Fact Sheet April - 2013.cdr - Tata Mutual Fund

Fact Sheet April - 2013.cdr - Tata Mutual Fund

Fact Sheet April - 2013.cdr - Tata Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

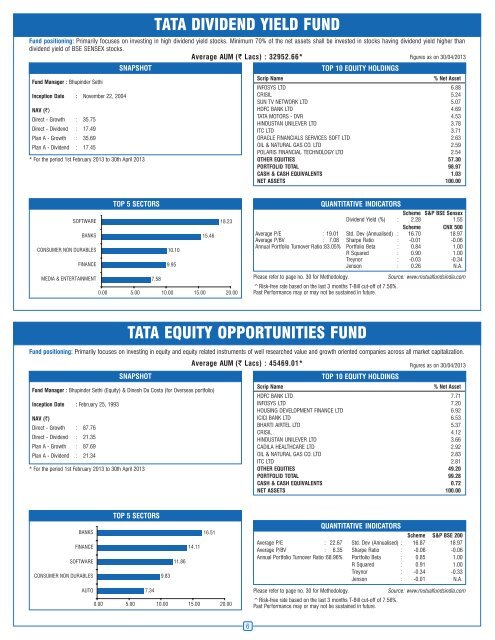

TATA DIVIDEND YIELD FUND<strong>Fund</strong> positioning: Primarily focuses on investing in high dividend yield stocks. Minimum 70% of the net assets shall be invested in stocks having dividend yield higher thandividend yield of BSE SENSEX stocks.Average AUM (` Lacs) : 32952.66*Figures as on 30/04/2013SNAPSHOTTOP 10 EQUITY HOLDINGS<strong>Fund</strong> Manager : Bhupinder SethiScrip Name% Net AssetINFOSYS LTD 6.88Inception Date : November 22, 2004CRISIL 5.24SUN TV NETWORK LTD 5.07NAV (`)HDFC BANK LTD 4.69Direct - Growth : 35.75TATA MOTORS - DVR 4.53HINDUSTAN UNILEVER LTD 3.78Direct - Dividend : 17.49ITC LTD 3.71Plan A - Growth : 35.69ORACLE FINANCIALS SERVICES SOFT LTD 2.63Plan A - Dividend : 17.45OIL & NATURAL GAS CO. LTD 2.59POLARIS FINANCIAL TECHNOLOGY LTD 2.54* For the period 1st February 2013 to 30th <strong>April</strong> 2013OTHER EQUITIES 57.30PORTFOLIO TOTAL 98.97CASH & CASH EQUIVALENTS 1.03NET ASSETS 100.00TOP 5 SECTORSSOFTWARE18.23BANKS15.46CONSUMER NON DURABLESFINANCE10.109.95MEDIA & ENTERTAINMENT7.580.00 5.00 10.00 15.00 20.00QUANTITATIVE INDICATORSScheme S&P BSE SensexDividend Yield (%) : 2.28 1.55Scheme CNX 500Average P/E : 19.01 Std. Dev (Annualised) : 16.70 18.97Average P/BV : 7.08 Sharpe Ratio : -0.01 -0.06Annual Portfolio Turnover Ratio:83.05% Portfolio Beta : 0.84 1.00R Squared : 0.90 1.00Treynor : -0.03 -0.34Jenson : 0.26 N.A.Please refer to page no. 30 for Methodology.Source: www.mutualfundsindia.com^Risk-free rate based on the last 3 months T-Bill cut-off of 7.56%.Past Performance may or may not be sustained in future.TATA EQUITY OPPORTUNITIES FUND<strong>Fund</strong> positioning: Primarily focuses on investing in equity and equity related instruments of well researched value and growth oriented companies across all market capitalization.Average AUM (` Lacs) : 45469.01*Figures as on 30/04/2013SNAPSHOTTOP 10 EQUITY HOLDINGS<strong>Fund</strong> Manager : Bhupinder Sethi (Equity) & Dinesh Da Costa (for Overseas portfolio)Scrip Name% Net AssetHDFC BANK LTD 7.71Inception Date : February 25, 1993INFOSYS LTD 7.20HOUSING DEVELOPMENT FINANCE LTD 6.92NAV (`)ICICI BANK LTD 6.53Direct - Growth : 87.76BHARTI AIRTEL LTD 5.37CRISIL 4.12Direct - Dividend : 21.35HINDUSTAN UNILEVER LTD 3.66Plan A - Growth : 87.69CADILA HEALTHCARE LTD 2.92Plan A - Dividend : 21.34OIL & NATURAL GAS CO. LTD 2.83ITC LTD 2.81* For the period 1st February 2013 to 30th <strong>April</strong> 2013OTHER EQUITIES 49.20PORTFOLIO TOTAL 99.28CASH & CASH EQUIVALENTS 0.72NET ASSETS 100.00BANKSFINANCESOFTWARECONSUMER NON DURABLESTOP 5 SECTORS9.8311.8614.1116.51QUANTITATIVE INDICATORSScheme S&P BSE 200Average P/E : 22.67 Std. Dev (Annualised) : 16.87 18.97Average P/BV : 6.35 Sharpe Ratio : -0.06 -0.06Annual Portfolio Turnover Ratio :68.96% Portfolio Beta : 0.85 1.00R Squared : 0.91 1.00Treynor : -0.34 -0.33Jenson : -0.01 N.A.AUTO7.340.00 5.00 10.00 15.00 20.00Please refer to page no. 30 for Methodology.Source: www.mutualfundsindia.com^Risk-free rate based on the last 3 months T-Bill cut-off of 7.56%.Past Performance may or may not be sustained in future.6