063 102.643 0.230 -15.2 0.98XS0732490668 1.625 EUROPEAN INVESTMENT BANK 15.01.2015 1000 Aaa AAA 101.420 0.036 101.456 0.170 -22.0 0.98XS0731679907 2.125 VOLKSWAGEN INTL FIN NV 19.01.2015 1000 A3 A- 101.540 0.023 101.563 0.559 12.7 0.98XS0430015742 4.375 SLOVAK REPUBLIC 21.01.2015 1000 A2 A 104.060 0.024 104.084 0.281 6.7 0.99DE000EH1A4X4 3.000 HYPOTHEKENBANK FRANKFURT 26.01.2015 1000 Aa3 NR 102.715 2.975 105.690 0.299 -10.8 0.98EU000A1AKD47 3.125 EUROPEAN UNION 27.01.2015 1000 Aaa AA+ 102.998 3.091 106.089 0.155 -22.9 0.98XS0479866567 4.375 RCI BANQUE SA 27.01.2015 1000 Baa3 BBB 103.599 4.327 107.926 0.787 127.1 0.96XS0479542150 3.375 GAS NATURAL CAPITAL 27.01.2015 50000 Baa2 BBB 102.539 3.338 105.877 0.842 46.4 0.97XS0585868622 3.250 HSBC BANK PLC 28.01.2015 100000 Aa3 AA- 102.895 3.205 106.100 0.384 -1.5 0.98XS0470518605 3.500 VOLKSWAGEN INTL FIN NV 02.02.2015 1000 A3 A- 103.024 3.404 106.428 0.534 14.6 0.99XS0483829320 3.000 SWEDISH COVERED BOND 03.02.2015 50000 Aaa AAA 102.805 2.910 105.715 0.263 -7.4 1.00XS0483673132 4.000 FORTIS BANK NEDERLAND NV 03.02.2015 50000 A2 A 103.541 3.879 107.420 0.536 17.8 0.99EU000A1G0AE8 1.625 EFSF 04.02.2015 1000 Aa1 AA 101.463 1.572 103.035 0.202 -20.3 1.01XS0485309313 3.250 INSTITUT CREDITO OFICIAL 10.02.2015 1000 Baa3 BBB- 102.520 3.090 105.610 0.823 46.1 1.01FR0011185032 1.875 CAISSE D'AMORT DETTE SOC 16.02.2015 1000 Aa1 NR 101.720 1.752 103.472 0.254 -17.4 1.04XS0487438979 3.000 RABOBANK NEDERLAND 16.02.2015 1000 Aa2 AA- 102.705 2.803 105.508 0.445 4.9 1.03XS0750684929 2.000 GE CAPITAL EURO FUNDING 27.02.2015 1000 A1 AA+ 101.549 1.808 103.357 0.576 19.3 1.07SI0002103065 2.750 REPUBLIKA SLOVENIJA 17.03.2015 1000 Ba1 A- 102.436 2.351 104.787 0.617 108.0 1.12XS0353181190 6.250 MONDELEZ INTERNATIONAL 20.03.2015 50000 Baa1 BBB- 106.415 5.291 111.706 0.669 35.0 1.10XS0497185511 3.375 MERCK FIN SERVICES GMBH 24.03.2015 1000 A3 A 103.328 2.820 106.148 0.512 12.2 1.13BE0000316258 3.500 BELGIUM KINGDOM 28.03.2015 0.01 Aa3 NR 103.865 2.886 106.751 0.218 -22.2 1.15XS0421565317 5.500 STATKRAFT AS 02.04.2015 50000 Baa1 A- 105.890 4.460 110.350 0.527 12.9 1.14DE000EAA0CZ5 1.250 ERSTE ABWICKLUNGSANSTALT 02.04.2015 100000 Aa1 AA- 101.191 1.014 102.205 0.248 -14.4 1.18FR0010878991 3.750 KERING 08.04.2015 1000 BBB 103.757 2.979 106.736 0.618 27.8 1.17XS0672219580 2.000 UBS AG LONDON (COVERED BOND SWISS 10.04.2015 MRTGS) 1000 Aaa 102.006 1.578 103.584 0.341 -7.4 1.19DE000A1DAMJ6 2.250 KFW 10.04.2015 1000 Aaa AAA 102.475 1.775 104.250 0.206 -22.0 1.19XS0428461718 3.625 TOTAL CAPITAL SA 19.05.2015 1000 Aa1 AA- 104.254 2.473 106.727 0.392 -1.5 1.28DE000A1MLSR4 1.750 DAIMLER AG 21.05.2015 1000 A3 A- 101.646 1.184 102.830 0.502 12.8 1.30DE000A1MBB96 0.625 KFW 29.05.2015 1000 Aaa AAA 100.572 0.409 100.981 0.200 -22.0 1.34EU000A1G0AS8 1.125 EFSF 01.06.2015 1000 Aa1 AA 101.213 0.727 101.940 0.228 -20.3 1.34XS0514870368 2.375 NEDER WATERSCHAPSBANK 04.06.2015 50000 Aaa AA+ 102.877 1.516 104.393 0.259 -16.8 1.34XS0412154378 5.125 BASF FINANCE EUROPE NV 09.06.2015 50000 A1 A+ 106.428 3.201 109.629 0.434 2.8 1.33XS0515762093 2.500 SPAREBANKEN VEST (COVERED BOND) 09.06.2015 50000 Aaa 102.944 1.562 104.506 0.353 -4.4 1.35FR0010915116 5.625 PEUGEOT SA 29.06.2015 1000 B1 BB- 105.625 3.205 108.830 1.615 143.2 1.3620.01.2014

ISIN Coupon Name Maturity Minimum Piece Moody's S&P Price Acc. Int. Dirty Price YTM/Worst SWAP Mod DurFR0010916734 5.625 RENAULT S.A. 30.06.2015 1000 Ba1 BB+ 106.230 3.190 109.420 1.217 100.9 1.37DE000NWB29J0 1.125 NRW.BANK 08.07.2015 1000 Aa1 AA- 101.258 0.613 101.871 0.259 -15.1 1.44XS0525490198 2.875 BNP PARIBAS 13.07.2015 1000 A2 A+ 103.193 1.528 104.721 0.686 27.1 1.44XS0525890967 2.125 BK NEDERLANDSE GEMEENTEN 14.07.2015 1000 Aaa AA+ 102.679 1.124 103.803 0.301 -13.1 1.45XS0526073290 3.500 UBS AG LONDON 15.07.2015 1000 A2 A 104.355 1.841 106.196 0.532 14.7 1.44XS0528912214 3.750 ICO (GUAR. KINGDOM OF SPAIN) 28.07.2015 1000 Baa3 BBB- 104.230 1.839 106.069 0.921 61.4 1.47DE000A0XFFY8 2.125 L-BANK BW FOERDERBANK 04.08.2015 1000 Aaa AAA 102.861 1.001 103.862 0.249 -15.6 1.51XS0385771158 5.875 PHILIP MORRIS INTL INC 04.09.2015 50000 A2 A 108.448 2.270 110.718 0.597 17.1 1.55XS0539845171 3.750 LLOYDS TSB BANK PLC 07.09.2015 50000 A2 A 104.958 1.418 106.376 0.665 26.6 1.58DE000A0T06N0 6.125 DAIMLER INTL FINANCE BV 08.09.2015 50000 A3 A- 108.973 2.299 111.272 0.560 16.5 1.56XS0539871763 3.000 RBS PLC (COVERED BOND UK) 08.09.2015 50000 Aaa 104.199 1.126 105.325 0.402 -3.4 1.59XS0541455191 2.875 NATIONWIDE BLDG SOCIETY 14.09.2015 50000 Aaa AAA 104.115 1.032 105.147 0.356 -9.3 1.61XS0541608286 3.875 LEASEPLAN CORPORATION NV 16.09.2015 50000 Baa2 BBB+ 105.101 1.370 106.471 0.746 36.7 1.60XS0541454467 2.875 GE CAPITAL EURO FUNDING 17.09.2015 1000 A1 AA+ 103.491 1.008 104.499 0.737 30.5 1.61XS0831383194 1.000 MAN SE 21.09.2015 1000 A3 NR 100.723 0.340 101.063 0.561 13.5 1.64XS0683565476 3.500 COMPAGNIE DE ST GOBAIN 30.09.2015 100000 Baa2 BBB 104.664 1.103 105.767 0.706 29.4 1.64XS0683639933 5.625 RCI BANQUE SA 05.10.2015 1000 Baa3 BBB 107.660 1.695 109.355 1.051 148.0 1.63XS0832873060 1.250 GE CAPITAL EURO FUNDING 15.10.2015 1000 A1 AA+ 100.871 0.342 101.213 0.740 28.7 1.70XS0968922764 2.375 INSTITUT CREDITO OFICIAL 31.10.2015 1000 Baa3 BBB- 102.370 0.911 103.281 1.016 63.0 1.73XS0557635777 4.000 LUXOTTICA GROUP SPA 10.11.2015 50000 BBB+ 105.763 0.811 106.574 0.758 36.8 1.75XS0853679867 2.000 SNAM SPA 13.11.2015 100000 Baa1 BBB+ 101.813 0.389 102.202 0.981 52.6 1.77DE000A1R0U31 1.000 SAP AG 13.11.2015 1000 100.574 0.195 100.769 0.679 24.4 1.78DE000A1EWEB2 1.875 KFW 16.11.2015 1000 Aaa AAA 102.934 0.349 103.283 0.252 -22.5 1.79ES0324244005 5.125 MAPFRE SA 16.11.2015 100000 BBB- /* 106.497 0.955 107.452 1.466 104.0 1.74XS0995413696 0.250 BK NEDERLANDSE GEMEENTEN 20.11.2015 1000 Aaa AA+ 99.843 0.044 99.887 0.336 -11.5 1.82DE000A1EWEC0 2.000 KFW (GUAR. GERMANY, "MIKROFINANZANLEIHE") 30.11.2015 50000 Aaa AAA 103.235 0.296 103.531 0.248 -20.8 1.83XS0564366770 2.625 CREDIT SUISSE GUERNSEY (SWISS COV. 01.12.2015 BOND)100000 Aaa 104.069 0.381 104.450 0.419 -3.2 1.82XS0565041174 2.625 SAMPO HOUSING (FINNISH COVERED BOND) 02.12.2015 100000 Aaa 104.053 0.374 104.427 0.430 -10.3 1.83EU000A1GKVZ9 2.500 EUROPEAN UNION 04.12.2015 1000 Aaa AA+ 104.240 0.342 104.582 0.218 -26.0 1.84XS0861589819 3.125 AIB MORTGAGE BANK 04.12.2015 100000 Baa2 /*- A 103.383 0.428 103.811 1.275 78.0 1.81XS0403540189 6.750 LINDE FINANCE BV 08.12.2015 1000 A3 A+ 111.617 0.851 112.468 0.508 7.2 1.81XS0521103860 3.625 STANDARD CHARTERED PLC 15.12.2015 50000 A2 A+ 105.506 0.387 105.893 0.689 27.6 1.85XS0520759803 6.750 HEIDELBERGCEMENT FIN LUX 15.12.2015 1000 Ba2 NR 109.891 0.713 110.604 1.438 103.4 1.79ES0378641122 4.000 FADE 17.12.2015 100000 Baa3 BBB- 105.507 0.405 105.912 1.056 72.7 1.84XS0579339416 2.500 BK NEDERLANDSE GEMEENTEN 18.01.2016 1000 Aaa AA+ 104.210 0.034 104.244 0.369 -8.5 1.96XS0732496194 3.125 UBS AG LONDON 18.01.2016 1000 A2 A 104.972 0.043 105.015 0.599 18.0 1.94DE000A1K0RS7 2.250 DT. PFANDBRIEFBANK (COVERED BOND)18.01.2016 1000 Aa2 AA+ 103.590 0.031 103.621 0.431 -5.2 1.96ES0340609140 3.250 CAIXABANK 22.01.2016 100000 Baa3 BBB- 103.891 0.009 103.900 1.265 171.6 1.94XS0583801997 3.250 BMW FINANCE NV 28.01.2016 1000 A2 A+ 105.141 3.205 108.346 0.671 22.2 1.91XS0409318309 6.375 TELEKOM FINANZMANAGEMENT 29.01.2016 1000 Baa2 BBB- 110.600 6.270 116.870 1.036 62.0 1.83XS1016635580 1.450 SANTAN CONSUMER FINANCE 29.01.2016 100000 Baa2e BBB- 100.184 0.000 100.184 135.612 85.9 0.78FR0011261890 1.500 GDF SUEZ 01.02.2016 1000 A1 A 101.671 1.463 103.134 0.665 17.1 1.97XS0411602765 6.625 TOYOTA MOTOR CREDIT CORP 03.02.2016 1000 Aa3 AA- 112.360 6.425 118.785 0.485 7.6 1.85FR0011001361 4.250 GECINA 03.02.2016 100000 Baa2 BBB 106.336 4.122 110.458 1.074 61.9 1.89XS0852479996 2.375 ACHMEA HYPOTHEEKBANK NV 08.02.2016 100000 A 102.534 2.868 105.402 1.113 92.7 1.95XS0412443052 7.000 VOLKSWAGEN INTL FIN NV 09.02.2016 1000 A3 A- 112.714 6.674 119.388 0.713 23.0 1.86XS0412968876 4.500 SHELL INTERNATIONAL FIN 09.02.2016 1000 Aa1 AA 108.075 4.290 112.365 0.519 4.5 1.91XS0412896861 3.750 LANDWIRTSCH. RENTENBANK 11.02.2016 1000 Aaa AAA 107.090 3.555 110.645 0.277 -23.1 1.94FR0011008366 3.000 CAISSE D'AMORT DETTE SOC 25.02.2016 1000 Aa1 NR 105.430 2.729 108.159 0.385 -12.6 2.00DE000A1RET56 0.500 KFW 26.02.2016 1000 Aaa AAA 100.420 0.473 100.893 0.298 -20.8 2.0720.01.2014

ISIN Coupon Name Maturity Minimum Piece Moody's S&P Price Acc. Int. Dirty Price YTM/Worst SWAP Mod DurXS0415624120 5.625 ROCHE HLDGS INC 04.03.2016 1000 A1 AA 110.440 5.009 115.449 0.636 12.9 1.96EU000A1G0BA4 0.500 EFSF 07.03.2016 1000 Aa1 AA 100.350 0.444 100.794 0.334 -15.8 2.10XS0599711826 3.500 BNP PARIBAS 07.03.2016 1000 A2 A+ 105.505 3.088 108.593 0.870 37.0 2.01EU000A1G0BA4 0.500 EFSF 07.03.2016 1000 Aa1 AA 100.359 0.444 100.803 0.330 -15.8 2.10XS0755521142 4.000 HEIDELBERGCEMENT FIN LUX 08.03.2016 50000 Ba2 NR 105.500 1.500 107.000 1.365 107.4 2.02XS0491047154 3.875 RHOEN-KLINIKUM AG 11.03.2016 1000 Baa3 105.342 3.376 108.718 1.318 93.1 2.00DE000HSH4GS3 0.625 HSH NORDBANK AG 11.03.2016 1000 Aa2 100.438 0.541 100.979 0.418 -7.0 2.11XS0503331323 2.625 EUROPEAN INVESTMENT BANK 15.03.2016 1000 Aaa AAA 105.020 2.258 107.278 0.274 -22.8 2.07XS0417208161 5.250 VATTENFALL AB 17.03.2016 50000 A3 A- 109.751 4.488 114.239 0.666 20.6 2.00XS0419195408 5.750 PHILIP MORRIS INTL INC 24.03.2016 50000 A2 A 110.859 4.805 115.664 0.689 17.3 2.01BE0000319286 2.750 BELGIUM KINGDOM 28.03.2016 0 Aa3 NR 105.231 2.268 107.499 0.338 -19.5 2.10FR0011124544 6.875 PEUGEOT SA 30.03.2016 1000 B1 BB- 109.492 5.632 115.124 2.363 199.6 1.96XS0419264063 5.496 TELEFONICA EMISIONES SAU 01.04.2016 50000 Baa2 BBB 109.351 4.472 113.823 1.144 73.9 2.02XS0613002368 6.375 FIAT FINANCE & TRADE 01.04.2016 100000 B1 /*- BB- 107.573 5.187 112.760 2.756 239.7 1.97XS0421249235 6.375 BHP BILLITON FINANCE LTD 04.04.2016 50000 A1 A+ 112.517 5.135 117.652 0.620 11.0 2.02FR0011124601 4.472 CASINO GUICHARD PERRACHO 04.04.2016 100000 BBB- 107.684 3.602 111.286 0.922 49.2 2.06XS0768453101 2.375 SWEDBANK AB 04.04.2016 100000 A1 A+ 103.389 1.913 105.302 0.812 31.5 2.11EU000A1AJM31 3.625 EUROPEAN UNION 06.04.2016 1000 Aaa AA+ 107.360 2.900 110.260 0.269 -24.8 2.10XS0686597286 3.500 UNIBAIL-RODAMCO SE 06.04.2016 100000 NR A 105.735 2.800 108.535 0.859 35.6 2.09DE000A1H36V3 3.125 KFW 08.04.2016 1000 Aaa AAA 106.180 2.483 108.663 0.312 -22.0 2.12XS0910916666 0.625 BQUE PSA (GUAR. FRANCE) 08.04.2016 1000 Aa1 AA 100.470 0.497 100.967 0.411 -11.3 2.18XS0425743506 3.500 EUROPEAN INVESTMENT BANK 15.04.2016 1000 Aaa AAA 107.070 2.714 109.784 0.310 -21.3 2.13FI4000018049 1.750 FINNISH GOVERNMENT 15.04.2016 1000 Aaa AAA 103.296 1.357 104.653 0.264 -27.1 2.17XS0619232928 3.250 LANDBK HESSEN-THUERINGEN 20.04.2016 1000 Aaa NR 106.570 2.475 109.045 0.304 -19.6 2.15XS0428037740 4.500 SANOFI 18.05.2016 1000 A1 AA 108.906 3.082 111.988 0.619 10.7 2.19FR0011049782 3.750 CAISSE FRANCAISE DE FIN 18.05.2016 1000 Aaa AA+ 107.390 2.568 109.958 0.535 -0.1 2.21XS0429612566 7.250 MAN SE 20.05.2016 1000 A3 NR 114.850 4.926 119.776 0.778 28.6 2.13XS0633014427 3.472 BP CAPITAL MARKETS PLC 01.06.2016 100000 A2 A 106.312 2.245 108.557 0.757 22.3 2.24XS0432070752 4.750 PFIZER INC 03.06.2016 50000 A1 AA 109.491 3.045 112.536 0.683 12.6 2.22EU000A1GRYT1 2.750 EUROPEAN UNION 03.06.2016 1000 Aaa AA+ 105.710 1.763 107.473 0.318 -23.7 2.28XS0633111207 3.375 VOLKSWAGEN LEASING GMBH 03.06.2016 100000 A3 A- 106.116 2.164 108.280 0.751 22.2 2.25XS0632934583 3.000 UBS AG LONDON 06.06.2016 1000 Aaa 105.833 1.899 107.732 0.516 -5.7 2.27FR0011056126 3.250 SOCENAL SFH (FRENCH COVERED BOND)06.06.2016 100000 Aaa 106.520 2.057 108.577 0.475 -9.4 2.27DE000AAR0116 3.125 AAREAL BANK AG (GERMAN COVERED BOND) 14.06.2016 1000 106.310 1.909 108.219 0.465 -9.4 2.29XS0432810116 4.250 NOVARTIS FINANCE SA 15.06.2016 50000 Aa3 AA- 108.733 2.585 111.318 0.566 6.2 2.27BE0000329384 1.250 BELGIUM KINGDOM 22.06.2018 0.01 NR 101.039 0.736 101.775 1.008 1.8 4.25XS0642351505 2.875 DEUTSCHE BAHN FINANCE BV 30.06.2016 1000 Aa1 AA 105.299 1.630 106.929 0.674 2.4 2.34DE000A0Z2KS2 3.125 KFW 04.07.2016 1000 Aaa AAA 106.730 1.738 108.468 0.357 -20.3 2.35XS0940302002 1.750 RCI BANQUE SA 06.07.2016 1000 Baa3 BBB 101.550 1.108 102.658 1.105 135.5 2.38ES0302761020 5.500 FROB (GUAR. KINGDOM OF SPAIN) 12.07.2016 100000 Baa3 BBB- 110.176 2.938 113.114 1.284 94.4 2.30XS0647624609 3.000 NEDER WATERSCHAPSBANK 12.07.2016 100000 Aaa AA+ 106.159 1.603 107.762 0.484 -5.9 2.37XS0647188605 4.875 AMADEUS CAP MARKT 15.07.2016 100000 Baa2 BBB 109.387 2.564 111.951 1.017 50.7 2.32EU000A1G0AA6 2.750 EFSF 18.07.2016 1000 Aa1 AA 105.780 1.424 107.204 0.408 -16.5 2.40FR0011077023 3.375 CRED MUTUEL- CIC HOME LO 18.07.2016 100000 Aaa AAA 107.051 1.748 108.799 0.513 -5.8 2.38DE000A1G7EH9 1.250 BMW US CAPITAL LLC 20.07.2016 1000 A2 A+ 101.220 0.640 101.860 0.753 19.1 2.44DE000A1MBCB3 0.500 KFW 25.07.2016 1000 Aaa AAA 100.337 0.249 100.586 0.365 -20.2 2.48XS0445463887 4.625 EADS FINANCE B.V. 12.08.2016 50000 A2 A 109.785 2.078 111.863 0.740 19.2 2.41XS0667463995 2.250 BK NEDERLANDSE GEMEENTEN 24.08.2016 1000 Aaa AA+ 104.510 0.937 105.447 0.490 -6.9 2.51XS0820869948 3.000 KBC IFIMA NV 29.08.2016 100000 NR A- 104.895 1.208 106.103 1.079 46.9 2.49XS0968431949 0.625 LANDWIRTSCH. RENTENBANK 05.09.2016 1000 Aaa AAA 100.650 0.240 100.890 0.375 -22.0 2.5920.01.2014