Fact Sheet April - 2013.cdr - Tata Mutual Fund

Fact Sheet April - 2013.cdr - Tata Mutual Fund

Fact Sheet April - 2013.cdr - Tata Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

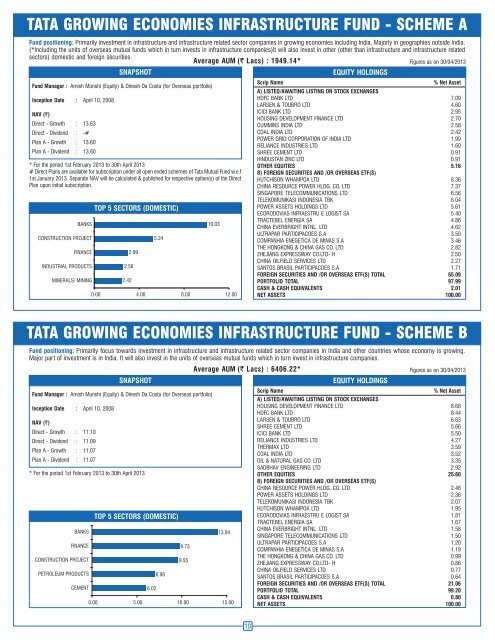

TATA GROWING ECONOMIES INFRASTRUCTURE FUND - SCHEME A<strong>Fund</strong> positioning: Primarily investment in infrastructure and infrastructure related sector companies in growing economies including India. Majorly in geographies outside India.(*Including the units of overseas mutual funds which in turn invests in infrastructure companies)It will also invest in other (other than infrastructure and infrastructure relatedsectors) domestic and foreign securities.Average AUM (` Lacs) : 1949.14*Figures as on 30/04/2013<strong>Fund</strong> Manager : Amish Munshi (Equity) & Dinesh Da Costa (for Overseas portfolio)Inception Date : <strong>April</strong> 10, 2008NAV (`)Direct - Growth : 13.63Direct - Dividend : -#Plan A - Growth : 13.60Plan A - Dividend : 13.60SNAPSHOT* For the period 1st February 2013 to 30th <strong>April</strong> 2013# Direct Plans are available for subscription under all open ended schemes of <strong>Tata</strong> <strong>Mutual</strong> <strong>Fund</strong> w.e.f1st January 2013. Separate NAV will be calculated & published for respective option(s) of the DirectPlan upon initial subscription.BANKSCONSTRUCTION PROJECTFINANCEINDUSTRIAL PRODUCTSMINERALS/ MININGTOP 5 SECTORS (DOMESTIC)2.582.422.995.2410.030.00 4.00 8.00 12.00EQUITY HOLDINGSScrip Name% Net AssetA) LISTED/AWAITING LISTING ON STOCK EXCHANGESHDFC BANK LTD 7.09LARSEN & TOUBRO LTD 4.60ICICI BANK LTD 2.95HOUSING DEVELOPMENT FINANCE LTD 2.70CUMMINS INDIA LTD 2.58COAL INDIA LTD 2.42POWER GRID CORPORATION OF INDIA LTD 1.99RELIANCE INDUSTRIES LTD 1.60SHREE CEMENT LTD 0.91HINDUSTAN ZINC LTD 0.91OTHER EQUITIES 5.16B) FOREIGN SECURITIES AND /OR OVERSEAS ETF(S)HUTCHISON WHAMPOA LTD 8.36CHINA RESOURCE POWER HLDG. CO. LTD 7.37SINGAPORE TELECOMMUNICATIONS LTD 6.56TELEKOMUNIKASI INDONESIA TBK 6.04POWER ASSETS HOLDINGS LTD 5.61ECORODOVIAS INFRAESTRU E LOGIST SA 5.40TRACTEBEL ENERGIA SA 4.86CHINA EVERBRIGHT INTNL LTD 4.62ULTRAPAR PARTICIPACOES S.A 3.50COMPANHIA ENEGETICA DE MINAS S.A 3.46THE HONGKONG & CHINA GAS CO. LTD 2.82ZHEJIANG EXPRESSWAY CO.LTD- H 2.50CHINA OILFIELD SERVICES LTD 2.27SANTOS BRASIL PARTICIPACOES S.A 1.71FOREIGN SECURITIES AND /OR OVERSEAS ETF(S) TOTAL 65.09PORTFOLIO TOTAL 97.99CASH & CASH EQUIVALENTS 2.01NET ASSETS 100.00TATA GROWING ECONOMIES INFRASTRUCTURE FUND - SCHEME B<strong>Fund</strong> positioning: Primarily focus towards investment in infrastructure and infrastructure related sector companies in India and other countries whose economy is growing.Major part of investment is in India. It will also invest in the units of overseas mutual funds which in turn invest in infrastructure companies.Average AUM (` Lacs) : 6406.22*Figures as on 30/04/2013SNAPSHOTEQUITY HOLDINGS<strong>Fund</strong> Manager : Amish Munshi (Equity) & Dinesh Da Costa (for Overseas portfolio)Scrip Name% Net AssetA) LISTED/AWAITING LISTING ON STOCK EXCHANGESInception Date : <strong>April</strong> 10, 2008HOUSING DEVELOPMENT FINANCE LTD 8.68HDFC BANK LTD 8.44NAV (`)LARSEN & TOUBRO LTD 6.63SHREE CEMENT LTD 5.66Direct - Growth : 11.10ICICI BANK LTD 5.50Direct - Dividend : 11.09RELIANCE INDUSTRIES LTD 4.27Plan A - Growth : 11.07THERMAX LTD 3.59COAL INDIA LTD 3.52Plan A - Dividend : 11.07OIL & NATURAL GAS CO. LTD 3.35SADBHAV ENGINEERING LTD 2.92* For the period 1st February 2013 to 30th <strong>April</strong> 2013OTHER EQUITIES 25.60B) FOREIGN SECURITIES AND /OR OVERSEAS ETF(S)CHINA RESOURCE POWER HLDG. CO. LTD 2.46POWER ASSETS HOLDINGS LTD 2.36TELEKOMUNIKASI INDONESIA TBK 2.07HUTCHISON WHAMPOA LTD 1.95TOP 5 SECTORS (DOMESTIC)ECORODOVIAS INFRAESTRU E LOGIST SA 1.81TRACTEBEL ENERGIA SA 1.67BANKS13.94CHINA EVERBRIGHT INTNL LTD 1.58SINGAPORE TELECOMMUNICATIONS LTD 1.50FINANCECONSTRUCTION PROJECT9.739.55ULTRAPAR PARTICIPACOES S.ATHE HONGKONG & CHINA GAS CO. LTD1.200.99COMPANHIA ENEGETICA DE MINAS S.AZHEJIANG EXPRESSWAY CO.LTD- H1.190.86PETROLEUM PRODUCTSCEMENT6.986.02CHINA OILFIELD SERVICES LTDFOREIGN SECURITIES AND /OR OVERSEAS ETF(S) TOTAL0.7721.06SANTOS BRASIL PARTICIPACOES S.APORTFOLIO TOTAL0.6499.20CASH & CASH EQUIVALENTS 0.800.00 5.00 10.00 15.00 NET ASSETS 100.0010