NC Register Volume 19 Issue 06 - Office of Administrative Hearings

NC Register Volume 19 Issue 06 - Office of Administrative Hearings

NC Register Volume 19 Issue 06 - Office of Administrative Hearings

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

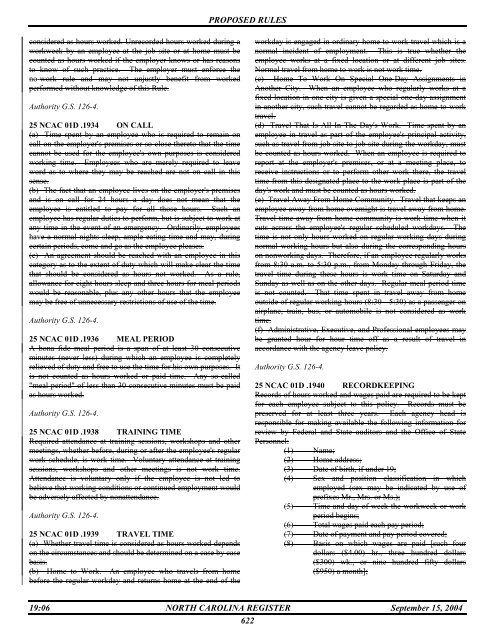

PROPOSED RULESconsidered as hours worked. Unrecorded hours worked during aworkweek by an employee at the job site or at home must becounted as hours worked if the employer knows or has reasonsto know <strong>of</strong> such practice. The employer must enforce theno-work rule and may not unjustly benefit from workedperformed without knowledge <strong>of</strong> this Rule.Authority G.S. 126-4.25 <strong>NC</strong>AC 01D .<strong>19</strong>34 ON CALL(a) Time spent by an employee who is required to remain oncall on the employer's premises or so close thereto that the timecannot be used for the employee's own purposes is consideredworking time. Employees who are merely required to leaveword as to where they may be reached are not on call in thissense.(b) The fact that an employee lives on the employer's premisesand is on call for 24 hours a day does not mean that theemployee is entitled to pay for all those hours. Such anemployee has regular duties to perform, but is subject to work atany time in the event <strong>of</strong> an emergency. Ordinarily, employeeshave a normal nights sleep, ample eating time and may, duringcertain periods, come and go as the employee pleases.(c) An agreement should be reached with an employee in thiscategory as to the extent <strong>of</strong> duty which will make clear the timethat should be considered as hours not worked. As a rule,allowance for eight hours sleep and three hours for meal periodswould be reasonable, plus any other hours that the employeemay be free <strong>of</strong> unnecessary restrictions <strong>of</strong> use <strong>of</strong> the time.Authority G.S. 126-4.25 <strong>NC</strong>AC 01D .<strong>19</strong>36 MEAL PERIODA bona fide meal period is a span <strong>of</strong> at least 30 consecutiveminutes (never less) during which an employee is completelyrelieved <strong>of</strong> duty and free to use the time for his own purposes. Itis not counted as hours worked or paid time. Any so-called"meal period" <strong>of</strong> less than 30 consecutive minutes must be paidas hours worked.Authority G.S. 126-4.25 <strong>NC</strong>AC 01D .<strong>19</strong>38 TRAINING TIMERequired attendance at training sessions, workshops and othermeetings, whether before, during or after the employee's regularwork schedule, is work time. Voluntary attendance at trainingsessions, workshops and other meetings is not work time.Attendance is voluntary only if the employee is not led tobelieve that working conditions or continued employment wouldbe adversely affected by nonattendance.Authority G.S. 126-4.25 <strong>NC</strong>AC 01D .<strong>19</strong>39 TRAVEL TIME(a) Whether travel time is considered as hours worked dependson the circumstances and should be determined on a case by casebasis.(b) Home to Work. An employee who travels from homebefore the regular workday and returns home at the end <strong>of</strong> theworkday is engaged in ordinary home to work travel which is anormal incident <strong>of</strong> employment. This is true whether theemployee works at a fixed location or at different job sites.Normal travel from home to work is not work time.(c) Home To Work On Special One-Day Assignments inAnother City. When an employee who regularly works at afixed location in one city is given a special one-day assignmentin another city, such travel cannot be regarded as home-to-worktravel.(d) Travel That Is All In The Day's Work. Time spent by anemployee in travel as part <strong>of</strong> the employee's principal activity,such as travel from job site to job site during the workday, mustbe counted as hours worked. When an employee is required toreport at the employer's premises, or at a meeting place, toreceive instructions or to perform other work there, the traveltime from this designated place to the work place is part <strong>of</strong> theday's work and must be counted as hours worked.(e) Travel Away From Home Community. Travel that keeps anemployee away from home overnight is travel away from home.Travel time away from home community is work time when itcuts across the employee's regular scheduled workdays. Thetime is not only hours worked on regular working days duringnormal working hours but also during the corresponding hourson nonworking days. Therefore, if an employee regularly worksfrom 8:30 a.m. to 5:30 p.m., from Monday through Friday, thetravel time during these hours is work time on Saturday andSunday as well as on the other days. Regular meal period timeis not counted. That time spent in travel away from homeoutside <strong>of</strong> regular working hours (8:30 - 5:30) as a passenger onairplane, train, bus, or automobile is not considered as worktime.(f) <strong>Administrative</strong>, Executive, and Pr<strong>of</strong>essional employees maybe granted hour for hour time <strong>of</strong>f as a result <strong>of</strong> travel inaccordance with the agency leave policy.Authority G.S. 126-4.25 <strong>NC</strong>AC 01D .<strong>19</strong>40 RECORDKEEPINGRecords <strong>of</strong> hours worked and wages paid are required to be keptfor each employee subject to this policy. Records must bepreserved for at least three years. Each agency head isresponsible for making available the following information forreview by Federal and State auditors and the <strong>Office</strong> <strong>of</strong> StatePersonnel:(1) Name;(2) Home address;(3) Date <strong>of</strong> birth, if under <strong>19</strong>;(4) Sex and position classification in whichemployed (sex may be indicated by use <strong>of</strong>prefixes Mr., Mrs. or Ms.);(5) Time and day <strong>of</strong> week the workweek or workperiod begins;(6) Total wages paid each pay period;(7) Date <strong>of</strong> payment and pay period covered;(8) Basis on which wages are paid [such fourdollars ($4.00) hr., three hundred dollars($300) wk., or nine hundred fifty dollars($950) a month];<strong>19</strong>:<strong>06</strong> NORTH CAROLINA REGISTER September 15, 2004622