Fact Sheet April - 2013.cdr - Tata Mutual Fund

Fact Sheet April - 2013.cdr - Tata Mutual Fund

Fact Sheet April - 2013.cdr - Tata Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

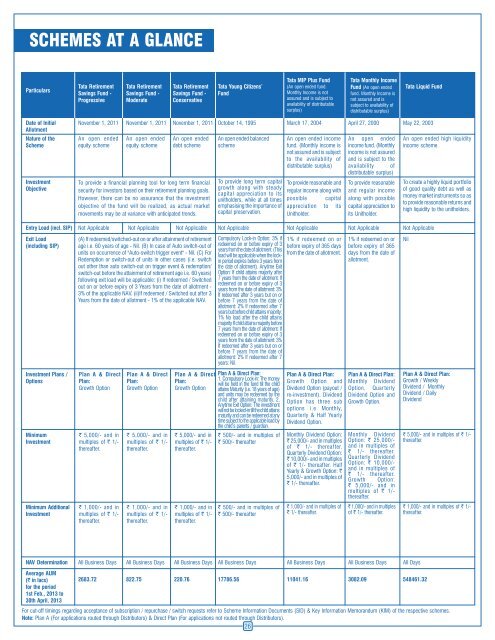

SCHEMES AT A GLANCEParticulars<strong>Tata</strong> RetirementSavings <strong>Fund</strong> -Progressive<strong>Tata</strong> RetirementSavings <strong>Fund</strong> -Moderate<strong>Tata</strong> RetirementSavings <strong>Fund</strong> -Conservative<strong>Tata</strong> Young Citizens’<strong>Fund</strong><strong>Tata</strong> MIP Plus <strong>Fund</strong>(An open ended fund.Monthly Income is notassured and is subject toavailability of distributablesurplus)<strong>Tata</strong> Monthly Income<strong>Fund</strong> (An open endedfund. Monthly Income isnot assured and issubject to availability ofdistributable surplus)<strong>Tata</strong> Liquid <strong>Fund</strong>Date of InitialAllotmentNovember 1, 2011November 1, 2011November 1, 2011October 14, 1995March 17, 2004<strong>April</strong> 27, 2000May 22, 2003Nature of theSchemeInvestmentObjectiveAn open endedequity schemeAn open endedequity schemeAn open endeddebt schemeTo provide a financial planning tool for long term financialsecurity for investors based on their retirement planning goals.However, there can be no assurance that the investmentobjective of the fund will be realized, as actual marketmovements may be at variance with anticipated trends.An open ended balancedschemeTo provide long term capitalgrowth along with steadycapital appreciation to itsunitholders, while at all timesemphasising the importance ofcapital preservation.An open ended incomefund. (Monthly income isnot assured and is subjectto the availability ofdistributable surplus)To provide reasonable andregular income along withpossible capitalappreciation to itsUnitholder.An open endedincome fund. (Monthlyincome is not assuredand is subject to theavailability ofdistributable surplus)To provide reasonableand regular incomealong with possiblecapital appreciation toits Unitholder.An open ended high liquidityincome scheme.To create a highly liquid portfolioof good quality debt as well asmoney market instruments so asto provide reasonable returns andhigh liquidity to the unitholders.Entry Load (incl. SIP)Exit Load(including SIP)Investment Plans /OptionsMinimumInvestmentMinimum AdditionalInvestmentNot Applicable(A) If redeemed/switched-out on or after attainment of retirementage i.e. 60 years of age - Nil. (B) In case of Auto switch-out ofunits on occurrence of "Auto-switch trigger event" - Nil. (C) ForRedemption or switch-out of units in other cases (i.e. switchout other than auto switch-out on trigger event & redemption/switch-out before the attainment of retirement age i.e. 60 years)following exit load will be applicable: (i) If redeemed / Switchedout on or before expiry of 3 Years from the date of allotment -3% of the applicable NAV. (ii)If redeemed / Switched out after 3Years from the date of allotment - 1% of the applicable NAV.Plan A & DirectPlan:Growth Option` 5,000/- and inmultiples of ` 1/-thereafter.` 1,000/- and inmultiples of ` 1/-thereafter.Not ApplicablePlan A & DirectPlan:Growth Option` 5,000/- and inmultiples of ` 1/-thereafter.` 1,000/- and inmultiples of ` 1/-thereafter.Not ApplicablePlan A & DirectPlan:Growth Option` 5,000/- and inmultiples of ` 1/-thereafter.` 1,000/- and inmultiples of ` 1/-thereafter.Not ApplicableCompulsory Lock-in Option: 3% ifredeemed on or before expiry of 3years from the date of allotment. (Thisload will be applicable when the lockinperiod expires before 3 years fromthe date of allotment). Anytime ExitOption: If child attains majority after7 years from the date of allotment: Ifredeemed on or before expiry of 3years from the date of allotment: 3%If redeemed after 3 years but on orbefore 7 years from the date ofallotment: 2% If redeemed after 7years but before child attains majority:1% No load after the child attainsmajority If child attains majority before7 years from the date of allotment: Ifredeemed on or before expiry of 3years from the date of allotment: 3%If redeemed after 3 years but on orbefore 7 years from the date ofallotment: 2% If redeemed after 7years: Nil.Plan A & Direct Plan:1. Compulsory Lock-in: The moneywill be held in the fund till the childattains Maturity (i.e. 18 years of age)and units may be redeemed by thechild after attaining maturity. 2.Anytime Exit Option: The investmentwill not be locked-in till the child attainsmaturity and can be redeemed at anytime subject to the applicable load bythe child’s parents / guardian.` 500/- and in multiples of` 500/- thereafter` 500/- and in multiples of` 500/- thereafterNot Applicable1% if redeemed on orbefore expiry of 365 daysfrom the date of allotment.Plan A & Direct Plan:Growth Option andDividend Option (payout /re-investment). DividendOption has three suboptions i.e Monthly,Quarterly & Half YearlyDividend Option.Monthly Dividend Option:` 25,000/- and in multiplesof ` 1/- thereafter.Quarterly Dividend Option:` 10,000/- and in multiplesof ` 1/- thereafter. HalfYearly & Growth Option: `5,000/- and in multiples of` 1/- thereafter.` 1,000/- and in multiples of` 1/- thereafter.Not Applicable1% if redeemed on orbefore expiry of 365days from the date ofallotment.Plan A & Direct Plan:Monthly DividendOption, QuarterlyDividend Option andGrowth Option.Monthly DividendOption: ` 25,000/-and in multiples of` 1/- thereafter.Quarterly DividendOption: ` 10,000/-and in multiples of` 1/- thereafter.Growth Option:` 5,000/- and inmultiples of ` 1/-thereafter.` 1,000/- and in multiplesof ` 1/- thereafter.Not ApplicableNilPlan A & Direct Plan:Growth / WeeklyDividend / MonthlyDividend / DailyDividend` 5,000/- and in multiples of ` 1/-thereafter.` 1,000/- and in multiples of ` 1/-thereafter.NAV DeterminationAverage AUM(` in lacs)for the period1st Feb., 2013 to30th <strong>April</strong>, 2013All Business Days2683.72All Business Days822.75All Business Days220.76All Business Days17786.56All Business DaysFor cut-off timings regarding acceptance of subscription / repurchase / switch requests refer to Scheme Information Documents (SID) & Key Information Memorandum (KIM) of the respective schemes.Note: Plan A (For applications routed through Distributors) & Direct Plan (For applications not routed through Distributors).2611041.16All Business Days3082.09All Days548461.32